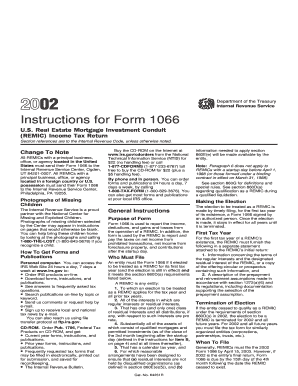

Real Estate Mortgage Investment Conduit REMIC Income Tax Return Form

What is the Real Estate Mortgage Investment Conduit REMIC Income Tax Return

The Real Estate Mortgage Investment Conduit (REMIC) Income Tax Return is a specialized tax form used by entities that qualify as REMICs. REMICs are investment vehicles that hold a pool of mortgage loans and issue securities backed by these loans. This tax return is crucial for reporting income, deductions, and other tax-related information specific to the REMIC structure. It is designed to ensure compliance with Internal Revenue Service (IRS) regulations, allowing REMICs to pass through income to investors without incurring entity-level tax.

How to use the Real Estate Mortgage Investment Conduit REMIC Income Tax Return

Using the REMIC Income Tax Return involves several steps. First, entities must determine their eligibility as a REMIC under IRS guidelines. Once eligibility is established, the entity must gather all necessary financial information, including income from mortgage loans, expenses, and distributions to investors. The completed form must then be filed with the IRS, typically by the due date specified for the tax year. It is essential to ensure accuracy in reporting to avoid penalties and ensure compliance with tax laws.

Steps to complete the Real Estate Mortgage Investment Conduit REMIC Income Tax Return

Completing the REMIC Income Tax Return requires careful attention to detail. The following steps outline the process:

- Gather financial statements and records related to mortgage income and expenses.

- Determine the amount of income that will be passed through to investors.

- Complete the form, ensuring all sections are filled out accurately.

- Review the form for any errors or omissions.

- Submit the form to the IRS by the established deadline.

Key elements of the Real Estate Mortgage Investment Conduit REMIC Income Tax Return

The REMIC Income Tax Return includes several key elements that must be reported. These elements typically include:

- Total income from mortgage loans.

- Deductions for allowable expenses, such as servicing costs and management fees.

- Distributions made to investors during the tax year.

- Any tax credits or adjustments applicable to the REMIC.

Filing Deadlines / Important Dates

Filing deadlines for the REMIC Income Tax Return are critical to avoid penalties. Generally, the return is due on the fifteenth day of the fourth month following the end of the tax year. For entities operating on a calendar year, this typically means an April deadline. It is important to stay updated on any changes to these dates, as they can vary based on specific circumstances or IRS announcements.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the REMIC Income Tax Return can result in significant penalties. These may include monetary fines for late submissions, inaccuracies, or failure to file altogether. The IRS may also impose additional penalties based on the amount of tax owed. Therefore, it is essential for REMICs to adhere to all filing requirements and deadlines to avoid these financial repercussions.

Quick guide on how to complete real estate mortgage investment conduit remic income tax return

Execute [SKS] effortlessly on any gadget

Digital document administration has gained traction among companies and individuals alike. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to find the necessary template and securely save it online. airSlate SignNow provides all the tools you require to produce, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign [SKS] with ease

- Find [SKS] and select Get Form to initiate.

- Utilize the tools we offer to complete your template.

- Emphasize critical parts of your documents or redact sensitive information with tools specifically available from airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to store your alterations.

- Select how you wish to send your template, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Alter and electronically sign [SKS] to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Real Estate Mortgage Investment Conduit REMIC Income Tax Return

Create this form in 5 minutes!

How to create an eSignature for the real estate mortgage investment conduit remic income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Real Estate Mortgage Investment Conduit REMIC Income Tax Return?

A Real Estate Mortgage Investment Conduit REMIC Income Tax Return is a specialized tax return required for entities involved in mortgage investments. This document helps report earnings and deductions associated with the REMIC, ensuring compliance with tax regulations. Understanding this return is crucial for investors looking to maximize their tax efficiency.

-

How can airSlate SignNow assist with Real Estate Mortgage Investment Conduit REMIC Income Tax Returns?

airSlate SignNow streamlines the process of preparing and submitting your Real Estate Mortgage Investment Conduit REMIC Income Tax Return. Our platform facilitates electronic signatures and document management, making it easier to compile necessary documents. This efficiency can help reduce errors and save time during tax season.

-

What pricing options does airSlate SignNow offer for tax document management?

airSlate SignNow provides flexible pricing plans to cater to various business needs, including those focused on Real Estate Mortgage Investment Conduit REMIC Income Tax Returns. Plans range from individual subscriptions to enterprise solutions, all designed to offer value through our cost-effective platform. Explore our pricing page for tailored options.

-

Are there any features that specifically support Real Estate Mortgage Investment Conduit REMIC Income Tax Returns?

Yes, airSlate SignNow offers features like customizable templates and automated workflows that specifically support Real Estate Mortgage Investment Conduit REMIC Income Tax Returns. These tools help simplify document preparation and enhance collaboration among team members. Efficient automation ensures accuracy and expedites the filing process.

-

What benefits does airSlate SignNow provide for handling tax documents?

Using airSlate SignNow for your Real Estate Mortgage Investment Conduit REMIC Income Tax Return brings numerous benefits, including reduced processing time and improved accuracy. Our user-friendly platform promotes seamless collaboration, enabling multiple stakeholders to review and sign documents. Additionally, our secure storage solutions protect sensitive information.

-

Does airSlate SignNow integrate with accounting software for Real Estate Mortgage Investment Conduit REMIC Income Tax Returns?

Yes, airSlate SignNow integrates with various accounting software solutions, enhancing your ability to manage Real Estate Mortgage Investment Conduit REMIC Income Tax Returns effectively. These integrations allow for seamless data transfer and streamline the overall tax preparation process. Check out our integration options for compatibility details.

-

How secure is my information when using airSlate SignNow for tax purposes?

Security is a top priority for airSlate SignNow, especially for sensitive documents like the Real Estate Mortgage Investment Conduit REMIC Income Tax Return. We utilize advanced encryption technologies and comply with industry standards to safeguard your information. This commitment ensures that your data remains confidential and protected.

Get more for Real Estate Mortgage Investment Conduit REMIC Income Tax Return

Find out other Real Estate Mortgage Investment Conduit REMIC Income Tax Return

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now