Notice 931 Rev February Deposit Requirements for Employment Taxes Form

What is the Notice 931 Rev February Deposit Requirements For Employment Taxes

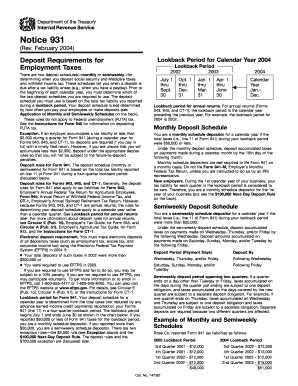

The Notice 931 Rev February outlines the deposit requirements for employment taxes, which include federal income tax withholding, Social Security tax, and Medicare tax. This notice is crucial for employers to ensure compliance with IRS regulations regarding timely tax deposits. Understanding this notice helps businesses avoid penalties and maintain proper tax records.

Key elements of the Notice 931 Rev February Deposit Requirements For Employment Taxes

Essential elements of the Notice 931 include the types of taxes that must be deposited, the frequency of deposits based on the employer's tax liability, and the applicable deposit methods. Employers must also be aware of the specific thresholds that determine whether they are required to make monthly or semi-weekly deposits. This notice serves as a guide for employers to understand their responsibilities and ensure compliance with federal tax laws.

Steps to complete the Notice 931 Rev February Deposit Requirements For Employment Taxes

To effectively use the Notice 931, employers should follow these steps:

- Review the notice to understand the types of employment taxes applicable.

- Determine the deposit schedule based on your tax liability.

- Calculate the total amount of employment taxes owed.

- Choose an appropriate deposit method, such as electronic funds transfer (EFT).

- Make the deposit by the required deadline to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for employment tax deposits are critical to avoid penalties. Employers must be aware of the specific dates for monthly and semi-weekly deposits. Typically, monthly deposits are due by the 15th of the following month, while semi-weekly deposits have specific due dates based on the payroll schedule. It is essential to consult the Notice 931 for precise dates and to mark these deadlines in your calendar.

Penalties for Non-Compliance

Failure to comply with the deposit requirements outlined in the Notice 931 can result in significant penalties. The IRS imposes penalties based on the amount of tax owed and the length of time the payment is late. Employers may face a failure-to-deposit penalty, which can range from two to fifteen percent of the unpaid tax, depending on how late the deposit is. Understanding these penalties emphasizes the importance of timely compliance.

How to obtain the Notice 931 Rev February Deposit Requirements For Employment Taxes

Employers can obtain the Notice 931 Rev February directly from the IRS website or through tax professionals. It is advisable to access the most current version to ensure compliance with the latest regulations. Additionally, businesses may consider subscribing to IRS updates to receive notifications regarding any changes to tax deposit requirements.

Quick guide on how to complete notice 931 rev february deposit requirements for employment taxes 1661579

Execute [SKS] effortlessly on any device

Digital document administration has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents rapidly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and simplify any document-oriented process today.

How to modify and electronically sign [SKS] easily

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using the tools specifically provided by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes requiring the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Notice 931 Rev February Deposit Requirements For Employment Taxes

Create this form in 5 minutes!

How to create an eSignature for the notice 931 rev february deposit requirements for employment taxes 1661579

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Notice 931 Rev February Deposit Requirements For Employment Taxes?

Notice 931 Rev February Deposit Requirements For Employment Taxes outlines the rules that employers must follow regarding their employment tax deposits. It provides essential deadlines and methods for making these deposits to avoid penalties. Understanding this notice is crucial for businesses to maintain compliance with IRS regulations.

-

How can airSlate SignNow help me manage Notice 931 Rev February Deposit Requirements For Employment Taxes?

airSlate SignNow streamlines the process of managing documentation related to Notice 931 Rev February Deposit Requirements For Employment Taxes. By digitizing your tax-related documents, you can ensure all forms are signed and submitted on time. Our solution simplifies tracking deadlines and maintaining compliance.

-

Is airSlate SignNow cost-effective for small businesses handling Notice 931 Rev February Deposit Requirements For Employment Taxes?

Yes, airSlate SignNow offers a cost-effective solution designed for small businesses navigating Notice 931 Rev February Deposit Requirements For Employment Taxes. Our pricing plans are competitive, allowing businesses to access powerful eSignature features without breaking the budget. This enables small businesses to focus on compliance without added financial stress.

-

What features does airSlate SignNow provide to assist with employment tax documentation?

airSlate SignNow includes features that are particularly useful for compliance with Notice 931 Rev February Deposit Requirements For Employment Taxes, such as customizable templates and secure eSigning. Additionally, our platform offers document tracking and automated reminders, which simplifies the process of ensuring timely and accurate submissions.

-

Can I integrate airSlate SignNow with my existing accounting software for employment taxes?

Absolutely! airSlate SignNow can be easily integrated with various accounting software to manage your Notice 931 Rev February Deposit Requirements For Employment Taxes. This seamless connection helps streamline your workflow, ensuring all necessary documents are readily available and signed in a timely manner.

-

What are the benefits of using airSlate SignNow for managing tax documents?

Using airSlate SignNow to manage documents related to Notice 931 Rev February Deposit Requirements For Employment Taxes provides numerous benefits, including enhanced efficiency and increased compliance. Our platform minimizes the risk of errors associated with manual processes, ensuring your documents are correctly managed. This ultimately helps you avoid costly penalties from the IRS.

-

Are there templates available for completing Notice 931 Rev February?

Yes, airSlate SignNow offers customizable templates that can be tailored to meet the specific requirements of Notice 931 Rev February Deposit Requirements For Employment Taxes. These templates help reduce the time spent on document preparation by providing a structured format. Users can easily fill in the necessary information and ensure compliance.

Get more for Notice 931 Rev February Deposit Requirements For Employment Taxes

- Dekko place apartments form

- Two way tables independent practice worksheet form

- Martin county owner builder permit form

- Credit card holder authorization letter form

- Irs pub 584 form

- Timson securities reviews form

- Chapter18 consumer loanscredit cards and real estate lending form

- Sf 12v2 survey standard spanish edgewood form

Find out other Notice 931 Rev February Deposit Requirements For Employment Taxes

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online

- Sign West Virginia Car Insurance Quotation Form Online

- Sign Wisconsin Car Insurance Quotation Form Online

- Sign Alabama Life-Insurance Quote Form Free

- Sign California Apply for Lead Pastor Easy

- Sign Rhode Island Certeficate of Insurance Request Free

- Sign Hawaii Life-Insurance Quote Form Fast

- Sign Indiana Life-Insurance Quote Form Free

- Sign Maryland Church Donation Giving Form Later