Form W 5 Fill in Version Earned Income Credit Advance Payment Certificate

What is the Form W-5 Earned Income Credit Advance Payment Certificate?

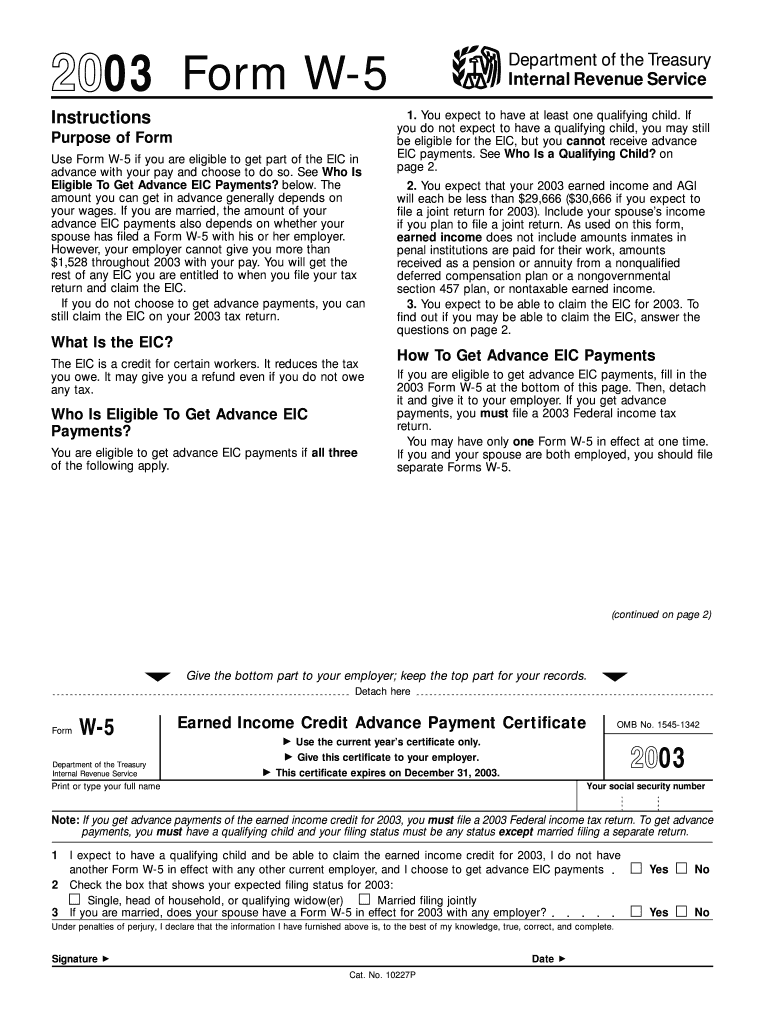

The Form W-5, officially known as the Earned Income Credit Advance Payment Certificate, is a tax form used in the United States. It allows eligible employees to request advance payments of the Earned Income Tax Credit (EITC) directly from their employers. This form is particularly beneficial for low to moderate-income workers, as it provides immediate financial relief by allowing them to receive part of their tax credit throughout the year instead of waiting until they file their tax returns.

How to Obtain the Form W-5

To obtain the Form W-5, individuals can visit the official IRS website, where the form is available for download. Additionally, taxpayers may request a physical copy from their employers or local IRS offices. It is important to ensure that the most current version of the form is used to avoid any issues with processing. When seeking the form, verify that it is the fillable version to facilitate digital completion and submission.

Steps to Complete the Form W-5

Completing the Form W-5 involves several key steps:

- Personal Information: Fill in your name, address, and Social Security number at the top of the form.

- Eligibility Check: Confirm your eligibility for the EITC by reviewing the criteria outlined in the form instructions.

- Advance Payment Request: Indicate the amount you wish to receive as an advance payment, based on your estimated EITC for the year.

- Employer Information: Provide your employer's name and address in the designated section.

- Signature: Sign and date the form to certify that the information provided is accurate and complete.

Key Elements of the Form W-5

The Form W-5 includes several important elements that must be accurately filled out:

- Personal Identification: This section requires your name, address, and Social Security number.

- Eligibility Criteria: You must meet specific income and filing status requirements to qualify for the EITC.

- Advance Payment Amount: Specify the amount you are requesting, which should be based on your estimated EITC.

- Employer Details: Include your employer's information to facilitate the advance payment process.

IRS Guidelines for the Form W-5

The IRS provides specific guidelines for completing and submitting the Form W-5. Taxpayers must ensure that they meet the eligibility requirements for the EITC, which include income limits and qualifying children criteria. Additionally, the IRS recommends that taxpayers keep copies of the form and any related documents for their records. It is crucial to submit the form to your employer promptly to start receiving advance payments as soon as possible.

Eligibility Criteria for the Form W-5

To qualify for the advance payments through the Form W-5, individuals must meet certain eligibility criteria:

- Income Level: Your earned income must fall within the specified limits set by the IRS for the tax year.

- Filing Status: You must file as single, head of household, or married filing jointly.

- Qualifying Children: If applicable, you must have qualifying children who meet the IRS requirements.

Quick guide on how to complete form w 5 fill in version earned income credit advance payment certificate

Complete Form W 5 Fill in Version Earned Income Credit Advance Payment Certificate with ease on any device

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the right form and safely store it digitally. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Form W 5 Fill in Version Earned Income Credit Advance Payment Certificate on any device with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign Form W 5 Fill in Version Earned Income Credit Advance Payment Certificate effortlessly

- Obtain Form W 5 Fill in Version Earned Income Credit Advance Payment Certificate and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your updates.

- Choose how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign Form W 5 Fill in Version Earned Income Credit Advance Payment Certificate to facilitate outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 5 fill in version earned income credit advance payment certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form W 5 Fill in Version Earned Income Credit Advance Payment Certificate?

The Form W 5 Fill in Version Earned Income Credit Advance Payment Certificate is a document used to verify your eligibility for the Earned Income Credit. It allows qualifying individuals to receive advance payments of the credit throughout the year. This form simplifies the process of claiming advance payments, ensuring you receive the benefits you are entitled to.

-

How can I complete the Form W 5 Fill in Version Earned Income Credit Advance Payment Certificate using airSlate SignNow?

You can easily complete the Form W 5 Fill in Version Earned Income Credit Advance Payment Certificate through airSlate SignNow's user-friendly interface. Simply upload the form, fill in the required fields, and eSign it electronically. Our platform makes document completion and submission quicker and hassle-free.

-

Is there a cost associated with using the airSlate SignNow for the Form W 5 Fill in Version Earned Income Credit Advance Payment Certificate?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. Our pricing is competitive and ensures you receive great value for eSigning and managing documents like the Form W 5 Fill in Version Earned Income Credit Advance Payment Certificate. Choose a plan that fits your requirements and budget.

-

What are the benefits of using airSlate SignNow for the Form W 5 Fill in Version Earned Income Credit Advance Payment Certificate?

Using airSlate SignNow for the Form W 5 Fill in Version Earned Income Credit Advance Payment Certificate provides numerous benefits, including enhanced security, faster processing times, and the ability to manage documents from any device. You can track the signing process, ensuring that your forms are completed and submitted timely.

-

Can I integrate airSlate SignNow with other applications for processing the Form W 5 Fill in Version Earned Income Credit Advance Payment Certificate?

Yes, airSlate SignNow offers seamless integrations with various applications and platforms. This allows you to streamline your workflow when processing the Form W 5 Fill in Version Earned Income Credit Advance Payment Certificate and other necessary documents, enhancing overall efficiency and productivity.

-

Is electronic signing of the Form W 5 Fill in Version Earned Income Credit Advance Payment Certificate legally valid?

Yes, electronic signatures on the Form W 5 Fill in Version Earned Income Credit Advance Payment Certificate are legally binding. airSlate SignNow complies with all applicable laws, ensuring that your eSigned documents hold up in court and meet regulatory requirements. This provides peace of mind while managing your important documents.

-

What support does airSlate SignNow provide if I have questions about the Form W 5 Fill in Version Earned Income Credit Advance Payment Certificate?

airSlate SignNow offers excellent customer support to assist you with any questions regarding the Form W 5 Fill in Version Earned Income Credit Advance Payment Certificate. Our dedicated support team is available through various channels, ready to help you navigate any complexities you might encounter while using our platform.

Get more for Form W 5 Fill in Version Earned Income Credit Advance Payment Certificate

- Authorization form in favour of vfs visa application centre vfs global

- Power of attorney form 2848me maine gov

- Handstand rubric form

- Mold remediation notification form cmu edu

- Cme activity planning worksheet form

- Contact us treasurer tax collector tulare county ca gov form

- Patient registration form the retina group of washington

- Form it 2664 nonresident cooperative unit estimated income tax payment form tax year

Find out other Form W 5 Fill in Version Earned Income Credit Advance Payment Certificate

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile