Form 940 Fill in Version Employer's Annual Federal Unemployment FUTA Tax Return

What is the Form 940 Fill in Version Employer's Annual Federal Unemployment FUTA Tax Return

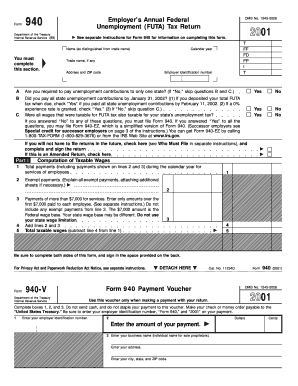

The Form 940, officially known as the Employer's Annual Federal Unemployment (FUTA) Tax Return, is a crucial document for employers in the United States. This form is used to report and pay federal unemployment taxes, which fund unemployment compensation for workers who have lost their jobs. Employers must file this form annually if they meet certain criteria, such as having paid $1,500 or more in wages during any calendar quarter or having at least one employee for any part of a day in twenty weeks during the current or preceding calendar year.

How to use the Form 940 Fill in Version Employer's Annual Federal Unemployment FUTA Tax Return

Using the Form 940 involves several key steps. First, employers need to gather relevant payroll information, including total wages paid and any state unemployment taxes paid. Next, they should accurately fill out the form, ensuring that all sections are completed, including the calculation of the FUTA tax owed. After completing the form, employers can submit it electronically or by mail to the IRS. It is important to keep a copy for your records and to ensure compliance with federal regulations.

Steps to complete the Form 940 Fill in Version Employer's Annual Federal Unemployment FUTA Tax Return

Completing the Form 940 involves a systematic approach:

- Gather Information: Collect all necessary payroll records, including total wages and any applicable state unemployment taxes.

- Fill Out the Form: Enter all required information in the designated fields, ensuring accuracy in calculations.

- Calculate Taxes: Determine the total FUTA tax owed based on the wages reported.

- Review the Form: Double-check all entries for accuracy and completeness.

- Submit the Form: File the completed form with the IRS by the due date, either electronically or via mail.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines for the Form 940. The form is typically due by January 31 of the year following the tax year being reported. If employers have made timely deposits of all FUTA tax owed, they may have an extension until February 10 to file the form. It is essential to adhere to these deadlines to avoid penalties and interest on unpaid taxes.

Key elements of the Form 940 Fill in Version Employer's Annual Federal Unemployment FUTA Tax Return

The Form 940 consists of several key elements that employers must complete:

- Employer Information: This section requires the employer's name, address, and Employer Identification Number (EIN).

- Wages Paid: Employers must report total wages paid to employees during the year.

- Tax Calculation: This section involves calculating the FUTA tax based on the reported wages and any credits for state unemployment taxes.

- Signature: The form must be signed by the employer or an authorized representative to validate the information provided.

Legal use of the Form 940 Fill in Version Employer's Annual Federal Unemployment FUTA Tax Return

The legal use of the Form 940 is mandated by the Internal Revenue Service (IRS) for employers subject to federal unemployment tax. Filing this form is a legal obligation for eligible employers, and failure to do so can result in penalties. The information reported on the form is used by the IRS to ensure compliance with federal tax laws and to determine the employer's eligibility for certain credits related to state unemployment taxes.

Quick guide on how to complete form 940 fill in version employers annual federal unemployment futa tax return

Complete [SKS] effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and store it securely online. airSlate SignNow provides all the necessary tools to create, edit, and e-sign your documents swiftly without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications, and simplify your document-based processes today.

How to edit and e-sign [SKS] easily

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information carefully and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you choose. Edit and e-sign [SKS] to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 940 Fill in Version Employer's Annual Federal Unemployment FUTA Tax Return

Create this form in 5 minutes!

How to create an eSignature for the form 940 fill in version employers annual federal unemployment futa tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 940 Fill in Version Employer's Annual Federal Unemployment FUTA Tax Return?

The Form 940 Fill in Version Employer's Annual Federal Unemployment FUTA Tax Return is a crucial document that businesses must file annually to report unemployment taxes. This form helps determine your tax liability based on your wages and employee count throughout the year. Properly completing this form is essential for compliance with federal tax regulations.

-

How can airSlate SignNow assist with the Form 940 Fill in Version Employer's Annual Federal Unemployment FUTA Tax Return?

airSlate SignNow provides an efficient platform to easily fill out, sign, and manage your Form 940 Fill in Version Employer's Annual Federal Unemployment FUTA Tax Return. With our user-friendly interface, you can quickly input your information, save your progress, and eSign your documents securely. This streamlines your filing process, saving you time and reducing errors.

-

What are the key features of airSlate SignNow for handling Form 940?

Key features of airSlate SignNow for handling Form 940 Fill in Version Employer's Annual Federal Unemployment FUTA Tax Return include customizable templates, real-time collaboration, and secure cloud storage. Additionally, the platform offers automated reminders for important tax deadlines, ensuring that you never miss a filing date. These features enhance efficiency and improve overall transactional workflow.

-

Is airSlate SignNow cost-effective for small businesses filing Form 940?

Yes, airSlate SignNow offers a cost-effective solution for small businesses needing to file the Form 940 Fill in Version Employer's Annual Federal Unemployment FUTA Tax Return. Our competitive pricing plans cater to a range of business sizes, ensuring that everyone can access affordable eSignature services. This makes it easier to manage essential documents without straining your budget.

-

What benefits does using airSlate SignNow bring for IRS tax forms like Form 940?

Using airSlate SignNow to handle IRS tax forms like Form 940 Fill in Version Employer's Annual Federal Unemployment FUTA Tax Return provides several benefits. It enhances accuracy by minimizing manual errors, speeds up the signing process through digital signatures, and ensures secure data handling. This leads to a more efficient tax preparation experience overall.

-

Can airSlate SignNow integrate with other accounting software for Form 940?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software solutions, allowing you to streamline the completion and submission of your Form 940 Fill in Version Employer's Annual Federal Unemployment FUTA Tax Return. This integration helps maintain accurate financial records and ensures all data is readily available and synchronized across platforms, enhancing your overall workflow.

-

What if I need assistance while filling out Form 940 with airSlate SignNow?

If you need assistance while filling out Form 940 Fill in Version Employer's Annual Federal Unemployment FUTA Tax Return using airSlate SignNow, our support team is readily available to help. We offer various resources, including tutorials, FAQs, and customer support via chat and email. Whether you have a question about the form or the software, our team is here to ensure you have a smooth experience.

Get more for Form 940 Fill in Version Employer's Annual Federal Unemployment FUTA Tax Return

Find out other Form 940 Fill in Version Employer's Annual Federal Unemployment FUTA Tax Return

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed