Form 945 a Rev August Fill in Capable

Understanding Form 945 A Rev August

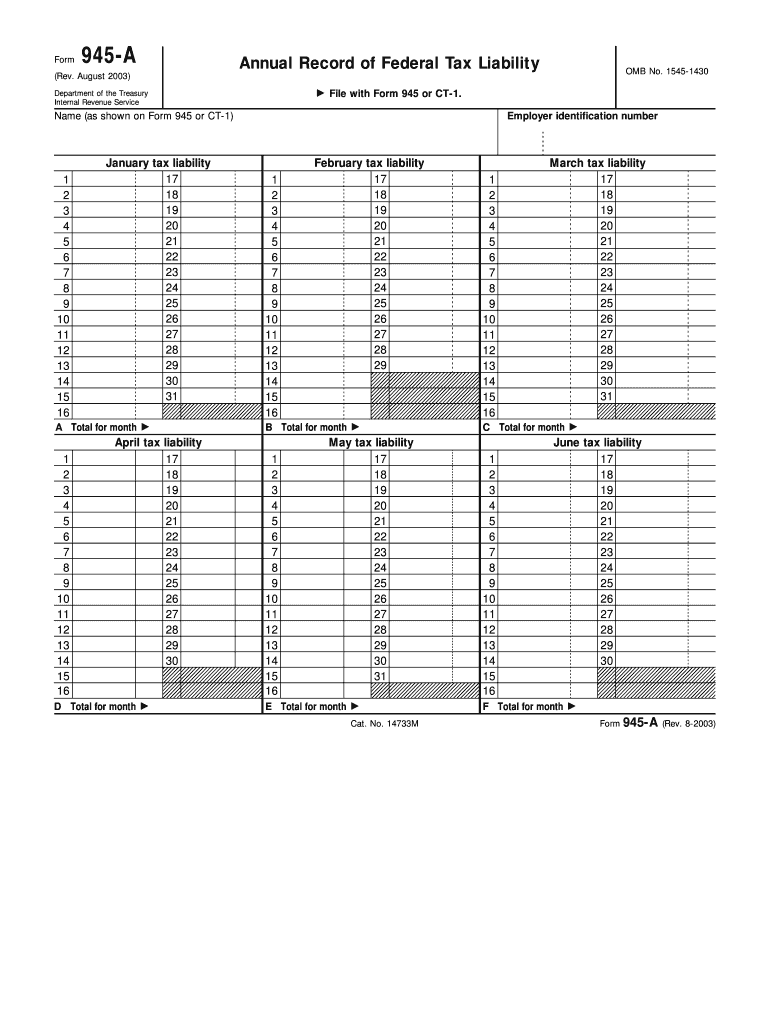

The Form 945 A Rev August is a tax form used by employers to report and pay federal income tax withheld from nonpayroll payments. This form is particularly relevant for businesses that make payments such as pensions, annuities, and other types of income that require withholding. Understanding this form is crucial for compliance with IRS regulations and for ensuring accurate tax reporting.

Steps to Complete Form 945 A Rev August

Completing the Form 945 A Rev August involves several key steps:

- Gather necessary information, including the total amount of nonpayroll payments and the corresponding federal income tax withheld.

- Fill in the identification information, such as the employer's name, address, and Employer Identification Number (EIN).

- Report the total payments and the total tax withheld in the designated fields.

- Review the form for accuracy to avoid potential penalties.

- Submit the completed form to the IRS by the specified deadline.

How to Obtain Form 945 A Rev August

The Form 945 A Rev August can be obtained directly from the IRS website or through various tax preparation software. It is important to ensure that you are using the most current version of the form to comply with IRS requirements. Additionally, printed copies may be available at local IRS offices or through tax professionals.

Legal Use of Form 945 A Rev August

The Form 945 A Rev August must be used in accordance with IRS regulations. Employers are legally required to file this form if they withhold federal income tax from nonpayroll payments. Failure to file or inaccuracies in the form can result in penalties and interest charges. It is essential to understand the legal implications of this form to maintain compliance.

Filing Deadlines for Form 945 A Rev August

Filing deadlines for the Form 945 A Rev August are typically set by the IRS. Employers must submit the form annually, usually by January thirty-first of the following year for the previous tax year. It is important to stay informed about any changes to these deadlines to avoid late filing penalties.

Examples of Using Form 945 A Rev August

Common scenarios for using the Form 945 A Rev August include:

- Employers making pension payments to retirees and withholding federal income tax.

- Distributions from retirement plans where tax withholding is applicable.

- Payments to independent contractors that require federal income tax withholding.

Each of these scenarios requires careful reporting on the form to ensure compliance with tax regulations.

Quick guide on how to complete form 945 a rev august fill in capable

Complete [SKS] effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as a perfect environmentally-friendly alternative to traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Handle [SKS] on any platform using airSlate SignNow’s Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and press the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Edit and eSign [SKS] to ensure effective communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 945 A Rev August Fill In Capable

Create this form in 5 minutes!

How to create an eSignature for the form 945 a rev august fill in capable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 945 A Rev August Fill In Capable and how can it be used?

Form 945 A Rev August Fill In Capable is a document designed for employers to report federal income tax withheld. With airSlate SignNow, users can easily fill out and electronically sign this form, streamlining the compliance process. This capability reduces errors and ensures that your submission is processed on time, making tax reporting more efficient.

-

How does airSlate SignNow handle pricing for using Form 945 A Rev August Fill In Capable?

airSlate SignNow offers competitive pricing plans that cater to various business needs for using Form 945 A Rev August Fill In Capable. Users can choose a plan that suits their volume of documents and team size, ensuring they only pay for what they need. Additionally, there may be free trials available for new users to explore the platform’s features.

-

What features does airSlate SignNow offer for Form 945 A Rev August Fill In Capable?

airSlate SignNow provides numerous features for Form 945 A Rev August Fill In Capable, including customizable templates, eSignature capabilities, and document tracking. These features allow users to create, edit, and manage their tax forms efficiently while ensuring compliance with IRS regulations. The intuitive interface makes it easier for users of all skill levels to complete their forms accurately.

-

What are the benefits of using airSlate SignNow for Form 945 A Rev August Fill In Capable?

Using airSlate SignNow for Form 945 A Rev August Fill In Capable enhances workflow efficiency and improves document security. The ability to sign documents electronically reduces the time spent on paperwork and expedites approvals. Additionally, the platform ensures your data is secure with advanced encryption, giving you peace of mind.

-

Can I integrate airSlate SignNow with other business applications while using Form 945 A Rev August Fill In Capable?

Yes, airSlate SignNow offers seamless integrations with various business applications, enhancing the usability of Form 945 A Rev August Fill In Capable. Integrations with tools like Google Drive, Dropbox, and CRM systems help users streamline their processes. This connectivity allows for a more organized workflow and facilitates easier document management.

-

Is there a mobile app available for filling out Form 945 A Rev August Fill In Capable?

airSlate SignNow offers a mobile app that allows you to fill out Form 945 A Rev August Fill In Capable on the go. The app provides all the necessary features to edit, sign, and send documents directly from your smartphone or tablet. This flexibility ensures you can manage your tax forms efficiently, regardless of your location.

-

What kind of customer support does airSlate SignNow provide for Form 945 A Rev August Fill In Capable?

airSlate SignNow offers robust customer support for users of Form 945 A Rev August Fill In Capable. Their support team can assist you with any questions or technical issues you may encounter. With resources such as FAQs, live chat, and email support, help is readily available to ensure you have a smooth experience.

Get more for Form 945 A Rev August Fill In Capable

- Malala reading comprehension pdf form

- Chemotherapy side effects worksheet form

- Form 3903 moving expenses irs ustreas

- Mulholland scenic parkway specific plan form

- 208 add math module 08 indices and logarithms form

- Personal self assessment of anti bias behavior form

- Navres 1570 2 form

- Example of completed pip 2 form

Find out other Form 945 A Rev August Fill In Capable

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online