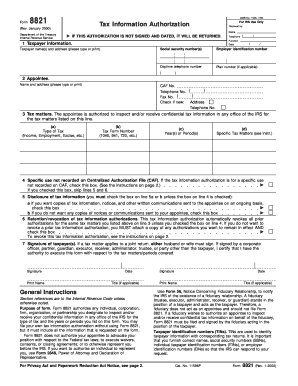

1545 1165 Rev Form

What is the Rev

The Rev is a form issued by the Internal Revenue Service (IRS) primarily used for tax-related purposes. This form is designed to collect specific information from taxpayers to ensure compliance with federal tax regulations. It serves as a critical tool for reporting income, deductions, and credits, helping the IRS assess tax liabilities accurately. Understanding the purpose of this form is essential for individuals and businesses to fulfill their tax obligations effectively.

How to use the Rev

Using the Rev involves several straightforward steps. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, carefully fill out the form, ensuring that all required fields are completed accurately. It is important to double-check the information for any errors, as inaccuracies can lead to delays or penalties. Once completed, the form can be submitted electronically or via traditional mail, depending on the specific instructions provided by the IRS.

Steps to complete the Rev

Completing the Rev requires attention to detail. Start by downloading the form from the IRS website or accessing it through tax preparation software. Follow these steps:

- Enter your personal information, including name, address, and Social Security number.

- Provide details about your income sources and any applicable deductions.

- Review the form for completeness and accuracy.

- Sign and date the form where indicated.

- Submit the form according to IRS guidelines, either electronically or by mail.

Legal use of the Rev

The legal use of the Rev is governed by IRS regulations. This form must be completed and submitted by individuals and businesses that meet specific criteria set forth by the IRS. Failing to use the form correctly can result in penalties or legal repercussions. It is crucial to understand the legal implications of the information provided on this form, as it is used to determine tax liabilities and compliance with federal tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Rev are critical to ensuring compliance with IRS regulations. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 for individual taxpayers. However, extensions may be available under certain circumstances. It is important to stay informed about any changes to deadlines, as the IRS occasionally adjusts these dates. Keeping track of important dates helps avoid late fees and potential penalties.

Required Documents

To complete the Rev accurately, several documents are required. These may include:

- W-2 forms from employers.

- 1099 forms for other income sources.

- Receipts for deductible expenses.

- Previous year’s tax return for reference.

Having these documents on hand will facilitate a smoother filing process and ensure that all necessary information is included.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the Rev. These guidelines outline the required information, acceptable filing methods, and potential penalties for non-compliance. Familiarizing oneself with these guidelines is essential for accurate filing. The IRS also offers resources and assistance for taxpayers who may have questions or need clarification on the form's requirements.

Quick guide on how to complete 1545 1165 rev

Complete [SKS] seamlessly on any device

Web-based document management has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The easiest method to modify and eSign [SKS] effortlessly

- Locate [SKS] and click on Get Form to initiate the process.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to deliver your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 1545 1165 Rev

Create this form in 5 minutes!

How to create an eSignature for the 1545 1165 rev

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1545 1165 Rev. and how does it work?

The 1545 1165 Rev. is a specific form used for tax purposes that enables easier document management. With airSlate SignNow, users can easily complete, send, and eSign the 1545 1165 Rev. form electronically, saving time and resources while ensuring compliance.

-

How much does it cost to use the airSlate SignNow service for the 1545 1165 Rev.?

Pricing for airSlate SignNow varies based on the features you need, starting with affordable plans tailored for small businesses. Utilizing airSlate SignNow for the 1545 1165 Rev. document can help companies save on printing and mailing costs.

-

What are the key features of airSlate SignNow for 1545 1165 Rev. processing?

Key features of airSlate SignNow for handling the 1545 1165 Rev. include easy document creation, eSigning capabilities, and automated workflows. These features streamline the signing process, ensuring your documents are signed securely and efficiently.

-

How can airSlate SignNow benefit businesses using the 1545 1165 Rev.?

Businesses can benefit from using airSlate SignNow for the 1545 1165 Rev. by enhancing document security and reducing turnaround times. With seamless eSignature integration, organizations can manage their forms more efficiently, leading to improved productivity.

-

Can I integrate airSlate SignNow with other tools for managing the 1545 1165 Rev.?

Yes, airSlate SignNow easily integrates with various tools such as CRM systems and cloud storage services. This functionality allows users to manage the 1545 1165 Rev. in a holistic manner, syncing documents across platforms for better organization.

-

Is the 1545 1165 Rev. eSignature legally binding?

Absolutely! The eSignatures obtained through airSlate SignNow for the 1545 1165 Rev. are legally binding and compliant with global electronic signature laws. This provides assurance for businesses that their documents will be recognized as valid.

-

How does airSlate SignNow ensure the security of the 1545 1165 Rev. documents?

airSlate SignNow prioritizes security by employing encryption, secure storage, and robust authentication measures. This safeguards the integrity of your 1545 1165 Rev. documents, ensuring that sensitive information is protected throughout the signing process.

Get more for 1545 1165 Rev

- Certificate of assumed business name allen county recorder allencountyrecorder form

- Ice arrest w form

- Charity care with ellis form

- General chemistry solutions manual pdf form

- D30 form

- Hoja de datos personales form

- Business tax receipt collier county form

- Scc serious medical condition certification form

Find out other 1545 1165 Rev

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document