PDF Form Ct 8822

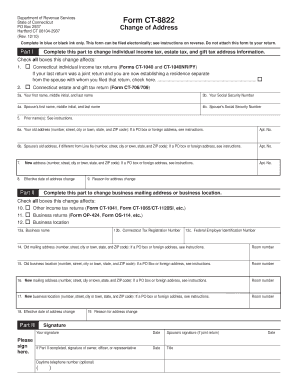

What is the PDF Form CT 8822?

The PDF Form CT 8822 is a tax form used by individuals in the United States to notify the Internal Revenue Service (IRS) of a change of address. This form is essential for ensuring that taxpayers receive important tax documents and correspondence at their new address. It is specifically designed for individuals who have moved and need to update their information with the IRS to avoid any disruptions in their tax filings or notifications.

How to Use the PDF Form CT 8822

Using the PDF Form CT 8822 involves filling out the required fields accurately to ensure that the IRS processes the address change correctly. Taxpayers can download the fillable form from the IRS website or other official sources. After completing the form, it can be submitted either electronically or by mail. It is crucial to ensure that all information is current and accurate to prevent delays in processing.

Steps to Complete the PDF Form CT 8822

Completing the PDF Form CT 8822 involves several key steps:

- Download the form from an official source.

- Fill in your personal information, including your name, old address, and new address.

- Provide your Social Security number or Individual Taxpayer Identification Number (ITIN).

- Sign and date the form to certify that the information provided is accurate.

- Submit the form via mail to the address specified in the instructions or electronically if applicable.

Legal Use of the PDF Form CT 8822

The PDF Form CT 8822 holds legal significance as it serves as the official notification to the IRS regarding a taxpayer's change of address. This form must be completed and submitted in accordance with IRS guidelines to ensure that it is legally binding. Failure to notify the IRS of a change of address can result in missed communications and potential penalties.

Form Submission Methods

The PDF Form CT 8822 can be submitted through various methods. Taxpayers have the option to mail the completed form to the IRS or submit it electronically through approved e-filing services. Each method has its own processing time, and it is essential to choose the one that best fits the taxpayer’s needs. Electronic submissions may offer quicker processing times compared to traditional mail.

Filing Deadlines / Important Dates

It is important for taxpayers to be aware of the filing deadlines associated with the PDF Form CT 8822. Generally, the form should be submitted as soon as a change of address occurs to ensure that the IRS has the most current information. While there is no specific deadline for submitting this form, timely notification is crucial to avoid any issues with tax correspondence and filings.

Quick guide on how to complete pdf form ct 8822

Easily Prepare Pdf Form Ct 8822 on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and safely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without any hold-ups. Handle Pdf Form Ct 8822 on any device using the airSlate SignNow apps for Android or iOS and enhance any document-centered process today.

The Easiest Way to Modify and Electronically Sign Pdf Form Ct 8822 Effortlessly

- Find Pdf Form Ct 8822 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Select important sections of your documents or cover sensitive information using the tools that airSlate SignNow offers specifically for this task.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate reprinting document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Pdf Form Ct 8822 and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pdf form ct 8822

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form ct 8822 fillable, and how can it be used?

The form ct 8822 fillable is an essential document for notifying the IRS of address changes. This interactive form allows users to easily fill out and submit their information online. By using the form ct 8822 fillable, you ensure that your correspondence with the IRS signNowes you promptly and accurately.

-

Is there a cost associated with using the form ct 8822 fillable on airSlate SignNow?

Using the form ct 8822 fillable on airSlate SignNow is part of their cost-effective eSigning solution. Depending on your subscription plan, you may access a variety of features at competitive pricing. Explore available plans to find the best fit for your needs while efficiently managing document signing.

-

What features does airSlate SignNow offer for completing the form ct 8822 fillable?

airSlate SignNow provides an intuitive platform for completing the form ct 8822 fillable, including easy drag-and-drop functionality and text fields. Users can customize their forms and securely eSign their documents without hassle. This streamlines the process and ensures compliance with IRS regulations.

-

How can the form ct 8822 fillable improve my business process?

The form ct 8822 fillable simplifies the process of updating your address with the IRS, enhancing operational efficiency. By using airSlate SignNow, businesses can electronically manage their documents, save time, and reduce paperwork. This leads to faster updates and improved communication with the IRS and clients.

-

Does airSlate SignNow integrate with other applications for processing the form ct 8822 fillable?

Yes, airSlate SignNow offers various integrations with popular apps that can assist in processing the form ct 8822 fillable. This includes CRM systems, cloud storage services, and productivity tools. These integrations enhance your workflow, allowing for a seamless experience when managing documents.

-

Can I track the status of my form ct 8822 fillable sent via airSlate SignNow?

Absolutely! airSlate SignNow provides users with robust tracking features for the form ct 8822 fillable. You can monitor who has signed the document, when it was viewed, and whether it has been completed, ensuring complete visibility throughout the eSigning process.

-

Is it safe to use airSlate SignNow for submitting the form ct 8822 fillable?

Using airSlate SignNow for submitting the form ct 8822 fillable is very safe. The platform employs top-level encryption and rigorous security measures to protect your personal information. You can confidently manage your documents knowing they are secure and compliant with industry standards.

Get more for Pdf Form Ct 8822

- Filing schedule tds form

- 2018 oklahoma corporation income and franchise tax form

- Survivors benefitssocial security administration form

- Manufacturing or mining form

- 2019 publication or 40 fy oregon income tax full year resident form

- Mo ptc claim chartpdf document form

- Form p 100 download fillable pdf application to ascertain

- 2019 form or 40 p oregon individual income tax return for

Find out other Pdf Form Ct 8822

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document