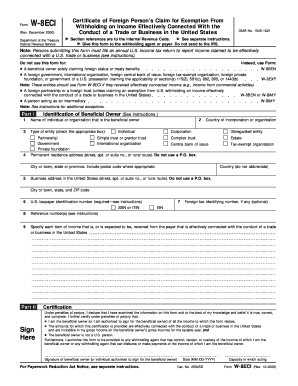

Note Persons Submitting This for M Must File an Annual U Form

What is the Note Persons Submitting This For M Must File An Annual U

The Note Persons Submitting This For M Must File An Annual U is a specific form used primarily for tax reporting purposes in the United States. This form is essential for individuals and businesses that are required to report certain types of income or financial activities to the Internal Revenue Service (IRS). It serves as a formal declaration of the income generated, ensuring compliance with federal tax laws.

How to use the Note Persons Submitting This For M Must File An Annual U

To effectively use the Note Persons Submitting This For M Must File An Annual U, individuals must first gather all relevant financial documentation. This includes income statements, previous tax returns, and any other pertinent financial records. Once the necessary information is collected, users can fill out the form, ensuring that all sections are completed accurately. It is crucial to double-check all entries for correctness before submission to avoid potential issues with the IRS.

Steps to complete the Note Persons Submitting This For M Must File An Annual U

Completing the Note Persons Submitting This For M Must File An Annual U involves several key steps:

- Gather all required financial documents, including income statements and previous tax filings.

- Carefully read the instructions provided with the form to understand each section.

- Fill out the form accurately, ensuring all information is complete and correct.

- Review the completed form for any errors or omissions.

- Submit the form to the IRS by the designated deadline, either electronically or by mail.

Filing Deadlines / Important Dates

Filing deadlines for the Note Persons Submitting This For M Must File An Annual U are critical to ensure compliance with IRS regulations. Typically, the form must be submitted annually by April fifteenth. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to stay informed about any changes in deadlines or requirements that may occur each tax year.

Required Documents

When preparing to submit the Note Persons Submitting This For M Must File An Annual U, individuals must have several documents on hand. Required documents typically include:

- Income statements such as W-2s or 1099s.

- Previous year’s tax return for reference.

- Any supporting documentation for deductions or credits claimed.

Having these documents ready will facilitate a smoother completion process and help ensure accuracy.

Penalties for Non-Compliance

Failure to submit the Note Persons Submitting This For M Must File An Annual U by the deadline can result in significant penalties. The IRS may impose fines based on the amount of tax owed and the length of time the form is late. Additionally, non-compliance can lead to increased scrutiny from the IRS, potentially resulting in audits or further legal action. It is essential to adhere to filing requirements to avoid these consequences.

Quick guide on how to complete note persons submitting this for m must file an annual u

Complete [SKS] effortlessly on any device

Online document organization has become increasingly popular with businesses and individuals alike. It offers an excellent eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents rapidly without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to adjust and eSign [SKS] effortlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invite link, or downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign [SKS] while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Note Persons Submitting This For M Must File An Annual U

Create this form in 5 minutes!

How to create an eSignature for the note persons submitting this for m must file an annual u

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does the term 'Note Persons Submitting This For M Must File An Annual U' refer to?

The phrase 'Note Persons Submitting This For M Must File An Annual U' is an important compliance reminder for businesses. It indicates that individuals responsible for certain submissions need to be aware of their annual filing requirements. airSlate SignNow provides guidance on managing these documents efficiently.

-

How does airSlate SignNow support users in filing their annual requirements?

airSlate SignNow helps streamline compliance by enabling users to prepare, sign, and manage documents digitally. This ensures that 'Note Persons Submitting This For M Must File An Annual U' requirements are met without the hassle of physical paperwork. Our solution is designed to simplify the document workflow for users.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers various pricing plans, catering to different business needs. Our plans are designed to be cost-effective, ensuring that all users can access essential features without breaking the bank. Remember, 'Note Persons Submitting This For M Must File An Annual U' may come with specific filing intricacies that our platform can assist with.

-

What key features does airSlate SignNow offer?

Key features of airSlate SignNow include eSigning, document templates, secure storage, and advanced integrations. These features collectively enhance productivity and ensure that users can manage their documents efficiently. With our solution, understanding 'Note Persons Submitting This For M Must File An Annual U' becomes straightforward.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow seamlessly integrates with various platforms to enhance your workflow. This allows users to connect their eSigning process with other business applications. By using our platform, you can more easily handle tasks related to 'Note Persons Submitting This For M Must File An Annual U.'

-

What are the benefits of using airSlate SignNow for document management?

Using airSlate SignNow for document management offers numerous benefits, including time savings, enhanced security, and improved collaboration. These advantages make it easier for businesses to meet regulatory requirements, including those related to 'Note Persons Submitting This For M Must File An Annual U.' Our user-friendly interface ensures a smooth experience.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely! airSlate SignNow employs advanced encryption and security measures to protect all documents. Users can confidently send sensitive files, knowing they are compliant with requirements like 'Note Persons Submitting This For M Must File An Annual U.' Security is a top priority at airSlate SignNow.

Get more for Note Persons Submitting This For M Must File An Annual U

Find out other Note Persons Submitting This For M Must File An Annual U

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form