Form 8859 Fill in Version District of Columbia First Time Homebuyer Credit

What is the Form 8859 Fill in Version District Of Columbia First Time Homebuyer Credit

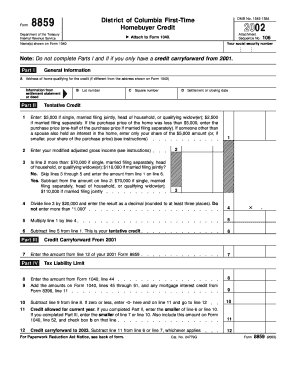

The Form 8859 is a specific tax form used in the District of Columbia to apply for the First Time Homebuyer Credit. This credit is designed to assist eligible first-time homebuyers in offsetting some of the costs associated with purchasing their first home. The form captures essential information regarding the buyer's identity, the property being purchased, and the financial details necessary to determine eligibility for the credit. Understanding this form is crucial for those looking to benefit from this financial incentive.

How to use the Form 8859 Fill in Version District Of Columbia First Time Homebuyer Credit

Using the Form 8859 involves several steps to ensure accurate completion and submission. First, gather all necessary information, including personal identification details, property information, and financial data. Next, carefully fill out the form, ensuring that all sections are completed accurately. After completing the form, review it for any errors or missing information. Finally, submit the form according to the guidelines provided by the District of Columbia's tax authority, either electronically or by mail.

Steps to complete the Form 8859 Fill in Version District Of Columbia First Time Homebuyer Credit

Completing the Form 8859 involves a systematic approach:

- Obtain the latest version of the form, ensuring it is the fill-in version for ease of use.

- Fill in your personal details, including your name, address, and Social Security number.

- Provide information about the property you are purchasing, including the address and purchase price.

- Detail your financial information, including any loans or grants you are receiving.

- Review the form for accuracy and completeness before submission.

Eligibility Criteria

To qualify for the First Time Homebuyer Credit in the District of Columbia, applicants must meet specific eligibility criteria. Generally, the applicant must be a first-time homebuyer, which is defined as someone who has not owned a home in the past three years. Additionally, the home must be purchased within the District of Columbia and must be used as the applicant's primary residence. Income limits may also apply, so it is essential to review the most current guidelines to ensure compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8859 are crucial for ensuring that applicants do not miss out on the First Time Homebuyer Credit. Typically, the form must be submitted by the tax filing deadline for the year in which the home purchase occurred. It is important to stay informed about any changes to deadlines, as these can vary from year to year. Marking important dates on your calendar can help ensure timely submission.

Required Documents

When completing the Form 8859, several documents are required to support your application. These typically include:

- Proof of identity, such as a driver's license or Social Security card.

- Documentation of the home purchase, including the purchase agreement and closing statement.

- Financial documentation, such as pay stubs or tax returns, to verify income eligibility.

Having these documents ready can streamline the application process and help avoid delays.

Quick guide on how to complete form 8859 fill in version district of columbia first time homebuyer credit

Complete [SKS] effortlessly on any device

Online document management has become increasingly prevalent among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and eSign your documents swiftly without delays. Handle [SKS] on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click on Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8859 Fill in Version District Of Columbia First Time Homebuyer Credit

Create this form in 5 minutes!

How to create an eSignature for the form 8859 fill in version district of columbia first time homebuyer credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 8859 Fill in Version District Of Columbia First Time Homebuyer Credit?

The Form 8859 Fill in Version District Of Columbia First Time Homebuyer Credit is a tax form designed for first-time homebuyers in Washington, D.C. This form allows eligible buyers to claim a tax credit, making homeownership more affordable. Completing this form correctly is essential to ensure you receive the benefits available to you.

-

How does airSlate SignNow assist with the Form 8859 Fill in Version District Of Columbia First Time Homebuyer Credit?

airSlate SignNow simplifies the process of completing the Form 8859 Fill in Version District Of Columbia First Time Homebuyer Credit by providing an easy-to-use platform for e-signing and submitting documents. Our solution streamlines the paperwork, ensuring that all necessary fields are filled in accurately. With our digital platform, you can manage your documents efficiently and reduce processing time.

-

Is there a cost associated with using the airSlate SignNow for the Form 8859 Fill in Version District Of Columbia First Time Homebuyer Credit?

Yes, there is a pricing model for using airSlate SignNow, but we offer competitive rates designed to provide excellent value. Our pricing gives you access to a powerful e-signature solution that can save you time and money while completing the Form 8859 Fill in Version District Of Columbia First Time Homebuyer Credit. You can choose from various plans that suit your needs.

-

What features does airSlate SignNow offer for filling out the Form 8859 Fill in Version District Of Columbia First Time Homebuyer Credit?

airSlate SignNow includes several important features to help you with the Form 8859 Fill in Version District Of Columbia First Time Homebuyer Credit. These features include customizable templates, cloud storage integration, and real-time status updates. Additionally, e-signing capabilities ensure that you can quickly and securely obtain necessary signatures.

-

Can I access the Form 8859 Fill in Version District Of Columbia First Time Homebuyer Credit on mobile devices using airSlate SignNow?

Absolutely! airSlate SignNow is mobile-friendly, allowing you to access and complete the Form 8859 Fill in Version District Of Columbia First Time Homebuyer Credit on your smartphone or tablet. This accessibility ensures you can manage your documents on-the-go, making the process more convenient and efficient.

-

What are the benefits of using airSlate SignNow for first-time homebuyers?

Using airSlate SignNow for completing the Form 8859 Fill in Version District Of Columbia First Time Homebuyer Credit offers numerous benefits, including enhanced efficiency, security, and user-friendliness. Our platform allows first-time homebuyers to navigate the documentation process with greater ease, streamlining communication and reducing paperwork errors.

-

Does airSlate SignNow integrate with other software for completing the Form 8859 Fill in Version District Of Columbia First Time Homebuyer Credit?

Yes, airSlate SignNow offers integrations with various software platforms to enhance your experience while filling out the Form 8859 Fill in Version District Of Columbia First Time Homebuyer Credit. These integrations allow you to pull in data from other systems, ensuring a seamless and efficient workflow. Whether you use CRM or accounting software, we have you covered.

Get more for Form 8859 Fill in Version District Of Columbia First Time Homebuyer Credit

- Form 2ta

- Application for ignition interlock permit hawaii state judiciary courts state hi form

- Mv 16a form

- Sensory profile questionnaire online form

- The necklace by guy de maupassant pdf form

- Ab83 form

- Homeschool affidavit maricopa county form

- Gas sample form no 62 1509 please refer to attached sample form

Find out other Form 8859 Fill in Version District Of Columbia First Time Homebuyer Credit

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF