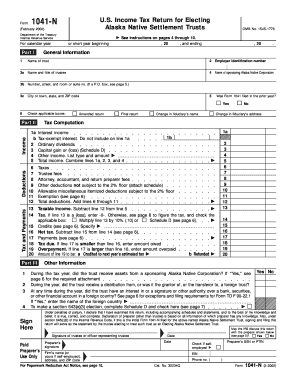

1041 N Form

What is the 1041 N

The 1041 N is a specific tax form used in the United States for reporting income, deductions, and credits for estates and trusts. This form is essential for fiduciaries who manage these entities, as it allows them to report the income generated during the tax year. The 1041 N is particularly relevant for non-resident aliens and foreign entities, ensuring compliance with U.S. tax regulations. Understanding this form is crucial for proper tax reporting and avoiding penalties.

How to use the 1041 N

To effectively use the 1041 N, fiduciaries must first gather all necessary financial information related to the estate or trust. This includes income sources, deductions, and any applicable credits. The form is structured to capture various types of income, such as interest, dividends, and capital gains. After completing the form, it must be submitted to the IRS by the designated deadline. It's important to ensure accuracy to prevent issues with the IRS.

Steps to complete the 1041 N

Completing the 1041 N involves several key steps:

- Gather all relevant financial documents, including income statements and expense records.

- Fill out the form, ensuring all sections are accurately completed.

- Calculate the total income, deductions, and credits to determine the tax liability.

- Review the completed form for accuracy and completeness.

- Submit the form to the IRS by the due date, either electronically or by mail.

Filing Deadlines / Important Dates

Filing deadlines for the 1041 N are crucial to avoid penalties. Generally, the form must be filed by the fifteenth day of the fourth month following the end of the tax year. For estates and trusts operating on a calendar year basis, this typically means April 15. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day. Keeping track of these dates ensures timely compliance with tax obligations.

Required Documents

When preparing to file the 1041 N, it is essential to have the following documents ready:

- Income statements, such as Form 1099s or K-1s.

- Expense records, including receipts for deductions.

- Previous year’s tax return for reference.

- Any relevant documentation related to credits or special circumstances.

IRS Guidelines

The IRS provides specific guidelines for completing and filing the 1041 N. These guidelines outline the necessary information required on the form, instructions for calculating income and deductions, and the process for submitting the form. It is important to refer to the latest IRS publications to ensure compliance with current tax laws and regulations. Adhering to these guidelines can help prevent errors and potential audits.

Quick guide on how to complete 1041 n

Easily Prepare [SKS] on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents efficiently and without delays. Manage [SKS] across any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Edit and eSign [SKS] Effortlessly

- Obtain [SKS] and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information using the tools available specifically for that purpose from airSlate SignNow.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you want to send your form—via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign [SKS] to ensure excellent communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 1041 N

Create this form in 5 minutes!

How to create an eSignature for the 1041 n

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the primary functionality of 1041 N. on airSlate SignNow?

The primary functionality of 1041 N. on airSlate SignNow is to streamline the process of sending and eSigning documents securely and efficiently. This feature allows users to manage their documents from anywhere, enhancing productivity and ensuring that critical agreements are signed promptly.

-

How does pricing work for 1041 N. on airSlate SignNow?

The pricing for 1041 N. on airSlate SignNow is designed to be cost-effective, offering various tiered plans to suit different business needs. Each plan provides a range of features, ensuring that customers can choose the right option that aligns with their budget and document management requirements.

-

What features are included in the 1041 N. package?

The 1041 N. package includes essential features such as customizable templates, secure eSigning, automated workflows, and team collaboration tools. These features empower businesses to enhance their efficiency and ensure that all document-related processes are handled seamlessly.

-

What are the benefits of using 1041 N. for document management?

Using 1041 N. for document management offers numerous benefits, including reduced turnaround times for signatures and improved compliance with legal standards. Additionally, the platform’s user-friendly interface ensures that all team members can easily navigate and utilize its capabilities.

-

Can 1041 N. integrate with other software applications?

Yes, 1041 N. on airSlate SignNow integrates seamlessly with various software applications, including CRM systems and cloud storage services. This integration capability enhances the overall efficiency of document workflows by allowing businesses to connect all their tools in one place.

-

Is 1041 N. suitable for small businesses?

Absolutely! 1041 N. is suitable for small businesses looking for an affordable and efficient eSignature solution. Its easy-to-use interface and flexible pricing options make it the perfect choice for any business size aiming to enhance their document management practices.

-

How secure is 1041 N. for handling sensitive documents?

1041 N. on airSlate SignNow is designed with high-level security protocols to protect sensitive documents. The platform employs encryption and secure access controls, ensuring that all data is safeguarded throughout the document signing process.

Get more for 1041 N

- Fill in 2015calendars form

- Opdes form 605 002b oklahoma department of environmental deq state ok 18218756

- Church van permission slip grassland youth form

- Solicitud de pasaporte ministerio de asuntos exteriores y de form

- Sponge worksheet answers form

- Form sa2 pdf

- Printable new hire packet form

- Signature page 13623787 form

Find out other 1041 N

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document