Form 8881 Fill in Version Credit for Small Employer Pension Plan Startup Costs

Understanding Form 8881: Credit for Small Employer Pension Plan Startup Costs

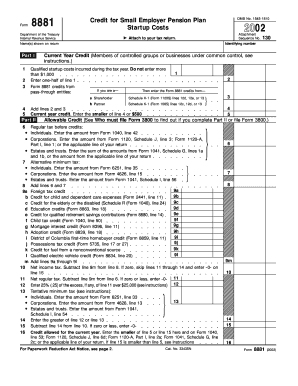

Form 8881 is a tax form used by eligible small businesses to claim a credit for startup costs associated with establishing a qualified pension plan. This form is particularly beneficial for small employers looking to provide retirement benefits to their employees, as it helps offset the costs of setting up such plans. The credit can cover a portion of the expenses incurred in creating a new retirement plan, making it an attractive option for businesses aiming to enhance employee benefits while managing costs.

Steps to Complete Form 8881

Completing Form 8881 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to the pension plan, including costs incurred for plan setup and administration. Next, fill out the form by providing details such as the number of employees covered by the plan and the total eligible startup costs. It is essential to calculate the credit amount correctly, as this will affect the overall tax benefit. Finally, review the completed form for any errors and submit it with your tax return.

Eligibility Criteria for Form 8881

To qualify for the credit claimed on Form 8881, businesses must meet specific eligibility requirements. The employer must have fewer than 100 employees who received at least $5,000 in compensation during the preceding year. Additionally, the pension plan must be new, and the credit can only be claimed for the first three years of the plan's existence. Understanding these criteria is crucial for businesses to ensure they can take advantage of this tax benefit.

Obtaining Form 8881

Form 8881 can be obtained directly from the Internal Revenue Service (IRS) website or through tax preparation software. It is available as a downloadable PDF, which can be printed and filled out manually. Businesses may also find the form within the tax filing software they use, making it easier to complete and file electronically. Ensuring you have the most current version of the form is important, as tax regulations may change from year to year.

IRS Guidelines for Form 8881

The IRS provides specific guidelines for completing and submitting Form 8881. These guidelines include instructions on how to calculate the credit, eligibility requirements, and filing procedures. It is important for businesses to familiarize themselves with these guidelines to ensure compliance and maximize the benefits of the credit. The IRS also offers resources and publications that can assist in understanding the nuances of the form and its requirements.

Filing Deadlines for Form 8881

Filing deadlines for Form 8881 align with the general tax return deadlines for businesses. Typically, this means that the form must be submitted by the due date of the business's tax return, including any extensions. Businesses should be aware of these deadlines to ensure they do not miss the opportunity to claim the credit. Keeping track of important dates is essential for effective tax planning and compliance.

Quick guide on how to complete 8881

Complete 8881 effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage form 8881 on any device using airSlate SignNow's Android or iOS applications and streamline any document-based tasks today.

The easiest way to edit and eSign 8881 with ease

- Locate form 8881 instructions and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs within a few clicks from any device you prefer. Modify and eSign form 8881 and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to form 8881 instructions

Create this form in 5 minutes!

How to create an eSignature for the form 8881

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask form 8881 instructions

-

What are the key features of airSlate SignNow for handling form 8881 instructions?

AirSlate SignNow offers a user-friendly platform that simplifies the management of form 8881 instructions. You can easily upload, send, and eSign documents, ensuring compliance and quick processing. The system is designed to be intuitive and efficient, making it suitable for all users regardless of their technical expertise.

-

How much does it cost to use airSlate SignNow for form 8881 instructions?

The pricing for airSlate SignNow is competitive and tailored to meet varying business needs. Plans are available based on the number of users and features required, including those focused on form 8881 instructions. You can review our pricing page for detailed information and choose a plan that best fits your budget.

-

Can I integrate airSlate SignNow with other software for processing form 8881 instructions?

Yes, airSlate SignNow supports a wide range of integrations with popular business tools. This allows for seamless management of form 8881 instructions alongside your existing workflows in apps like Google Drive, Salesforce, and more. Integrations help streamline processes, saving you time and effort.

-

Is there a mobile app for airSlate SignNow to manage form 8881 instructions on the go?

Absolutely! AirSlate SignNow offers a mobile app that allows you to manage form 8881 instructions anytime, anywhere. The app provides all essential functionalities, enabling you to send, sign, and manage documents directly from your mobile device for enhanced convenience.

-

What type of support does airSlate SignNow offer for users needing help with form 8881 instructions?

AirSlate SignNow provides comprehensive support resources for users needing assistance with form 8881 instructions. You can access a detailed knowledge base, FAQs, and tutorials, along with responsive customer support to address specific queries. Our team is committed to ensuring you have a smooth experience.

-

How secure is airSlate SignNow when handling sensitive form 8881 instructions?

Security is a top priority at airSlate SignNow. We utilize advanced encryption methods to ensure that your form 8881 instructions and all associated data are protected. Additionally, our platform complies with various industry standards to provide a safe eSigning environment.

-

Can multiple users collaborate on form 8881 instructions in airSlate SignNow?

Yes, airSlate SignNow supports collaborative workflows, allowing multiple users to work on form 8881 instructions simultaneously. This feature enhances teamwork and speeds up the document completion process. You can easily invite team members and track changes in real-time.

Get more for form 8881

Find out other 8881

- Can I eSign Washington lease agreement

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms