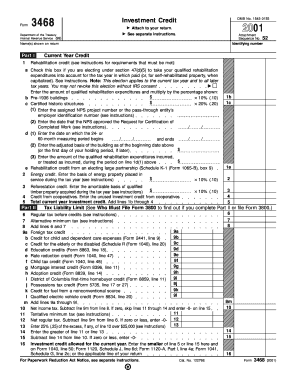

Form 3468 Fill in Version Investment Credit

What is the Form 3468 Investment Credit?

The Form 3468 is a tax form used by businesses and individuals to claim the investment credit, which allows for a reduction in federal income tax liability. This credit is primarily aimed at encouraging investment in certain types of property, such as renewable energy facilities and other qualified investments. Understanding the purpose of Form 3468 is essential for taxpayers looking to maximize their tax benefits while complying with IRS regulations.

Steps to Complete the Form 3468

Completing Form 3468 requires careful attention to detail. Here are the key steps to follow:

- Gather necessary documentation, including details of the property being claimed and any related expenses.

- Provide your name, address, and taxpayer identification number at the top of the form.

- Complete the sections regarding the type of property and the amount of investment credit being claimed.

- Calculate the total investment credit and ensure all figures are accurate.

- Sign and date the form to certify that the information provided is correct.

Eligibility Criteria for the Form 3468

To qualify for the investment credit claimed on Form 3468, taxpayers must meet specific eligibility criteria. Generally, the property must be eligible for the credit, which includes investments in renewable energy sources, certain types of equipment, and other qualified property. Additionally, the taxpayer must have incurred expenses related to the purchase or construction of the property within the applicable tax year.

IRS Guidelines for Form 3468

The IRS provides detailed guidelines on how to properly fill out and submit Form 3468. These guidelines include information on eligible property types, how to calculate the credit, and any limitations that may apply. Taxpayers should refer to the IRS instructions for Form 3468 to ensure compliance and to avoid potential issues during the filing process.

Examples of Using the Form 3468

Understanding how to apply Form 3468 can be enhanced by reviewing specific examples. For instance, a business that invests in solar panels for their facility may use Form 3468 to claim the investment credit on the cost of the panels. Another example includes a company that purchases energy-efficient equipment, which also qualifies for the credit. These examples illustrate the practical application of the form in real-world scenarios.

Form Submission Methods

Form 3468 can be submitted through various methods, depending on the taxpayer's preference. Options include filing electronically through tax software, mailing a paper copy to the appropriate IRS address, or submitting the form in person at designated IRS offices. Each method has its own requirements and processing times, so taxpayers should choose the one that best suits their needs.

Quick guide on how to complete form 3468

Prepare form 3468 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documentation, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents promptly without wait. Manage form 3468 on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign 3468 without hassle

- Locate 3468 form and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Modify and electronically sign form 3468 example and ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to form 3468

Create this form in 5 minutes!

How to create an eSignature for the 3468

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask form 3468 example

-

What is form 3468 and how can it benefit my business?

Form 3468 is a tax form used to claim investment tax credits. By utilizing form 3468, businesses can reduce their taxable income, which directly improves cash flow. Understanding how to file this form accurately can lead to signNow savings for your company.

-

How does airSlate SignNow simplify the process of completing form 3468?

airSlate SignNow provides an intuitive platform that streamlines the process of filling out form 3468. With easily accessible templates and eSignature capabilities, users can complete and send documents securely, ensuring compliance and efficiency in their submissions.

-

What are the pricing options for airSlate SignNow when using it to manage form 3468?

airSlate SignNow offers flexible pricing plans tailored to the needs of businesses of all sizes. Users can choose a plan that best suits their volume of documents and features required for efficiently managing form 3468 and other essential documents.

-

Can I integrate airSlate SignNow with other software to help manage form 3468?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, enabling users to manage form 3468 alongside other essential business tools. Whether it's CRM systems or workflow applications, integrations facilitate a smoother document management experience.

-

What features does airSlate SignNow offer for completing tax documents like form 3468?

airSlate SignNow includes features such as customizable templates, in-app eSigning, and document tracking, which are essential for completing tax documents like form 3468. These features ensure that users avoid errors and have complete visibility over their document workflow.

-

Is airSlate SignNow user-friendly for new users tackling form 3468?

Absolutely! airSlate SignNow has been designed with user-friendliness in mind, making it easy for newcomers to navigate the features necessary for managing form 3468. The platform provides step-by-step guidance to help users complete their forms confidently.

-

What security measures does airSlate SignNow have in place for sensitive documents like form 3468?

airSlate SignNow takes document security seriously and employs industry-standard encryption and authentication measures to protect sensitive information, including form 3468. This ensures that your data remains secure throughout the signing and submission process.

Get more for form 3468

Find out other 3468

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe