Form 3903 Fill in Version Moving Expenses

What is the Form 3903 Fill in Version Moving Expenses

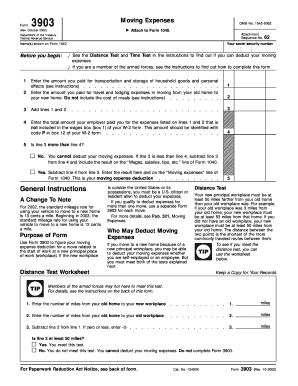

The Form 3903 Fill in Version Moving Expenses is a tax form used by individuals to report moving expenses incurred during a relocation for work purposes. This form is particularly relevant for taxpayers who meet specific criteria set by the IRS, allowing them to deduct eligible moving costs from their taxable income. The form captures essential details regarding the move, including the distance traveled and the expenses incurred, ensuring that taxpayers can accurately claim their deductions.

How to use the Form 3903 Fill in Version Moving Expenses

Using the Form 3903 Fill in Version Moving Expenses involves several steps. First, gather all necessary documentation related to your move, such as receipts for transportation, storage, and travel expenses. Next, fill out the form by providing your personal information and detailing the moving expenses. Ensure that you follow the IRS guidelines for eligible expenses to maximize your deductions. After completing the form, it can be submitted with your tax return, either electronically or by mail, depending on your filing method.

Steps to complete the Form 3903 Fill in Version Moving Expenses

Completing the Form 3903 Fill in Version Moving Expenses requires careful attention to detail. Start by entering your name, address, and Social Security number at the top of the form. Next, list your moving expenses in the designated sections, categorizing them as either transportation expenses or storage expenses. Be sure to include the total amount for each category and verify that all entries are accurate. Finally, review the form for completeness before submitting it with your tax return.

Eligibility Criteria

To qualify for using the Form 3903 Fill in Version Moving Expenses, taxpayers must meet specific eligibility criteria. Generally, the move must be closely related to the start of a new job or business location, and the distance must exceed a certain threshold from the previous residence to the new workplace. Additionally, the taxpayer must be employed or self-employed at the time of the move. Understanding these criteria is essential for ensuring that you can legitimately claim moving expenses on your tax return.

IRS Guidelines

The IRS provides detailed guidelines regarding the use of the Form 3903 Fill in Version Moving Expenses. Taxpayers should familiarize themselves with the types of expenses that can be deducted, such as transportation costs, packing and shipping expenses, and temporary lodging fees. It is also important to note that certain expenses, like meals during the move, are not deductible. Reviewing these guidelines will help ensure compliance and maximize potential deductions.

Required Documents

When completing the Form 3903 Fill in Version Moving Expenses, several documents are required to substantiate your claims. These may include receipts for moving services, transportation costs, and any related travel expenses. Additionally, documentation proving the distance of the move and the connection to employment is essential. Keeping organized records will facilitate the completion of the form and support your deductions in case of an audit.

Form Submission Methods

The Form 3903 Fill in Version Moving Expenses can be submitted through various methods. Taxpayers may choose to file their tax returns electronically, which often allows for a quicker processing time. Alternatively, the form can be printed and mailed to the appropriate IRS address. It is important to follow the submission guidelines provided by the IRS to ensure that the form is processed correctly and in a timely manner.

Quick guide on how to complete form 3903 fill in version moving expenses

Easily Prepare [SKS] on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers a fantastic environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the features required to create, edit, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Modify and eSign [SKS] Effortlessly

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize essential sections of the documents or obscure sensitive details with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 3903 Fill in Version Moving Expenses

Create this form in 5 minutes!

How to create an eSignature for the form 3903 fill in version moving expenses

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 3903 Fill in Version Moving Expenses and how does it work?

The Form 3903 Fill in Version Moving Expenses allows users to easily report eligible moving expenses on their tax returns. With airSlate SignNow, you can fill out this form online, saving time and ensuring accuracy. Our platform simplifies the process, making it easy for users to navigate.

-

Is there a cost associated with using the Form 3903 Fill in Version Moving Expenses on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that you can choose from based on your needs. Using the Form 3903 Fill in Version Moving Expenses is included in the subscription, providing you with a cost-effective solution for document management. Check our pricing page for specific details.

-

What features does airSlate SignNow offer for filling out the Form 3903 Fill in Version Moving Expenses?

airSlate SignNow provides a user-friendly interface, eSignature capabilities, and the ability to store and share completed documents. When using the Form 3903 Fill in Version Moving Expenses, you can easily collaborate with others and ensure compliance with IRS requirements. Our platform integrates various tools to enhance efficiency.

-

Can I use airSlate SignNow to eSign the Form 3903 Fill in Version Moving Expenses?

Absolutely! airSlate SignNow allows you to eSign the Form 3903 Fill in Version Moving Expenses securely. This feature ensures that your signatures are legally binding and encrypted for confidentiality, streamlining the submission process.

-

Are there any integrations available with airSlate SignNow for managing the Form 3903 Fill in Version Moving Expenses?

Yes, airSlate SignNow integrates with various applications such as Google Drive, Dropbox, and Microsoft Office, enhancing your workflow efficiency. These integrations facilitate easy access to your Form 3903 Fill in Version Moving Expenses, allowing you to manage documents seamlessly across platforms.

-

How can airSlate SignNow help me keep track of my Form 3903 Fill in Version Moving Expenses submissions?

With airSlate SignNow, you have access to real-time tracking features that allow you to monitor the progress of your Form 3903 Fill in Version Moving Expenses submissions. You'll receive notifications whenever the status changes, ensuring you stay informed throughout the process.

-

Is technical support available if I encounter issues with the Form 3903 Fill in Version Moving Expenses?

Yes, airSlate SignNow offers comprehensive customer support to help you with any issues related to the Form 3903 Fill in Version Moving Expenses. Our team is available through various channels, ensuring you receive the assistance you need promptly and efficiently.

Get more for Form 3903 Fill in Version Moving Expenses

- Pak experience certification form online

- City of houston alarm permit application form

- Report to determine status application for employer number tngov tn form

- Ara alarm administration permit the security store houston tx form

- Cc 2e form

- Commonly prescribed psychotropic medications reachnola form

- Immi 1008form

- React pdf form filler

Find out other Form 3903 Fill in Version Moving Expenses

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free