April Department of the Treasury Internal Revenue Service Notice Concerning Fiduciary Relationship Internal Revenue Code Section Form

Understanding the April Department Of The Treasury Internal Revenue Service Notice Concerning Fiduciary Relationship

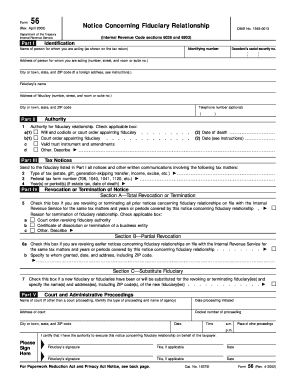

The April Department Of The Treasury Internal Revenue Service Notice Concerning Fiduciary Relationship is a crucial document that addresses the responsibilities of fiduciaries under Internal Revenue Code Sections 6036 and 6903. This notice provides guidance on how fiduciaries should manage tax obligations related to estates, trusts, and other entities. It outlines the necessary steps to ensure compliance with federal tax laws, emphasizing the importance of accurate reporting and timely filing.

Steps to Complete the April Department Of The Treasury Internal Revenue Service Notice Concerning Fiduciary Relationship

Completing the notice involves several key steps. First, fiduciaries must gather all relevant financial information regarding the estate or trust. This includes income statements, asset valuations, and any previous tax filings. Next, fiduciaries should fill out the notice accurately, ensuring that all required fields are completed. It is essential to review the document for any errors before submission. Finally, the completed notice should be submitted to the IRS by the specified deadline to avoid penalties.

Legal Use of the April Department Of The Treasury Internal Revenue Service Notice Concerning Fiduciary Relationship

This notice serves a vital legal function, as it helps establish the fiduciary's authority and responsibility regarding tax matters. By adhering to the guidelines set forth in the notice, fiduciaries can protect themselves from legal repercussions associated with mismanagement of tax obligations. It is important for fiduciaries to understand the legal implications of the notice, including potential penalties for non-compliance, which can include fines and legal action from the IRS.

Required Documents for the April Department Of The Treasury Internal Revenue Service Notice Concerning Fiduciary Relationship

To complete the notice, fiduciaries must prepare several documents. These typically include:

- Financial statements for the estate or trust

- Previous tax returns

- Documentation of income and expenses

- Any relevant legal documents, such as wills or trust agreements

Having these documents ready will facilitate the accurate completion of the notice and ensure compliance with IRS requirements.

Filing Deadlines for the April Department Of The Treasury Internal Revenue Service Notice Concerning Fiduciary Relationship

Fiduciaries must be aware of the filing deadlines associated with the notice. Generally, the notice must be filed by the due date of the tax return for the estate or trust. This deadline can vary based on the specific circumstances, such as the type of entity and fiscal year. It is advisable to consult the IRS guidelines for the exact dates to ensure timely submission and avoid penalties.

Examples of Using the April Department Of The Treasury Internal Revenue Service Notice Concerning Fiduciary Relationship

Real-world scenarios illustrate the application of this notice. For instance, a fiduciary managing an estate after a person's death must use the notice to report the estate's income and tax obligations. Similarly, a trustee of a living trust must complete the notice to ensure compliance with tax regulations. These examples highlight the importance of understanding the notice's requirements to effectively manage fiduciary responsibilities.

Quick guide on how to complete april department of the treasury internal revenue service notice concerning fiduciary relationship internal revenue code

Effortlessly Prepare [SKS] on Any Gadget

Digital document management has gained signNow traction among companies and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to Alter and eSign [SKS] with Ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that task.

- Craft your signature using the Sign tool, which takes mere seconds and carries the same legal validity as an ink signature.

- Review all the details and click on the Done button to preserve your updates.

- Choose your preferred method to send your form, either via email, SMS, invite link, or download it to your computer.

Bid farewell to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and eSign [SKS] to guarantee exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to April Department Of The Treasury Internal Revenue Service Notice Concerning Fiduciary Relationship Internal Revenue Code Section

Create this form in 5 minutes!

How to create an eSignature for the april department of the treasury internal revenue service notice concerning fiduciary relationship internal revenue code

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the April Department Of The Treasury Internal Revenue Service Notice Concerning Fiduciary Relationship Internal Revenue Code Sections 6036 And 6903 Identifying Number OMB No.?

The April Department Of The Treasury Internal Revenue Service Notice Concerning Fiduciary Relationship Internal Revenue Code Sections 6036 And 6903 Identifying Number OMB No. is a regulatory notice that outlines the responsibilities and requirements for fiduciaries managing certain accounts. It provides guidelines on how fiduciaries should report and handle matters related to their fiduciary duties under the Internal Revenue Code.

-

How does airSlate SignNow facilitate compliance with the April Department Of The Treasury Internal Revenue Service Notice Concerning Fiduciary Relationship?

airSlate SignNow facilitates compliance with the April Department Of The Treasury Internal Revenue Service Notice Concerning Fiduciary Relationship by offering robust features that simplify documentation and eSignature processes. Our platform helps businesses maintain accurate records and ensure compliance with IRS regulations, including those related to fiduciary obligations.

-

What are the pricing options for airSlate SignNow related to fiduciary services?

AirSlate SignNow offers flexible pricing plans designed to accommodate various business needs, including those requiring adherence to the April Department Of The Treasury Internal Revenue Service Notice Concerning Fiduciary Relationship. By offering tiered plans, we ensure that our clients can select the best option based on their volume of documents and required features.

-

What features does airSlate SignNow offer that align with IRS compliance requirements?

AirSlate SignNow provides essential features such as secure document storage, eSignatures, and audit trails, all of which are crucial for adhering to the April Department Of The Treasury Internal Revenue Service Notice Concerning Fiduciary Relationship. These features help organizations manage their fiduciary responsibilities effectively and ensure compliance with IRS regulations.

-

Can airSlate SignNow integrate with other accounting tools to meet IRS requirements?

Yes, airSlate SignNow integrates seamlessly with various accounting and financial software, making it easier for businesses to comply with the April Department Of The Treasury Internal Revenue Service Notice Concerning Fiduciary Relationship. These integrations help streamline workflows, ensuring that all financial records are properly documented and readily accessible.

-

What benefits does airSlate SignNow provide for fiduciaries managing IRS-related tasks?

AirSlate SignNow provides fiduciaries with a cost-effective solution to manage IRS-related tasks, including compliance with the April Department Of The Treasury Internal Revenue Service Notice Concerning Fiduciary Relationship. With our platform, fiduciaries can efficiently eSign documents, track their status, and maintain clear records, all in one convenient location.

-

How can airSlate SignNow enhance my business’s document workflow for IRS compliance?

By utilizing airSlate SignNow, businesses can enhance their document workflow for IRS compliance, particularly in relation to the April Department Of The Treasury Internal Revenue Service Notice Concerning Fiduciary Relationship. Our user-friendly platform simplifies document routing, approval processes, and eSignature collection, ensuring a smooth workflow.

Get more for April Department Of The Treasury Internal Revenue Service Notice Concerning Fiduciary Relationship Internal Revenue Code Section

Find out other April Department Of The Treasury Internal Revenue Service Notice Concerning Fiduciary Relationship Internal Revenue Code Section

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself