Form 1120 Schedule D, Fill in Version Capital Gains and Losses

Understanding Form 1120 Schedule D: Capital Gains and Losses

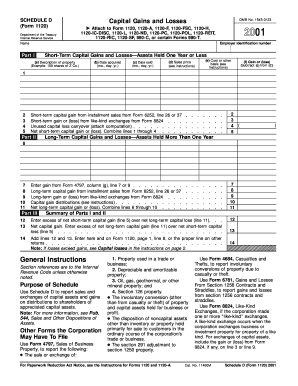

Form 1120 Schedule D is used by corporations to report capital gains and losses from the sale or exchange of capital assets. This form is essential for accurately calculating the tax owed on these transactions. Corporations must detail their capital gains and losses separately to ensure compliance with IRS regulations. The information provided in Schedule D helps determine the overall tax liability based on the corporation's investment activities.

Steps to Complete Form 1120 Schedule D

Completing Form 1120 Schedule D involves several key steps:

- Gather necessary financial records, including details of all capital asset transactions.

- Report short-term capital gains and losses in Part I of the form, using the appropriate columns to indicate the type of asset and transaction date.

- In Part II, report long-term capital gains and losses, ensuring that each transaction is accurately documented.

- Calculate the net capital gain or loss by subtracting total losses from total gains in both sections.

- Transfer the net amounts to the main Form 1120, where they will be included in the overall tax calculation.

Filing Deadlines for Form 1120 Schedule D

Corporations must file Form 1120 Schedule D along with their annual tax return, Form 1120. The typical deadline for filing is the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this deadline falls on April 15. It is important to be aware of any extensions that may apply to avoid penalties for late filing.

IRS Guidelines for Form 1120 Schedule D

The IRS provides specific guidelines for completing Form 1120 Schedule D. Corporations must adhere to the instructions outlined in the IRS publication regarding capital gains and losses. This includes understanding which transactions are reportable, how to classify assets, and the proper method for calculating gains and losses. Familiarity with these guidelines ensures compliance and helps avoid potential audits or penalties.

Key Elements of Form 1120 Schedule D

Form 1120 Schedule D includes several key elements that are crucial for accurate reporting:

- Part I: Short-term capital gains and losses, detailing assets held for one year or less.

- Part II: Long-term capital gains and losses, covering assets held for more than one year.

- Netting process: Calculating the net capital gain or loss from both short-term and long-term transactions.

- Carryover provisions: Rules regarding the carryover of unused capital losses to future tax years.

Examples of Using Form 1120 Schedule D

Corporations may encounter various scenarios requiring the use of Form 1120 Schedule D. For instance, a corporation that sells a piece of real estate it has owned for several years must report the transaction on Schedule D. Similarly, if a corporation sells stock it purchased last year, it will need to report any gains or losses from that sale. Each example illustrates the importance of accurately reporting these transactions to determine tax liability correctly.

Quick guide on how to complete schedule d 1120

Prepare schedule d 1120 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for standard printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly and without delays. Manage schedule g form 1120 on any device with the airSlate SignNow Android or iOS applications and enhance any document-driven task today.

The easiest way to modify and eSign form 1120 schedule g with ease

- Find schedule d form 1120 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign 1120 schedule g and ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to schedule g form 1120

Create this form in 5 minutes!

How to create an eSignature for the form 1120 schedule g

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask 1120 schedule g

-

What is a capital gains schedule D?

A capital gains schedule D is a tax form used to report capital gains and losses from transactions involving stocks, bonds, and other investments. It is essential for individuals who buy or sell assets and need to accurately report their financial activities when filing taxes. Knowing how to fill out a capital gains schedule D can help optimize your tax returns.

-

How does airSlate SignNow assist with capital gains schedule D documentation?

airSlate SignNow provides a seamless platform for eSigning and managing documents related to capital gains schedule D. With our user-friendly interface, you can easily send, sign, and store necessary tax documents securely. This ensures you keep your files organized and accessible for tax season.

-

Is there a cost associated with using airSlate SignNow for capital gains schedule D?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs, including features for managing capital gains schedule D documents. The cost is competitive and reflects the value of our user-friendly solution that helps businesses save time and reduce paperwork hassles. You can choose a plan that fits within your budget while maximizing efficiency.

-

What features does airSlate SignNow include for capital gains schedule D management?

airSlate SignNow includes features such as secure document storage, automated workflows, and electronic signatures, all of which streamline the process of preparing your capital gains schedule D. These tools help eliminate the need for physical paperwork, allowing you to electronically manage and send your tax-related documents efficiently. With our platform, your tax preparation becomes more organized and less stressful.

-

Can I integrate airSlate SignNow with other tools for managing capital gains schedule D?

Absolutely! airSlate SignNow integrates seamlessly with various tools like accounting software to help manage your capital gains schedule D. These integrations enable you to synchronize documents and data, ensuring that all information relevant to your capital gains is up-to-date and easily accessible. This versatility enhances your workflow and simplifies the management of tax documents.

-

What are the benefits of using airSlate SignNow for tax document eSigning?

Using airSlate SignNow for tax document eSigning provides signNow benefits such as improved efficiency, reduced turnaround time, and enhanced security for sensitive information like your capital gains schedule D. Our platform allows you to sign documents from anywhere, eliminating the need for physical signatures and travel. This ensures you can handle your tax-related tasks promptly and securely.

-

Is airSlate SignNow suitable for individuals or only for businesses concerning capital gains schedule D?

airSlate SignNow is suitable for both individuals and businesses dealing with capital gains schedule D. Whether you are an investor managing personal assets or a business navigating financial transactions, our platform provides the necessary tools to simplify document management. Everyone can benefit from our intuitive eSigning solution.

Get more for schedule d 1120

- White water challengers waiver form

- Residential rental unit licensing program city of allentown allentownpa form

- Lehigh acres street light form

- Application for admission northampton community college northampton form

- University of fort hare application forms 2016 pdf

- Missouri htc preliminary form

- Waiver of mandatory disclosure form

- Chartered banker mba application form the chartered

Find out other capital gains schedule d

- Sign Oklahoma General Partnership Agreement Online

- Sign Tennessee Non-Compete Agreement Computer

- Sign Tennessee Non-Compete Agreement Mobile

- Sign Utah Non-Compete Agreement Secure

- Sign Texas General Partnership Agreement Easy

- Sign Alabama LLC Operating Agreement Online

- Sign Colorado LLC Operating Agreement Myself

- Sign Colorado LLC Operating Agreement Easy

- Can I Sign Colorado LLC Operating Agreement

- Sign Kentucky LLC Operating Agreement Later

- Sign Louisiana LLC Operating Agreement Computer

- How Do I Sign Massachusetts LLC Operating Agreement

- Sign Michigan LLC Operating Agreement Later

- Sign Oklahoma LLC Operating Agreement Safe

- Sign Rhode Island LLC Operating Agreement Mobile

- Sign Wisconsin LLC Operating Agreement Mobile

- Can I Sign Wyoming LLC Operating Agreement

- Sign Hawaii Rental Invoice Template Simple

- Sign California Commercial Lease Agreement Template Free

- Sign New Jersey Rental Invoice Template Online