Form 1120 L Fill in Version U S Life Insurance Company Income Tax Return

What is the Form 1120 L Fill in Version U S Life Insurance Company Income Tax Return

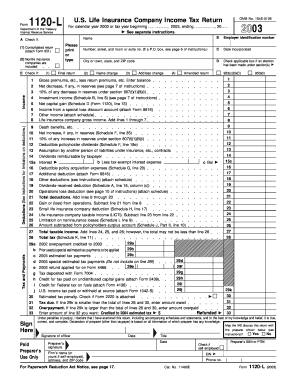

The Form 1120 L is specifically designed for U.S. life insurance companies to report their income, gains, losses, deductions, and credits. This form serves as the federal income tax return for these companies, ensuring compliance with the Internal Revenue Service (IRS) regulations. It is crucial for life insurance companies to accurately complete this form to determine their tax liability and maintain their operational status within the legal framework.

How to use the Form 1120 L Fill in Version U S Life Insurance Company Income Tax Return

To effectively use the Form 1120 L, life insurance companies must gather all necessary financial information, including income statements, balance sheets, and any applicable deductions. The form includes various sections that require detailed reporting of premiums, investment income, and other relevant financial data. Companies should ensure all figures are accurate and complete to avoid issues with the IRS.

Steps to complete the Form 1120 L Fill in Version U S Life Insurance Company Income Tax Return

Completing the Form 1120 L involves several key steps:

- Gather financial documents, including income statements and balance sheets.

- Fill out the identification section with the company’s name, address, and Employer Identification Number (EIN).

- Report income from premiums and investments in the appropriate sections.

- Detail any deductions, such as claims paid and operating expenses.

- Calculate the total tax liability based on the provided information.

- Review the completed form for accuracy before submission.

Key elements of the Form 1120 L Fill in Version U S Life Insurance Company Income Tax Return

The Form 1120 L consists of several critical components that must be filled out correctly:

- Income Section: This section captures all sources of income, including premiums collected and investment gains.

- Deductions: Companies can list various deductions that reduce taxable income, such as claims and administrative expenses.

- Tax Calculation: This part determines the total tax owed based on the net income reported.

- Signature: A designated officer must sign the form, verifying its accuracy and completeness.

Filing Deadlines / Important Dates

Life insurance companies must adhere to specific deadlines when filing the Form 1120 L. Generally, the form is due on the fifteenth day of the third month following the end of the tax year. For companies operating on a calendar year basis, this typically means a deadline of March 15. It is important to be aware of these dates to avoid penalties and ensure timely compliance with IRS requirements.

Penalties for Non-Compliance

Failure to file the Form 1120 L on time or inaccuracies in reporting can result in significant penalties. The IRS may impose fines based on the amount of tax owed or the duration of the delay. Additionally, non-compliance can lead to further scrutiny from the IRS, potentially resulting in audits or other legal repercussions. Therefore, it is essential for life insurance companies to prioritize accurate and timely filing of this form.

Quick guide on how to complete form 1120 l fill in version u s life insurance company income tax return

Complete [SKS] seamlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal green alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents quickly without interruptions. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to modify and electronically sign [SKS] effortlessly

- Find [SKS] and click on Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for this task.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to finalize your changes.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it directly to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1120 L Fill in Version U S Life Insurance Company Income Tax Return

Create this form in 5 minutes!

How to create an eSignature for the form 1120 l fill in version u s life insurance company income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1120 L Fill in Version U S Life Insurance Company Income Tax Return?

The Form 1120 L Fill in Version U S Life Insurance Company Income Tax Return is a specific tax return required for life insurance companies operating in the United States. This form allows companies to report their income, deductions, and calculate taxes owed. Utilizing this form ensures compliance with IRS regulations and can help streamline your tax preparation process.

-

How can airSlate SignNow assist with Form 1120 L Fill in Version U S Life Insurance Company Income Tax Return?

airSlate SignNow enables users to easily send and eSign the Form 1120 L Fill in Version U S Life Insurance Company Income Tax Return electronically. This service simplifies the document signing process, making it faster and more secure. Plus, our platform integrates seamlessly with various applications to enhance your workflow.

-

Is airSlate SignNow cost-effective for completing Form 1120 L Fill in Version U S Life Insurance Company Income Tax Return?

Yes, airSlate SignNow is a cost-effective solution for businesses needing to complete the Form 1120 L Fill in Version U S Life Insurance Company Income Tax Return. With flexible pricing plans, you can select an option that best fits your budget while gaining access to essential features. The efficiency gained can also save your company valuable time and resources.

-

What features does airSlate SignNow offer for handling Form 1120 L Fill in Version U S Life Insurance Company Income Tax Return?

airSlate SignNow offers features such as document templates, electronic signatures, and secure storage, all essential for handling the Form 1120 L Fill in Version U S Life Insurance Company Income Tax Return. Our intuitive interface makes it easy to fill out and send your forms to stakeholders. Additionally, you can track the status of your documents in real-time.

-

Can I integrate airSlate SignNow with other software to manage Form 1120 L Fill in Version U S Life Insurance Company Income Tax Return?

Absolutely! airSlate SignNow integrates with a variety of third-party applications, allowing for seamless management of the Form 1120 L Fill in Version U S Life Insurance Company Income Tax Return. Whether you use CRM systems or accounting software, these integrations enhance productivity and improve overall workflow efficiency.

-

What benefits can I expect from using airSlate SignNow for Form 1120 L Fill in Version U S Life Insurance Company Income Tax Return?

Using airSlate SignNow for the Form 1120 L Fill in Version U S Life Insurance Company Income Tax Return offers several benefits, such as enhanced security, improved turnaround times, and reduced paperwork. Digital signatures ensure compliance and authentication, while the ability to store documents securely streamlines your filing process. Overall, it transforms how you manage your legal and tax documentation.

-

Is there customer support available for Form 1120 L Fill in Version U S Life Insurance Company Income Tax Return inquiries?

Yes, airSlate SignNow provides customer support to assist with any questions related to the Form 1120 L Fill in Version U S Life Insurance Company Income Tax Return. Our support team is available to help you navigate any challenges you may face while using the platform. We are dedicated to ensuring you have a smooth experience in eSigning and managing your tax documents.

Get more for Form 1120 L Fill in Version U S Life Insurance Company Income Tax Return

Find out other Form 1120 L Fill in Version U S Life Insurance Company Income Tax Return

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself