Form 8283 Rev October Fill in Version Noncash Charitable Contributions

What is the Form 8283 Rev October Fill in Version Noncash Charitable Contributions

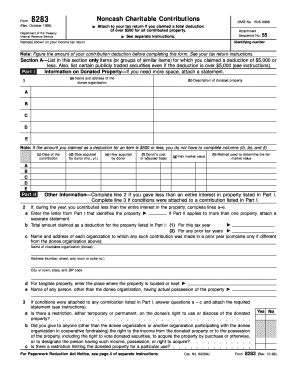

The Form 8283 Rev October is a tax form used in the United States for reporting noncash charitable contributions. This form is essential for taxpayers who donate property other than cash to qualified charitable organizations. It provides a structured way to report the value of the donated items and ensures that taxpayers receive the appropriate tax deductions for their contributions. The form is particularly important for donations exceeding a value of five hundred dollars, as it helps the IRS track and verify the legitimacy of these contributions.

How to use the Form 8283 Rev October Fill in Version Noncash Charitable Contributions

Using the Form 8283 involves several key steps. First, gather all relevant information about the noncash contributions, including descriptions, fair market values, and the date of donation. Next, fill out the form accurately, ensuring that all required fields are completed. Taxpayers must also obtain a written acknowledgment from the charitable organization for donations over five hundred dollars. Once completed, the form should be attached to the taxpayer's income tax return, ensuring compliance with IRS requirements.

Steps to complete the Form 8283 Rev October Fill in Version Noncash Charitable Contributions

Completing the Form 8283 involves the following steps:

- Identify the type of property donated, such as clothing, vehicles, or real estate.

- Determine the fair market value of the donated items, which may require appraisals for high-value donations.

- Fill in the donor's information, including name, address, and taxpayer identification number.

- Provide details about the charitable organization, including its name and address.

- Complete the sections detailing the nature of the contribution and its value.

- Obtain a written acknowledgment from the charity for donations exceeding five hundred dollars.

- Review the completed form for accuracy before submission.

Legal use of the Form 8283 Rev October Fill in Version Noncash Charitable Contributions

The legal use of Form 8283 is governed by IRS regulations regarding charitable contributions. Taxpayers must ensure that the donations are made to qualified organizations as defined by the IRS. Additionally, accurate reporting of the fair market value is crucial to avoid penalties or audits. The form must be filed in conjunction with the taxpayer's annual income tax return, and failure to comply with these legal requirements can result in disallowed deductions and potential penalties.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 8283. These guidelines include instructions on determining fair market value, the necessity of obtaining appraisals for certain items, and the requirement for written acknowledgments from charities. Taxpayers should refer to the IRS instructions for Form 8283 to ensure compliance with all reporting requirements and to understand the implications of their charitable contributions on their tax returns.

Filing Deadlines / Important Dates

Filing deadlines for Form 8283 align with the general tax return deadlines. Typically, taxpayers must submit their income tax returns, including Form 8283, by April fifteenth of the following year. If a taxpayer files for an extension, they must still ensure that any contributions reported on Form 8283 are submitted by the extended deadline. It is important to keep track of these dates to avoid late filing penalties and ensure that all contributions are properly documented for tax purposes.

Quick guide on how to complete form 8283 rev october fill in version noncash charitable contributions

Complete [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without any delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to alter and electronically sign [SKS] with ease

- Find [SKS] and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specially offers for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Don't worry about lost or mislaid files, tedious form searching, or errors that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] and ensure exceptional communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8283 Rev October Fill in Version Noncash Charitable Contributions

Create this form in 5 minutes!

How to create an eSignature for the form 8283 rev october fill in version noncash charitable contributions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 8283 Rev October Fill in Version Noncash Charitable Contributions?

The Form 8283 Rev October Fill in Version Noncash Charitable Contributions is a crucial document used to report noncash contributions to charitable organizations. This form requires detailed information about the donated items and their value, ensuring compliance with IRS regulations. Using airSlate SignNow simplifies the process of filling out and submitting this form electronically, making it easier for donors.

-

How can airSlate SignNow help with the Form 8283 Rev October Fill in Version Noncash Charitable Contributions?

airSlate SignNow streamlines the process of creating and signing the Form 8283 Rev October Fill in Version Noncash Charitable Contributions. Our platform allows you to fill in the form electronically, ensuring all necessary fields are completed accurately. Additionally, eSigning features enable quick and secure agreement from all parties involved.

-

Is there a cost associated with using airSlate SignNow for Form 8283?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. While our basic plan provides essential features to easily fill out the Form 8283 Rev October Fill in Version Noncash Charitable Contributions, premium plans unlock advanced functionalities. Explore our options to find a plan that fits your requirements and budget.

-

What are the main features of airSlate SignNow for handling Form 8283?

airSlate SignNow includes a user-friendly interface, customizable templates for the Form 8283 Rev October Fill in Version Noncash Charitable Contributions, and secure eSignature capabilities. You can also track the status of your documents in real time. These features contribute to a more efficient document management process.

-

Can I integrate airSlate SignNow with other software for Form 8283 management?

Absolutely! airSlate SignNow seamlessly integrates with various software and applications, enhancing your workflow for managing the Form 8283 Rev October Fill in Version Noncash Charitable Contributions. Whether you’re using CRM tools or accounting software, integration allows for a more cohesive document handling experience.

-

What benefits does airSlate SignNow provide for organizations processing Form 8283?

By using airSlate SignNow for the Form 8283 Rev October Fill in Version Noncash Charitable Contributions, organizations benefit from faster processing times and reduced paperwork. Our secure platform also helps to ensure that sensitive information is protected while complying with regulatory standards. This efficiency allows nonprofits to focus more on their charitable mission.

-

Is airSlate SignNow user-friendly for filling out Form 8283?

Yes, airSlate SignNow has been designed with user experience in mind. Users can easily navigate through the fillable sections of the Form 8283 Rev October Fill in Version Noncash Charitable Contributions, making the process straightforward and quick. Support resources and tutorials are also available to assist users if needed.

Get more for Form 8283 Rev October Fill in Version Noncash Charitable Contributions

Find out other Form 8283 Rev October Fill in Version Noncash Charitable Contributions

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF