Form 945 Annual Return of Withheld Federal Income Tax for Withholding Reported on Forms 1099 and W 2G

Understanding Form 945 Annual Return Of Withheld Federal Income Tax

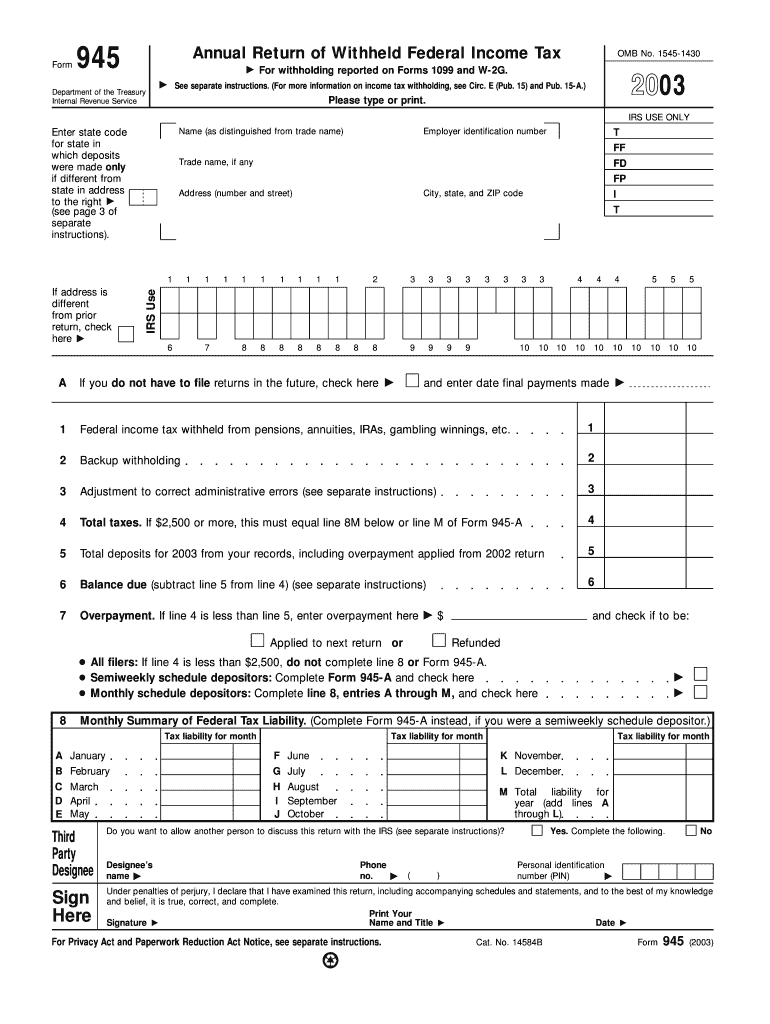

Form 945 is a crucial document used by businesses to report withheld federal income tax from payments made to non-employees, such as independent contractors. This form is particularly relevant for amounts reported on Forms 1099 and W-2G. It ensures that the IRS receives accurate information regarding the taxes withheld, helping to maintain compliance with federal tax regulations. Businesses must file this form annually, providing a summary of all withheld taxes throughout the year.

Steps to Complete Form 945

Completing Form 945 involves several key steps to ensure accuracy and compliance. Start by gathering all necessary information, including the total amount of federal income tax withheld and the details of payments made to non-employees. Next, fill out the form with the required information, including your business name, Employer Identification Number (EIN), and the total withheld amount. Double-check all entries for accuracy before submitting the form. Finally, ensure you sign and date the form to validate your submission.

Filing Deadlines for Form 945

It is essential to be aware of the filing deadlines for Form 945 to avoid penalties. The form must be filed by January 31 of the year following the tax year being reported. If January 31 falls on a weekend or holiday, the deadline is extended to the next business day. Timely submission is crucial to ensure compliance with IRS regulations and to avoid any potential fines associated with late filings.

Obtaining Form 945

Form 945 can be easily obtained from the IRS website. It is available for download in PDF format, which allows for printing and manual completion. Additionally, businesses can request a physical copy by contacting the IRS directly. It is important to ensure that you are using the most current version of the form to avoid any issues during filing.

Key Elements of Form 945

Form 945 includes several important sections that must be completed accurately. Key elements include the business name, EIN, and the total amount of federal income tax withheld. Additionally, the form requires information about the types of payments made, such as non-employee compensation. Accurate reporting of these elements is essential for proper tax compliance and to avoid discrepancies with the IRS.

Penalties for Non-Compliance with Form 945

Failure to file Form 945 on time or inaccuracies in reporting can result in significant penalties. The IRS may impose fines for late submissions, which can accumulate over time. Additionally, incorrect information may lead to audits or further scrutiny from the IRS. It is vital for businesses to adhere to filing requirements to mitigate these risks and maintain good standing with tax authorities.

Quick guide on how to complete form 945 annual return of withheld federal income tax for withholding reported on forms 1099 and w 2g

Prepare [SKS] seamlessly on any system

Digital document management has become increasingly favored by companies and individuals alike. It offers an excellent environmentally friendly solution to conventional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides you all the resources necessary to create, edit, and eSign your documents promptly without any holdups. Manage [SKS] on any system using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign [SKS] effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 945 Annual Return Of Withheld Federal Income Tax For Withholding Reported On Forms 1099 And W 2G

Create this form in 5 minutes!

How to create an eSignature for the form 945 annual return of withheld federal income tax for withholding reported on forms 1099 and w 2g

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 945 Annual Return Of Withheld Federal Income Tax For Withholding Reported On Forms 1099 And W 2G?

The Form 945 Annual Return Of Withheld Federal Income Tax For Withholding Reported On Forms 1099 And W 2G is a tax form used by businesses to report withheld federal income tax. This form consolidates information about taxes withheld from payments made to non-employees and is essential for compliance with IRS regulations.

-

How can airSlate SignNow help with the Form 945 Annual Return Of Withheld Federal Income Tax For Withholding Reported On Forms 1099 And W 2G?

airSlate SignNow facilitates the process of preparing and eSigning the Form 945 Annual Return Of Withheld Federal Income Tax For Withholding Reported On Forms 1099 And W 2G. Our platform streamlines document management, ensuring all relevant forms are easily accessible and securely signed.

-

What features does airSlate SignNow offer for managing the Form 945 process?

Our platform offers features such as customizable templates, real-time collaboration, and tracking for the Form 945 Annual Return Of Withheld Federal Income Tax For Withholding Reported On Forms 1099 And W 2G. These tools simplify document preparation and ensure compliance with federal regulations.

-

Is there a cost associated with using airSlate SignNow for the Form 945 Annual Return?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. The cost may vary depending on factors like the number of users and features required for efficiently managing the Form 945 Annual Return Of Withheld Federal Income Tax For Withholding Reported On Forms 1099 And W 2G.

-

Can I integrate airSlate SignNow with other software for smoother workflow?

Absolutely! airSlate SignNow supports integrations with various software tools, such as accounting and payroll systems. This compatibility enhances how businesses manage the Form 945 Annual Return Of Withheld Federal Income Tax For Withholding Reported On Forms 1099 And W 2G, allowing for more efficient operations.

-

What are the benefits of using airSlate SignNow for form submissions?

Using airSlate SignNow for the Form 945 Annual Return Of Withheld Federal Income Tax For Withholding Reported On Forms 1099 And W 2G offers numerous benefits, including increased efficiency, reduced errors, and enhanced security. Our platform ensures that your tax forms are filed correctly and on time.

-

How secure is airSlate SignNow when handling sensitive tax information?

airSlate SignNow prioritizes security with features like encryption and secure storage for your documents. When submitting the Form 945 Annual Return Of Withheld Federal Income Tax For Withholding Reported On Forms 1099 And W 2G, you can rest assured that your sensitive information is well-protected.

Get more for Form 945 Annual Return Of Withheld Federal Income Tax For Withholding Reported On Forms 1099 And W 2G

- Yearbook permission slip to drive off campus to sell ad1d205 form

- Zda application forms

- Solicitud de registro de ttulo profesional de tcnico saiiut utec tgo edu form

- Oacsiminstallation services directoratearmy environmental form

- Riasec form

- City of houston wcr application form

- Basket party agreement form

- Port to mtnl mumbai form

Find out other Form 945 Annual Return Of Withheld Federal Income Tax For Withholding Reported On Forms 1099 And W 2G

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself