Gov 20021040EZ Instructions IRS Form

Understanding the Gov 20021040EZ Instructions IRS

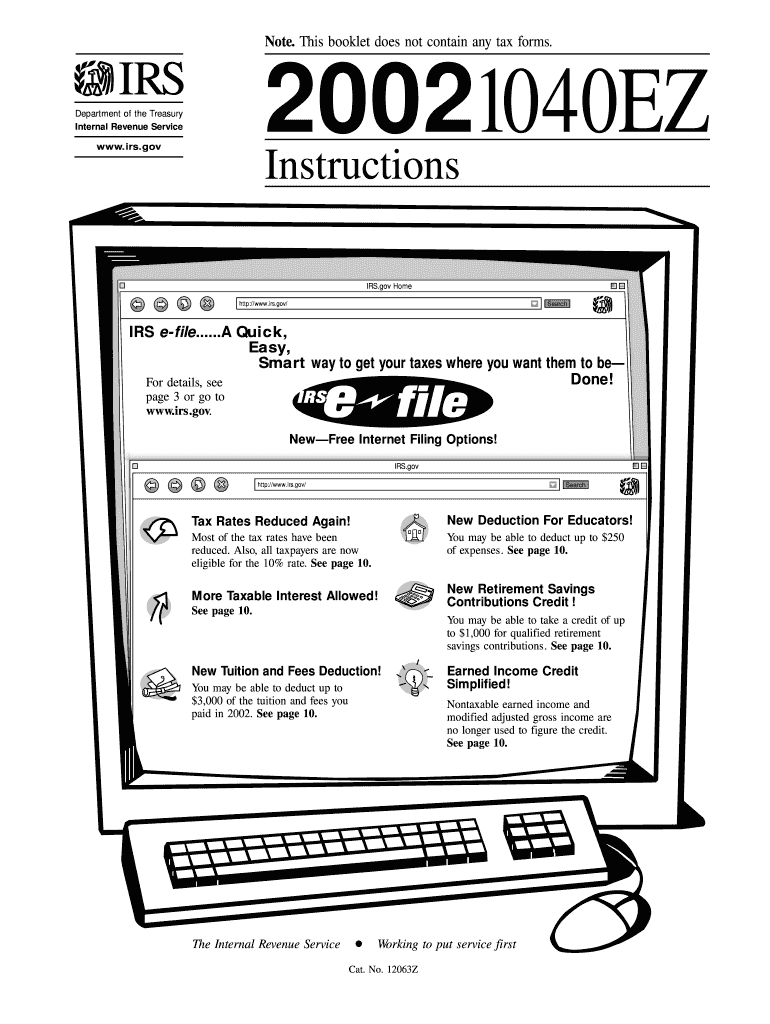

The Gov 20021040EZ Instructions IRS provide essential guidelines for taxpayers who are eligible to file their federal income tax returns using the simplified Form 1040EZ. This form is designed for individuals with straightforward tax situations, typically those who earn a standard income without complex deductions or credits. The instructions detail the eligibility criteria, including income limits, filing status, and age restrictions, ensuring that users can determine if they qualify to use this streamlined form.

Steps to Complete the Gov 20021040EZ Instructions IRS

Completing the Gov 20021040EZ Instructions IRS involves several straightforward steps. First, gather all necessary information, such as your Social Security number, income statements, and any applicable tax documents. Next, follow the instructions to fill out each section of the form accurately. This includes reporting your income, calculating your tax liability, and determining any refund or amount owed. Finally, review the completed form for accuracy before submitting it to the IRS, either electronically or by mail.

Eligibility Criteria for the Gov 20021040EZ Instructions IRS

To use the Gov 20021040EZ Instructions IRS, taxpayers must meet specific eligibility criteria. These include being single or married filing jointly, having a taxable income below a certain threshold, and not claiming any dependents. Additionally, the taxpayer must be under the age of sixty-five and cannot have income from sources such as self-employment, rental properties, or capital gains. Understanding these criteria is crucial for ensuring compliance and optimizing the filing process.

Required Documents for the Gov 20021040EZ Instructions IRS

Before completing the Gov 20021040EZ Instructions IRS, it is important to gather all required documents. Key documents include W-2 forms from employers, any 1099 forms for additional income, and records of any tax credits or deductions that may apply. Having these documents readily available simplifies the process and helps ensure that all income is accurately reported, minimizing the risk of errors during filing.

Filing Deadlines for the Gov 20021040EZ Instructions IRS

Timely submission of the Gov 20021040EZ Instructions IRS is essential to avoid penalties. The standard deadline for filing federal income tax returns is April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of the option to file for an extension, which can provide additional time to submit the form, though any taxes owed must still be paid by the original deadline.

Form Submission Methods for the Gov 20021040EZ Instructions IRS

Taxpayers have multiple options for submitting the Gov 20021040EZ Instructions IRS. The form can be filed electronically through various tax software platforms or the IRS e-file system, which is often the quickest method for processing returns. Alternatively, individuals may choose to print the form and mail it to the appropriate IRS address. It is important to select a submission method that aligns with personal preferences and ensures timely processing.

Penalties for Non-Compliance with the Gov 20021040EZ Instructions IRS

Failing to comply with the Gov 20021040EZ Instructions IRS can result in various penalties. Common consequences include late filing fees, interest on unpaid taxes, and potential audits. To avoid these penalties, it is crucial for taxpayers to adhere to filing deadlines, accurately report income, and ensure that all required information is included on the form. Understanding these risks can help taxpayers remain compliant and minimize financial repercussions.

Quick guide on how to complete gov 20021040ez instructions irs

Effortlessly Prepare [SKS] on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to retrieve the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, edit, and eSign your documents promptly without any hold-ups. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to Edit and eSign [SKS] with Ease

- Locate [SKS] and select Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize essential sections of your documents or redact sensitive details using the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Verify the information and click on the Done button to save your changes.

- Select your preferred delivery method for the form, be it email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or the need to print new document copies due to errors. airSlate SignNow caters to all your document management needs with just a few clicks from any device you choose. Modify and eSign [SKS] while ensuring effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Gov 20021040EZ Instructions IRS

Create this form in 5 minutes!

How to create an eSignature for the gov 20021040ez instructions irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Gov 20021040EZ Instructions IRS?

The Gov 20021040EZ Instructions IRS provide detailed guidance on how to properly complete and file the IRS Form 20021040EZ. This form is used for specific tax situations, and understanding the instructions is crucial for accurate filing. By leveraging the instructions, taxpayers can minimize errors and ensure compliance with IRS regulations.

-

How does airSlate SignNow help with the Gov 20021040EZ Instructions IRS?

airSlate SignNow simplifies the process of filling out the Gov 20021040EZ Instructions IRS by allowing users to upload, edit, and eSign documents in a secure online environment. This streamlines the filing process and reduces the likelihood of mistakes. With our solution, you can complete your tax documents efficiently and with confidence.

-

What features does airSlate SignNow offer for completing IRS forms?

airSlate SignNow offers features such as document editing, secure eSignature capabilities, and real-time collaboration, all of which are beneficial when working with the Gov 20021040EZ Instructions IRS. These features ensure that all parties can review and sign documents promptly, helping to expedite the filing process. Additionally, our platform is user-friendly and provides templates for easier document management.

-

Are there any costs associated with using airSlate SignNow for IRS forms?

Yes, airSlate SignNow provides several pricing plans based on your business needs. These plans offer varying features and levels of accessibility to help you effectively manage documents like those related to the Gov 20021040EZ Instructions IRS. We also offer free trials for potential customers to explore our service before committing to a subscription.

-

Can I integrate airSlate SignNow with other tools for tax preparation?

Yes, airSlate SignNow easily integrates with various accounting and tax preparation software to enhance your filing experience, particularly with the Gov 20021040EZ Instructions IRS. These integrations allow for a seamless flow of information, helping you manage your documents more efficiently. Check our integration list to see compatible platforms.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for your tax forms, including those tied to the Gov 20021040EZ Instructions IRS, provides benefits such as enhanced security, convenience, and faster processing times. Our platform ensures that all signed documents are securely stored and easily accessible whenever you need them. Moreover, the user-friendly interface minimizes the learning curve for new users.

-

How can I ensure compliance with the Gov 20021040EZ Instructions IRS using airSlate SignNow?

To ensure compliance with the Gov 20021040EZ Instructions IRS, airSlate SignNow provides structured templates and guides that help you adhere to IRS requirements. Additionally, our audit trail feature gives you a complete history of document interactions, ensuring thorough record-keeping for compliance purposes. This reduces your risk of errors that could lead to penalties.

Get more for Gov 20021040EZ Instructions IRS

Find out other Gov 20021040EZ Instructions IRS

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy