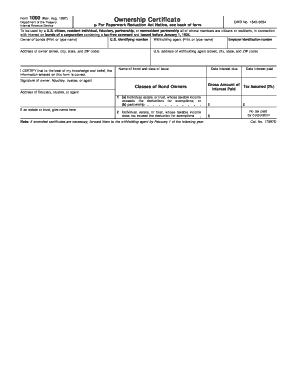

Date Interest Paid Form

What is the Date Interest Paid

The Date Interest Paid refers to the specific date on which interest payments are made on a loan or investment. This date is crucial for both borrowers and lenders, as it determines when interest accrues and affects the overall financial obligations. Understanding this date is essential for accurate financial planning and record-keeping.

How to use the Date Interest Paid

Using the Date Interest Paid involves documenting the date when interest payments are made. This information is important for tax reporting and financial statements. For businesses, accurately recording this date can impact cash flow management and financial forecasting. Individuals should also keep track of this date for personal finance management, ensuring they meet any payment deadlines.

Steps to complete the Date Interest Paid

To complete the Date Interest Paid, follow these steps:

- Identify the loan or investment agreement that specifies the interest payment schedule.

- Locate the date when the interest payment is due.

- Document the date in your financial records or accounting software.

- Ensure that all stakeholders are aware of this date to avoid any late payments.

Legal use of the Date Interest Paid

The Date Interest Paid has legal implications, particularly in the context of contracts and tax reporting. For businesses, failing to accurately report this date can lead to compliance issues with the IRS. Individuals should also be aware that incorrect reporting can affect their tax returns and financial statements.

IRS Guidelines

The IRS provides specific guidelines regarding the reporting of interest payments. Taxpayers must report interest income and expenses accurately, including the Date Interest Paid. This ensures compliance with federal tax laws and helps avoid potential penalties. It is advisable to consult IRS publications for detailed instructions on how to report interest payments correctly.

Examples of using the Date Interest Paid

Examples of the Date Interest Paid include:

- A mortgage payment where the interest is due on the first of each month.

- A bond investment that pays interest semi-annually on specific dates.

- A personal loan where the borrower must make interest payments quarterly.

Filing Deadlines / Important Dates

Filing deadlines related to the Date Interest Paid are critical for tax compliance. Taxpayers should be aware of the due dates for reporting interest income on their tax returns. Typically, interest income must be reported by April 15 for individual taxpayers, but specific deadlines may vary based on the type of income and the taxpayer's situation.

Quick guide on how to complete date interest paid

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly popular among organizations and individuals. It serves as a perfect environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents swiftly without hurdles. Manage [SKS] on any device using airSlate SignNow's Android or iOS apps and enhance any document-related workflow today.

The simplest way to modify and eSign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to secure your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow takes care of all your document management requirements in just a few clicks from any device you prefer. Alter and eSign [SKS] and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Date Interest Paid

Create this form in 5 minutes!

How to create an eSignature for the date interest paid

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'Date Interest Paid' feature in airSlate SignNow?

The 'Date Interest Paid' feature in airSlate SignNow allows users to specify the exact date when interest payments are made on documents. This is particularly useful for financial agreements and contracts to ensure clarity and compliance with payment terms.

-

How does airSlate SignNow ensure the security of 'Date Interest Paid' data?

airSlate SignNow prioritizes data security by employing advanced encryption protocols to protect sensitive information such as the 'Date Interest Paid.' Our platform complies with global data protection regulations, ensuring that your documents are secure from unauthorized access.

-

Can I customize the 'Date Interest Paid' field in my documents?

Yes, users can easily customize the 'Date Interest Paid' field in their documents using airSlate SignNow. This flexibility ensures that your contracts reflect the specific terms agreed upon, making it easier to manage payments effectively.

-

Is there an additional cost for the 'Date Interest Paid' feature?

The 'Date Interest Paid' feature is included in the standard package of airSlate SignNow at no extra cost. We believe in providing all essential features to our users without hidden fees, helping them manage documentation efficiently.

-

What types of documents can I use 'Date Interest Paid' with?

You can use the 'Date Interest Paid' feature with a variety of documents, including loan agreements, lease contracts, and financial statements. This versatility helps ensure that all your important financial transactions are clearly documented and easily referenced.

-

How can integrating airSlate SignNow benefit my business regarding 'Date Interest Paid' documentation?

Integrating airSlate SignNow into your business processes streamlines the management of 'Date Interest Paid' documentation. By automating the eSigning and document management, your team can focus more on core activities rather than administrative tasks.

-

What support does airSlate SignNow provide for using the 'Date Interest Paid' feature?

airSlate SignNow offers comprehensive support for users with the 'Date Interest Paid' feature through tutorials, FAQs, and a dedicated customer service team. Our goal is to ensure you leverage this feature effectively to meet your documentation needs.

Get more for Date Interest Paid

- Hud 9625 fillable form

- Georgian first generation bursary form

- Community food bank of eastern oklahoma form

- Invisalign informed consent

- A problem tree is a useful way of analysing the causes and effects of a specific problem e form

- Dhmh 4527 form

- Descargar pokemon amarillo trueno para gba rom form

- Cerap certification form

Find out other Date Interest Paid

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document