October Department of the Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return See Separate Ins Form

Understanding the October Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return

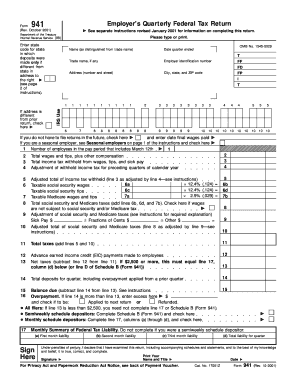

The October Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return is a crucial form used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form must be filed quarterly, and it provides the IRS with essential information regarding an employer's payroll tax obligations. Accurate completion of the form is vital to ensure compliance with federal tax laws and to avoid potential penalties.

Steps to Complete the October Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return

Completing the 99 941 form involves several steps:

- Gather all necessary payroll records for the quarter, including total wages paid, tips, and other compensation.

- Calculate the total federal income tax withheld from employees' wages.

- Compute the total Social Security and Medicare taxes owed based on employee wages.

- Fill out the form accurately, ensuring all calculations are correct and all required information is included.

- Review the completed form for any errors before submission.

Legal Use of the October Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return

The 99 941 form is legally required for employers who withhold taxes from employees' wages. Failure to file this form on time can result in penalties and interest charges. It is essential for employers to understand their legal obligations regarding payroll taxes and to ensure that they comply with IRS regulations. This form serves as a record of tax liabilities and helps maintain transparency with the IRS.

Filing Deadlines for the October Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return

Employers must adhere to specific deadlines for filing the 99 941 form. Generally, the form is due on the last day of the month following the end of the quarter. For example, the deadline for the third quarter, which ends on September 30, is October 31. Timely filing is crucial to avoid penalties and ensure compliance with federal tax regulations.

Form Submission Methods for the October Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return

Employers have several options for submitting the 99 941 form:

- Online filing through the IRS e-file system, which is a secure and efficient method.

- Mailing a paper form to the designated IRS address for your location.

- In-person submission at local IRS offices, although this may require an appointment.

Key Elements of the October Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return

Important elements of the 99 941 form include:

- Employer identification information, including the Employer Identification Number (EIN).

- Details of total wages, tips, and other compensation paid to employees.

- Calculations for federal income tax withheld, Social Security tax, and Medicare tax.

- Signature of the employer or authorized representative, certifying the accuracy of the information provided.

Examples of Using the October Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return

Employers can utilize the 99 941 form in various scenarios, such as:

- Reporting wages and taxes for full-time employees across multiple pay periods.

- Documenting payroll for seasonal workers or temporary staff.

- Ensuring compliance with federal tax laws for businesses of all sizes.

Quick guide on how to complete october department of the treasury internal revenue service 99 941 employers quarterly federal tax return see separate

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to obtain the correct document and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign [SKS] stress-free

- Locate [SKS] and click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your files or redact sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your document, via email, SMS, or sharing link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Modify and electronically sign [SKS] while ensuring effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to October Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return See Separate Ins

Create this form in 5 minutes!

How to create an eSignature for the october department of the treasury internal revenue service 99 941 employers quarterly federal tax return see separate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the October Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return?

The October Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return is a form that employers use to report income taxes, social security tax, or Medicare tax withheld from employee's paychecks. It's essential for maintaining compliance with federal tax regulations and should be completed accurately to avoid penalties. Detailed instructions are provided to assist in completing this return.

-

How does airSlate SignNow assist with the October Department Of The Treasury Internal Revenue Service 99 941 form?

airSlate SignNow provides a streamlined solution for electronically signing and sending the October Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return. Our platform simplifies document management, reducing the time spent on paperwork, so you can focus on your business operations. With our eSignature features, you ensure compliance and security in your tax filings.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to accommodate businesses of all sizes. Our pricing is competitive and reflects the comprehensive features we provide, including easy compliance with forms like the October Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return. We also offer a free trial so you can assess our services before committing to a subscription.

-

What features does airSlate SignNow offer for invoice management?

With airSlate SignNow, you'll have access to a variety of features that enhance invoice management. This includes automated reminders, easy integration with existing systems, and the capability to manage documents like the October Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return efficiently. Our platform also allows tracking of document statuses, ensuring timely follow-ups.

-

How can airSlate SignNow help improve my business's workflow?

airSlate SignNow enhances your business workflow by automating document processes, allowing for seamless collaboration and communication. By incorporating tools like the October Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return into our platform, businesses can streamline tax-related filings and reduce manual errors. This leads to improved efficiency and productivity across teams.

-

Is airSlate SignNow compliant with federal regulations?

Yes, airSlate SignNow is compliant with federal regulations, ensuring that your documents, including the October Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return, adhere to necessary legal standards. Our platform employs advanced security measures to protect sensitive information which is crucial for compliance. You can trust us for maintaining high standards of data safety and legal conformity.

-

Can I integrate airSlate SignNow with other software solutions?

Absolutely! airSlate SignNow allows for easy integration with a variety of third-party software solutions. This means you can connect your existing systems to facilitate processes related to the October Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return seamlessly. Our integration capabilities enhance overall productivity and make it easy to incorporate electronic signatures into your existing workflows.

Get more for October Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return See Separate Ins

Find out other October Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return See Separate Ins

- How Do I Sign Indiana Divorce Settlement Agreement Template

- Sign Indiana Child Custody Agreement Template Now

- Sign Minnesota Divorce Settlement Agreement Template Easy

- How To Sign Arizona Affidavit of Death

- Sign Nevada Divorce Settlement Agreement Template Free

- Sign Mississippi Child Custody Agreement Template Free

- Sign New Jersey Child Custody Agreement Template Online

- Sign Kansas Affidavit of Heirship Free

- How To Sign Kentucky Affidavit of Heirship

- Can I Sign Louisiana Affidavit of Heirship

- How To Sign New Jersey Affidavit of Heirship

- Sign Oklahoma Affidavit of Heirship Myself

- Sign Washington Affidavit of Death Easy

- Help Me With Sign Pennsylvania Cohabitation Agreement

- Sign Montana Child Support Modification Online

- Sign Oregon Last Will and Testament Mobile

- Can I Sign Utah Last Will and Testament

- Sign Washington Last Will and Testament Later

- Sign Wyoming Last Will and Testament Simple

- Sign Connecticut Living Will Online