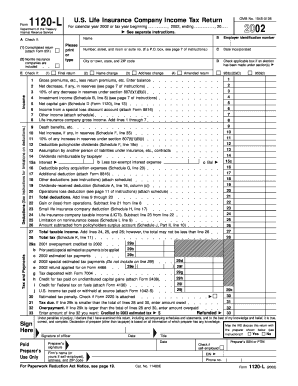

Life Insurance Company Income Tax Return for Calendar Year or Tax Year Beginning , , Ending See Separate Instructions Form

What is the Life Insurance Company Income Tax Return

The Life Insurance Company Income Tax Return is a specific tax form designed for life insurance companies operating in the United States. This form is essential for reporting income, deductions, and tax liabilities for a calendar year or a designated tax year. It ensures compliance with federal tax regulations and provides the IRS with necessary financial information about the company's operations. The form includes various sections that require detailed financial data, allowing the IRS to assess the company's tax obligations accurately.

How to Use the Life Insurance Company Income Tax Return

To effectively use the Life Insurance Company Income Tax Return, companies must first gather all relevant financial documents, including income statements, balance sheets, and prior tax returns. The form must be filled out accurately, reflecting the company's financial activities for the specified tax year. Each section of the form corresponds to different aspects of the company's finances, such as premiums collected, claims paid, and investment income. After completing the form, it should be reviewed for accuracy before submission to the IRS.

Steps to Complete the Life Insurance Company Income Tax Return

Completing the Life Insurance Company Income Tax Return involves several key steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Fill out the form sections carefully, ensuring all income and deductions are accurately reported.

- Double-check calculations to avoid errors that could lead to penalties.

- Sign and date the form, confirming its accuracy and completeness.

- Submit the form by the designated deadline, either electronically or by mail.

Filing Deadlines / Important Dates

Filing deadlines for the Life Insurance Company Income Tax Return are crucial for compliance. Typically, the return must be filed by the fifteenth day of the third month following the end of the tax year. For companies operating on a calendar year, this means the deadline is March fifteen of the following year. Extensions may be available, but they must be requested in advance and can affect the timing of tax payments.

Required Documents

To complete the Life Insurance Company Income Tax Return, several documents are required:

- Income statements detailing premiums and investment income.

- Balance sheets showing assets, liabilities, and equity.

- Records of claims paid and reserves for future claims.

- Prior year tax returns for reference and consistency.

Penalties for Non-Compliance

Failure to file the Life Insurance Company Income Tax Return on time or inaccuracies within the form can result in significant penalties. The IRS may impose fines based on the amount of tax owed, and interest may accrue on unpaid taxes. Additionally, non-compliance can lead to audits and further scrutiny of the company’s financial practices. It is vital for companies to adhere to filing requirements to avoid these consequences.

Quick guide on how to complete life insurance company income tax return for calendar year or tax year beginning ending see separate instructions

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as a perfect environmentally friendly substitute for traditional printed and signed papers, allowing you to access the right template and store it securely online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without any delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to Modify and eSign [SKS] with Ease

- Find [SKS] and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize critical sections of the documents or redact sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign tool, which only takes a few seconds and has the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate the hassle of lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from any device. Edit and electronically sign [SKS] and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Life Insurance Company Income Tax Return For Calendar Year Or Tax Year Beginning , , Ending See Separate Instructions

Create this form in 5 minutes!

How to create an eSignature for the life insurance company income tax return for calendar year or tax year beginning ending see separate instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the Life Insurance Company Income Tax Return For Calendar Year Or Tax Year Beginning , , Ending See Separate Instructions?

The Life Insurance Company Income Tax Return For Calendar Year Or Tax Year Beginning , , Ending See Separate Instructions provides guidelines for life insurance companies to file their income tax returns. It ensures compliance with tax regulations, helping companies accurately report their income and expenses related to life insurance activities. Following these instructions is crucial for avoiding tax penalties and maintaining good standing with tax authorities.

-

How can airSlate SignNow assist with filing the Life Insurance Company Income Tax Return?

airSlate SignNow streamlines the document signing process, making it easier for businesses to manage their Life Insurance Company Income Tax Return For Calendar Year Or Tax Year Beginning , , Ending See Separate Instructions. By digitizing the process, users can send, receive, and eSign necessary tax documents without hassle. This saves time and reduces the risk of errors during filing.

-

Are there any integration options available for airSlate SignNow to aid in tax preparation?

Yes, airSlate SignNow offers various integration options which can enhance your tax preparation workflow. By integrating with accounting and tax software, businesses can ensure that the data needed for the Life Insurance Company Income Tax Return For Calendar Year Or Tax Year Beginning , , Ending See Separate Instructions is accurate and readily available. This seamless process reduces manual data entry and improves overall efficiency.

-

What are the benefits of using airSlate SignNow for insurance companies?

Using airSlate SignNow for insurance companies provides numerous benefits, including enhanced document security, reduced turnaround times, and improved compliance. The platform is designed to facilitate the electronic signing and management of vital documents like the Life Insurance Company Income Tax Return For Calendar Year Or Tax Year Beginning , , Ending See Separate Instructions. It’s a cost-effective solution that can streamline operations and improve client experiences.

-

Is airSlate SignNow a cost-effective solution for small insurance businesses?

Absolutely! airSlate SignNow is designed to be a cost-effective solution ideal for small insurance businesses. With its competitive pricing model, users can access all necessary features to manage the Life Insurance Company Income Tax Return For Calendar Year Or Tax Year Beginning , , Ending See Separate Instructions efficiently without breaking the bank. This flexibility allows businesses to save on overhead costs while maintaining productivity.

-

Can airSlate SignNow help with compliance regarding tax filings?

Yes, airSlate SignNow aids in maintaining compliance with tax filings by providing a secure platform for document management and eSigning. By ensuring that all relevant documents, such as the Life Insurance Company Income Tax Return For Calendar Year Or Tax Year Beginning , , Ending See Separate Instructions, are signed and stored in accordance with legal requirements, businesses can mitigate risks related to non-compliance. It helps to stay organized and maintain comprehensive records.

-

What features does airSlate SignNow offer to facilitate tax documentation?

airSlate SignNow features a user-friendly interface, customizable workflows, document tracking, and secure storage. These features are essential for managing documents like the Life Insurance Company Income Tax Return For Calendar Year Or Tax Year Beginning , , Ending See Separate Instructions efficiently. Users can automate the signing process, ensuring timely submissions and reducing the administrative burden on staff.

Get more for Life Insurance Company Income Tax Return For Calendar Year Or Tax Year Beginning , , Ending See Separate Instructions

Find out other Life Insurance Company Income Tax Return For Calendar Year Or Tax Year Beginning , , Ending See Separate Instructions

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy