Income Tax Return to Report Income Claimed to Be Effectively Connected with a U Form

What is the Income Tax Return To Report Income Claimed To Be Effectively Connected With A U

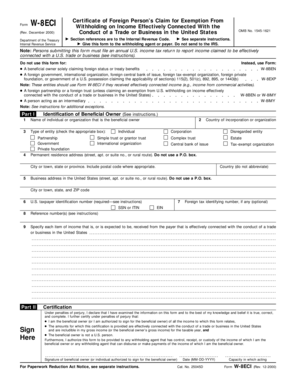

The Income Tax Return To Report Income Claimed To Be Effectively Connected With A U is a crucial tax document for individuals and businesses in the United States. This form is specifically designed for reporting income that is considered effectively connected with a U.S. trade or business. It is essential for non-resident aliens and foreign entities engaged in business activities within the U.S. to accurately report their income to comply with federal tax laws.

This form helps the Internal Revenue Service (IRS) assess the tax liabilities of foreign individuals and entities, ensuring they pay the correct amount of tax on their U.S.-sourced income. Understanding the purpose and requirements of this return is vital for maintaining compliance and avoiding penalties.

Steps to complete the Income Tax Return To Report Income Claimed To Be Effectively Connected With A U

Completing the Income Tax Return To Report Income Claimed To Be Effectively Connected With A U involves several steps that ensure accurate reporting of income. Begin by gathering all necessary documentation, including records of income earned, expenses incurred, and any relevant financial statements. This preparation is essential for accurately reflecting your financial situation.

Next, fill out the form with detailed information about your income sources, deductions, and credits. Be sure to follow the IRS guidelines closely to avoid errors. Once the form is completed, review it thoroughly to ensure all information is accurate and complete. After verification, submit the form to the IRS by the designated deadline, either electronically or via mail.

Required Documents

To successfully file the Income Tax Return To Report Income Claimed To Be Effectively Connected With A U, certain documents are necessary. These typically include:

- Proof of income earned in the U.S., such as W-2 forms or 1099 forms.

- Records of any business expenses related to the income claimed.

- Identification documents, including a Social Security Number or Individual Taxpayer Identification Number.

- Any prior year tax returns that may be relevant for reference.

Having these documents organized will help streamline the filing process and ensure compliance with IRS regulations.

IRS Guidelines

The IRS provides specific guidelines for completing the Income Tax Return To Report Income Claimed To Be Effectively Connected With A U. These guidelines outline the eligibility criteria, required fields, and acceptable methods for filing. It is important to adhere to these guidelines to avoid delays or rejections of your tax return.

Additionally, the IRS updates its guidelines periodically, so staying informed about any changes is essential for accurate reporting. Consulting the IRS website or a tax professional can provide valuable insights into the latest requirements and best practices for filing this form.

Filing Deadlines / Important Dates

Filing deadlines for the Income Tax Return To Report Income Claimed To Be Effectively Connected With A U are crucial for compliance. Generally, the deadline for filing is April 15 of the year following the tax year in question. However, if you are a non-resident alien, different deadlines may apply, and it is important to check the IRS guidelines for your specific situation.

Extensions may be available, but they require timely submission of a request. Being aware of these important dates can help you avoid penalties and ensure your return is processed smoothly.

Penalties for Non-Compliance

Failure to file the Income Tax Return To Report Income Claimed To Be Effectively Connected With A U on time can result in significant penalties. The IRS may impose fines based on the amount of tax owed and the duration of the delay. Additionally, interest may accrue on unpaid taxes, increasing the total amount due.

Non-compliance can also lead to more severe consequences, including audits and legal action. Understanding the importance of timely and accurate filing is essential for avoiding these potential issues.

Quick guide on how to complete income tax return to report income claimed to be effectively connected with a u

Complete [SKS] seamlessly on any device

Managing documents online has gained traction among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents quickly and efficiently. Handle [SKS] on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign [SKS] with ease

- Locate [SKS] and then click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Mark relevant sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the information and then click on the Done button to save your modifications.

- Decide how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Income Tax Return To Report Income Claimed To Be Effectively Connected With A U

Create this form in 5 minutes!

How to create an eSignature for the income tax return to report income claimed to be effectively connected with a u

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of an Income Tax Return To Report Income Claimed To Be Effectively Connected With A U.?

An Income Tax Return To Report Income Claimed To Be Effectively Connected With A U. is essential for individuals engaged in trade or business within the United States. This document helps report income accurately and ensures compliance with IRS regulations. By filing this return, you can avoid penalties and ensure that you're paying the correct amount of taxes.

-

How can airSlate SignNow assist with my Income Tax Return To Report Income Claimed To Be Effectively Connected With A U.?

airSlate SignNow provides a seamless platform for eSigning crucial documents related to your Income Tax Return To Report Income Claimed To Be Effectively Connected With A U. With our easy-to-use interface, you can streamline the document signing process, making it faster and more secure, ensuring that everything is completed on time.

-

What features does airSlate SignNow offer for tax document management?

Our platform includes features such as customizable templates, advanced security measures, and integration with various accounting software. These features simplify the process of preparing and managing your Income Tax Return To Report Income Claimed To Be Effectively Connected With A U. documents, ensuring you have everything you need at your fingertips.

-

Is airSlate SignNow affordable for small businesses handling tax returns?

Absolutely! airSlate SignNow offers cost-effective pricing plans tailored to fit small business budgets. By using our platform for your Income Tax Return To Report Income Claimed To Be Effectively Connected With A U., you can save on both time and resources while maintaining compliance with tax regulations.

-

Can I integrate airSlate SignNow with other software I use for tax management?

Yes, airSlate SignNow supports integrations with a variety of accounting and tax software. This allows for seamless transfer of information and easier management of your Income Tax Return To Report Income Claimed To Be Effectively Connected With A U. documents, enhancing your overall workflow.

-

How secure is airSlate SignNow when handling sensitive tax information?

airSlate SignNow prioritizes your security by implementing advanced encryption protocols and compliance with industry standards. This ensures that your Income Tax Return To Report Income Claimed To Be Effectively Connected With A U. documents are protected while being signed and shared. You can trust us with your sensitive information.

-

What benefits do I gain by eSigning my Income Tax Return To Report Income Claimed To Be Effectively Connected With A U. using airSlate SignNow?

eSigning your Income Tax Return To Report Income Claimed To Be Effectively Connected With A U. using airSlate SignNow offers tremendous benefits, such as faster processing times and the elimination of paper clutter. Furthermore, you'll have a secure, audit-trail backed method of tracking your document’s status throughout the signing process.

Get more for Income Tax Return To Report Income Claimed To Be Effectively Connected With A U

- Beachbody military coach application form

- Como preencher o formulrio de contestao da caixa

- Linguistic minority affidavit format

- Orphan sponsorship form world harvest ministries

- Pipe pressure test rest editable template form

- Mortgage proof of claim attachment fillable form

- Emotional economy test paul mitchell answers form

- Dl7 form

Find out other Income Tax Return To Report Income Claimed To Be Effectively Connected With A U

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later