Schedule 1 Form 1040A Fill in Version Interest and Ordinary Dividends for Form 1040A Filers

Understanding the Schedule 1 Form 1040A Fill in Version Interest and Ordinary Dividends

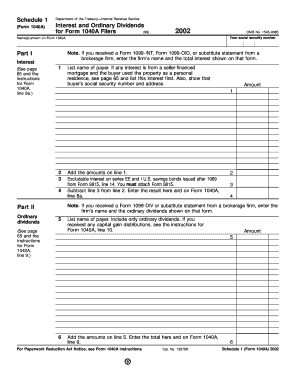

The Schedule 1 Form 1040A is a crucial document for taxpayers who need to report specific types of income, particularly interest and ordinary dividends. This form allows filers to provide additional information that is not captured on the main Form 1040A. It is essential for ensuring accurate tax reporting and compliance with IRS regulations. Taxpayers must complete this schedule if they have interest income or dividends that exceed certain thresholds, as this information impacts overall tax liability.

Steps to Complete the Schedule 1 Form 1040A Fill in Version Interest and Ordinary Dividends

Completing the Schedule 1 Form 1040A involves several straightforward steps:

- Gather necessary documents, including Form 1099-INT for interest income and Form 1099-DIV for dividends.

- Enter your name and Social Security number at the top of the form.

- Report interest income in the designated section, ensuring you include all amounts received during the tax year.

- List ordinary dividends in the appropriate field, reflecting the total received.

- Double-check all entries for accuracy before submitting the form with your tax return.

How to Obtain the Schedule 1 Form 1040A Fill in Version Interest and Ordinary Dividends

Taxpayers can easily obtain the Schedule 1 Form 1040A through various methods:

- Visit the IRS website to download and print the form directly.

- Request a physical copy by contacting the IRS or visiting a local IRS office.

- Utilize tax preparation software, which often includes the form as part of the filing process.

Key Elements of the Schedule 1 Form 1040A Fill in Version Interest and Ordinary Dividends

Understanding the key elements of the Schedule 1 Form 1040A is vital for accurate completion:

- Interest Income: This section requires the total amount of interest earned from various sources.

- Ordinary Dividends: Report the total dividends received from stocks or mutual funds.

- Additional Information: Include any other relevant details that may affect your tax situation.

IRS Guidelines for the Schedule 1 Form 1040A Fill in Version Interest and Ordinary Dividends

The IRS provides specific guidelines for completing the Schedule 1 Form 1040A. Taxpayers should consult the IRS instructions for the form to ensure compliance with reporting requirements. This includes understanding what qualifies as reportable interest and dividends, as well as any applicable deductions or credits that may be claimed. Adhering to these guidelines helps prevent errors and potential penalties.

Filing Deadlines for the Schedule 1 Form 1040A Fill in Version Interest and Ordinary Dividends

Filing deadlines for the Schedule 1 Form 1040A align with the overall tax return deadlines. Typically, individual tax returns are due by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is crucial for taxpayers to file on time to avoid penalties and interest on any owed taxes.

Quick guide on how to complete schedule 1 form 1040a fill in version interest and ordinary dividends for form 1040a filers

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the right form and securely store it in the cloud. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents rapidly without delays. Handle [SKS] on any device using the airSlate SignNow applications for Android or iOS, and streamline any document-related process today.

How to Edit and eSign [SKS] with Ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with the tools offered by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors requiring the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS], ensuring exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule 1 Form 1040A Fill in Version Interest And Ordinary Dividends For Form 1040A Filers

Create this form in 5 minutes!

How to create an eSignature for the schedule 1 form 1040a fill in version interest and ordinary dividends for form 1040a filers

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule 1 Form 1040A Fill in Version Interest And Ordinary Dividends For Form 1040A Filers?

The Schedule 1 Form 1040A Fill in Version Interest And Ordinary Dividends For Form 1040A Filers is a supplementary form used to report additional income and adjustments to income on your Federal tax return. This form specifically allows you to detail interest and ordinary dividends that must be reported to ensure accurate tax calculations. By using this form, filers can clearly outline their income sources in compliance with IRS guidelines.

-

How does airSlate SignNow assist with filling out the Schedule 1 Form 1040A?

airSlate SignNow streamlines the process of filling out the Schedule 1 Form 1040A Fill in Version Interest And Ordinary Dividends For Form 1040A Filers by offering a user-friendly platform. Users can easily import data, including interest and dividend amounts, directly from their financial documents. The eSignature feature also allows for quick approval and submission of the form, making tax season easier.

-

What are the benefits of using airSlate SignNow for the Schedule 1 Form 1040A?

Using airSlate SignNow for the Schedule 1 Form 1040A Fill in Version Interest And Ordinary Dividends For Form 1040A Filers offers numerous benefits, including time savings and improved accuracy. The platform enables users to fill forms digitally, reducing the likelihood of errors associated with manual entry. Additionally, eSigning features enhance the efficiency of document handling during tax preparation.

-

Is there a cost associated with using airSlate SignNow for tax form filling?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution for businesses and individuals. Pricing packages vary based on the features included, allowing users to choose a plan that best fits their needs while ensuring they have access to fill out the Schedule 1 Form 1040A Fill in Version Interest And Ordinary Dividends For Form 1040A Filers. Check our pricing page for more details.

-

Can I integrate airSlate SignNow with other applications for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with a variety of accounting software and tax preparation tools. This compatibility allows users to easily transfer data into the Schedule 1 Form 1040A Fill in Version Interest And Ordinary Dividends For Form 1040A Filers, ensuring a smooth workflow from document creation to submission. Explore our integration options to find the right tools for your tax needs.

-

Who can benefit from the Schedule 1 Form 1040A Fill in Version feature?

The Schedule 1 Form 1040A Fill in Version Interest And Ordinary Dividends For Form 1040A Filers is beneficial for anyone who needs to report additional income on their taxes. This includes individual taxpayers, freelancers, and small business owners who earn interest or dividends. By utilizing airSlate SignNow, these users can simplify their reporting process and ensure compliance with tax regulations.

-

Is my data secure when using airSlate SignNow for filling out tax forms?

Yes, security is a top priority for airSlate SignNow. Our platform employs advanced security measures to protect your data when filling out the Schedule 1 Form 1040A Fill in Version Interest And Ordinary Dividends For Form 1040A Filers. This includes encryption, secure access, and compliance with privacy regulations, so you can trust that your information is safe.

Get more for Schedule 1 Form 1040A Fill in Version Interest And Ordinary Dividends For Form 1040A Filers

- Action plan email sample form

- Complaint to recover possession of personal property nc form

- School form 110216

- Claim amp proposal forms religare religare health insurance

- Catholic schools week candy grams order form sppslex

- 1300 22 navy form

- Form 2ta

- Application for ignition interlock permit hawaii state judiciary courts state hi form

Find out other Schedule 1 Form 1040A Fill in Version Interest And Ordinary Dividends For Form 1040A Filers

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free