Form 6559 a Rev January Fill in Version Continuation Sheet for Form 6559

What is the Form 6559 A Rev January Fill in Version Continuation Sheet For Form 6559

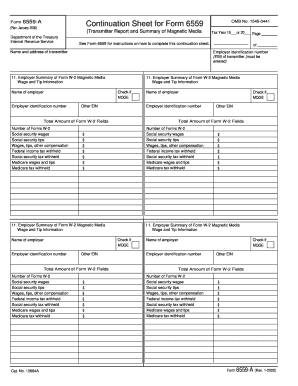

The Form 6559 A Rev January Fill in Version Continuation Sheet For Form 6559 is a supplementary document used in conjunction with the primary Form 6559. This form is designed to gather additional information that cannot be accommodated within the main form. It is particularly useful for individuals or businesses that require more space to provide detailed responses or explanations related to their submission. The continuation sheet ensures that all necessary information is captured, facilitating a smooth review process by the relevant authorities.

How to use the Form 6559 A Rev January Fill in Version Continuation Sheet For Form 6559

Using the Form 6559 A Rev January Fill in Version Continuation Sheet is straightforward. Begin by completing the primary Form 6559, and when you reach a point where additional information is necessary, refer to the continuation sheet. Clearly indicate the section of the main form that the additional information pertains to, ensuring that the reviewing body can easily connect the responses. Fill out the continuation sheet with the required details, and attach it to the primary form before submission.

Steps to complete the Form 6559 A Rev January Fill in Version Continuation Sheet For Form 6559

Completing the Form 6559 A Rev January Fill in Version Continuation Sheet involves several key steps:

- Begin by reviewing the primary Form 6559 to identify where additional information is needed.

- Clearly label each section on the continuation sheet to correspond with the relevant sections of the main form.

- Provide detailed responses, ensuring clarity and completeness to avoid delays in processing.

- Double-check all entries for accuracy and completeness.

- Attach the continuation sheet to the primary Form 6559 before submission.

Key elements of the Form 6559 A Rev January Fill in Version Continuation Sheet For Form 6559

The key elements of the Form 6559 A Rev January Fill in Version Continuation Sheet include:

- Identification Information: This includes the name, address, and identification number of the individual or business submitting the form.

- Section References: Clear references to the sections of the primary form that require additional information.

- Detailed Responses: Space for providing comprehensive answers or explanations that are necessary for the review process.

- Signature and Date: A section for the signer to confirm the accuracy of the information provided.

Legal use of the Form 6559 A Rev January Fill in Version Continuation Sheet For Form 6559

The Form 6559 A Rev January Fill in Version Continuation Sheet is legally recognized as part of the submission process for the primary Form 6559. It is essential to use this continuation sheet appropriately to ensure compliance with relevant regulations. Failure to provide necessary information on this form may lead to delays or penalties. Always ensure that the information provided is truthful and complete, as inaccuracies can result in legal repercussions.

Quick guide on how to complete form 6559 a rev january fill in version continuation sheet for form 6559

Effortlessly prepare [SKS] on any device

Digital document management has become increasingly favored by organizations and individuals. It offers a sustainable substitute for traditional printed and signed documents, allowing you to find the right template and securely keep it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and electronically sign [SKS] effortlessly

- Find [SKS] and click on Get Form to begin.

- Utilize the tools available to finish your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that function.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and then click the Done button to store your changes.

- Choose your preferred method of sharing your form, whether by email, SMS, invite link, or download it to your computer.

Forget about losing or misplacing documents, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] to ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 6559 a rev january fill in version continuation sheet for form 6559

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 6559 A Rev January Fill in Version Continuation Sheet For Form 6559?

The Form 6559 A Rev January Fill in Version Continuation Sheet For Form 6559 is a document used to provide additional information or context for the main Form 6559. This fillable version ensures that users can easily complete and submit their information electronically, streamlining the filing process.

-

How can I access the Form 6559 A Rev January Fill in Version Continuation Sheet For Form 6559?

You can access the Form 6559 A Rev January Fill in Version Continuation Sheet For Form 6559 directly from the airSlate SignNow platform. Simply navigate to the document section after logging in, and you’ll find the option to fill out and save the form conveniently.

-

Is the airSlate SignNow solution compatible with the Form 6559 A Rev January Fill in Version Continuation Sheet For Form 6559?

Yes, airSlate SignNow provides seamless integration for the Form 6559 A Rev January Fill in Version Continuation Sheet For Form 6559. Users can easily insert, fill, and eSign this form as part of our comprehensive document management solutions, enhancing efficiency in your workflow.

-

What are the pricing options for using airSlate SignNow with the Form 6559 A Rev January Fill in Version Continuation Sheet For Form 6559?

airSlate SignNow offers flexible pricing plans tailored to your business needs. Our plans provide unlimited access to fillable forms, including the Form 6559 A Rev January Fill in Version Continuation Sheet For Form 6559, ensuring that you get the best value while managing your document signing processes.

-

What features does airSlate SignNow offer for the Form 6559 A Rev January Fill in Version Continuation Sheet For Form 6559?

airSlate SignNow includes several features for the Form 6559 A Rev January Fill in Version Continuation Sheet For Form 6559, such as eSignature capabilities, cloud storage, and collaboration tools. These features help you manage and complete your documents efficiently and securely.

-

Can the Form 6559 A Rev January Fill in Version Continuation Sheet For Form 6559 be customized?

Absolutely! With airSlate SignNow, the Form 6559 A Rev January Fill in Version Continuation Sheet For Form 6559 can be customized to fit your specific business requirements. Users can add fields, adjust formatting, and include company branding to ensure it meets your organizational aesthetic.

-

How does airSlate SignNow enhance the security of the Form 6559 A Rev January Fill in Version Continuation Sheet For Form 6559?

Security is a top priority at airSlate SignNow. We use advanced encryption protocols and secure data storage to protect the integrity of the Form 6559 A Rev January Fill in Version Continuation Sheet For Form 6559, ensuring your information remains confidential and safe from unauthorized access.

Get more for Form 6559 A Rev January Fill in Version Continuation Sheet For Form 6559

Find out other Form 6559 A Rev January Fill in Version Continuation Sheet For Form 6559

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation