Notice 1036 Rev November Early Release Copies of Income Tax Withholding and Advance Earned Income Credit Payment Tables Form

What is the Notice 1036 Rev November Early Release Copies Of Income Tax Withholding And Advance Earned Income Credit Payment Tables

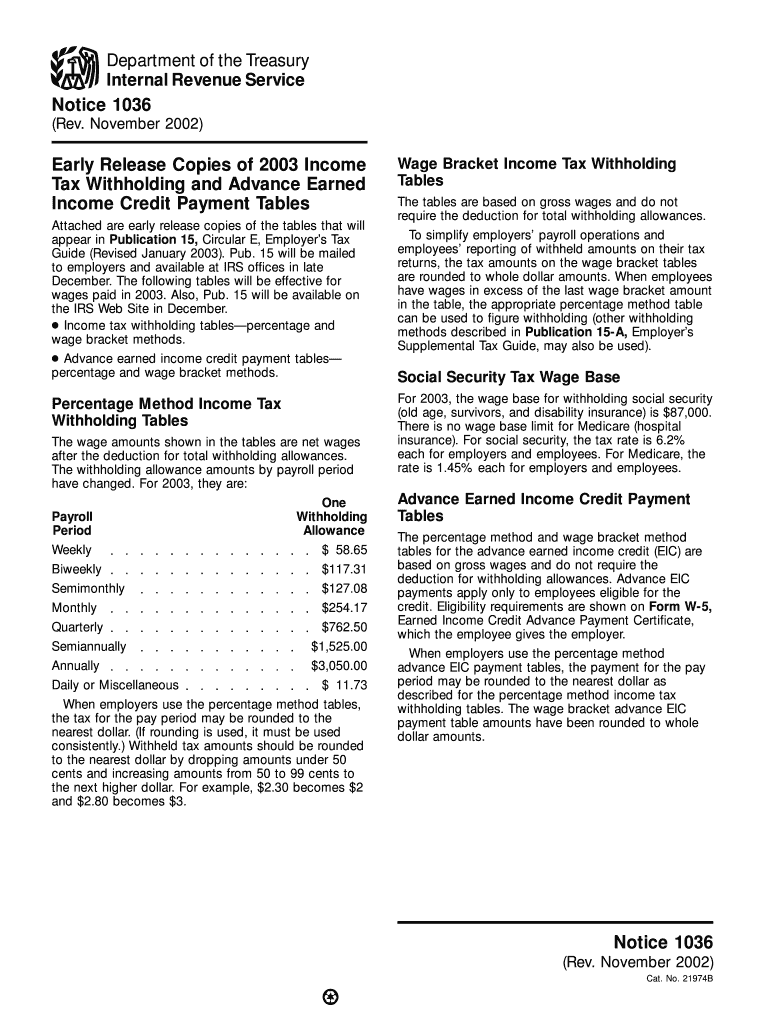

The Notice 1036 Rev November provides crucial information regarding income tax withholding and the Advance Earned Income Credit (EIC) payment tables. This document is issued by the Internal Revenue Service (IRS) to help employers and taxpayers understand the withholding requirements for the upcoming tax year. It outlines the updated tax tables that reflect changes in tax law, ensuring accurate withholding from employee wages. Understanding this notice is essential for compliance and accurate tax reporting.

How to use the Notice 1036 Rev November Early Release Copies Of Income Tax Withholding And Advance Earned Income Credit Payment Tables

To effectively use the Notice 1036 Rev November, employers should reference the tables included in the document when calculating the amount of federal income tax to withhold from employee paychecks. This notice provides specific guidance on how to apply the tables based on employee earnings and filing status. Employers must ensure they are using the most current version of the notice to avoid discrepancies in tax withholding, which could lead to penalties or underpayment issues.

Steps to complete the Notice 1036 Rev November Early Release Copies Of Income Tax Withholding And Advance Earned Income Credit Payment Tables

Completing the requirements outlined in the Notice 1036 Rev November involves several steps:

- Review the notice for the latest updates on tax withholding tables.

- Determine the filing status and income level of each employee.

- Refer to the appropriate table in the notice to find the correct withholding amount.

- Implement the withholding amounts in your payroll system for the upcoming tax year.

- Ensure all employees are informed of any changes that may affect their withholdings.

Key elements of the Notice 1036 Rev November Early Release Copies Of Income Tax Withholding And Advance Earned Income Credit Payment Tables

The key elements of the Notice 1036 Rev November include:

- Updated income tax withholding tables for various income levels.

- Guidance on the Advance Earned Income Credit, including eligibility criteria.

- Instructions for employers on how to apply the tables correctly.

- Information on any changes in tax law that may affect withholding calculations.

IRS Guidelines

IRS guidelines related to the Notice 1036 Rev November emphasize the importance of accurate withholding to prevent underpayment of taxes. Employers are encouraged to regularly consult the IRS website for any updates or changes to the notice. Additionally, the IRS provides resources and support for employers to ensure compliance with federal tax laws, including tools for calculating withholding amounts and understanding employee eligibility for the Advance Earned Income Credit.

Filing Deadlines / Important Dates

It is essential for employers to be aware of filing deadlines associated with the Notice 1036 Rev November. Typically, employers must implement the new withholding tables by the start of the tax year, which is January first. Additionally, they should be prepared for any quarterly filing requirements that may arise throughout the year. Staying informed about these important dates helps ensure compliance and avoids potential penalties for late filings.

Quick guide on how to complete notice 1036 rev november early release copies of income tax withholding and advance earned income credit payment tables

Finish [SKS] effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers a superb eco-friendly substitute for traditional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle [SKS] on any device with airSlate SignNow Android or iOS applications and simplify any document-centric process today.

How to alter and eSign [SKS] effortlessly

- Obtain [SKS] and click Get Form to initiate.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or mislaid documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from a device of your choosing. Modify and eSign [SKS] and ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Notice 1036 Rev November Early Release Copies Of Income Tax Withholding And Advance Earned Income Credit Payment Tables

Create this form in 5 minutes!

How to create an eSignature for the notice 1036 rev november early release copies of income tax withholding and advance earned income credit payment tables

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Notice 1036 Rev November and why is it important?

Notice 1036 Rev November provides essential information on early release copies of income tax withholding and advance earned income credit payment tables. It is important because it helps businesses and employees ensure they are withholding the correct amount of taxes, which can prevent issues during tax season.

-

How can airSlate SignNow help with using Notice 1036 Rev November?

airSlate SignNow can streamline the process of handling documents related to Notice 1036 Rev November by allowing users to easily send and eSign important tax documents. This enhances efficiency and ensures compliance with tax regulations.

-

Are there costs associated with using airSlate SignNow for Notice 1036 Rev November forms?

Yes, airSlate SignNow offers various pricing plans depending on the features you need. Whether you're a small business or a larger organization, our cost-effective solutions work well for managing documents related to Notice 1036 Rev November.

-

What features does airSlate SignNow offer that support Notice 1036 Rev November?

airSlate SignNow provides features like customizable templates, automated workflows, and real-time tracking for documents. These tools help ensure that all documents associated with Notice 1036 Rev November are handled efficiently and securely.

-

Can I integrate airSlate SignNow with other software to manage Notice 1036 Rev November?

Absolutely! airSlate SignNow allows for seamless integrations with various platforms, including CRMs and accounting software. This means you can easily manage all aspects of documents related to Notice 1036 Rev November from one central location.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents such as Notice 1036 Rev November offers signNow benefits, including reduced processing time and enhanced security. This ensures that sensitive information is protected while also allowing for quicker compliance with tax obligations.

-

Is airSlate SignNow user-friendly for those unfamiliar with Notice 1036 Rev November?

Yes, airSlate SignNow is designed to be user-friendly, catering to all levels of tech-savviness. Even if you're not familiar with Notice 1036 Rev November, our platform simplifies document management with easy navigation and clear guidance.

Get more for Notice 1036 Rev November Early Release Copies Of Income Tax Withholding And Advance Earned Income Credit Payment Tables

- Financial needs analysis questionnaire unstoppable crew unstoppablecrew form

- Create an alien project form

- Reveille peak ranch waiver form

- We are vertigo waiver form

- Destimoney trading software form

- Relationship of transported particle size to water velocity worksheet answer key form

- Mandato sepa pdf form

- Medication transfer form 51948210

Find out other Notice 1036 Rev November Early Release Copies Of Income Tax Withholding And Advance Earned Income Credit Payment Tables

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF