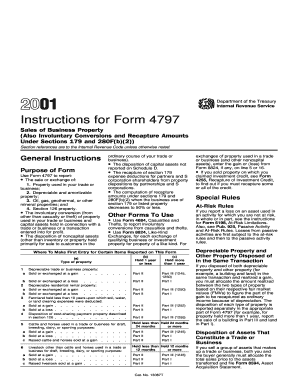

Instructions for Form 4797 Sales of Business Property Also Involuntary Conversions and Recapture Amounts under Sections 179 and

Understanding Form 4797

Form 4797 is used for reporting the sale of business property, including involuntary conversions and recapture amounts under Sections 179 and 280F(b)(2). This form is essential for businesses that have sold or exchanged property used in a trade or business, as it helps determine any gain or loss from the transaction. Understanding the nuances of this form is crucial for accurate tax reporting and compliance with IRS regulations.

How to Use Form 4797

To effectively use Form 4797, gather all necessary documentation related to the sale of business property. This includes records of the original purchase price, any improvements made, and the sale price. The form consists of several sections that require detailed information about the property sold, the type of transaction, and any applicable recapture amounts. Completing the form accurately ensures that you report the correct gain or loss, which is vital for your overall tax return.

Steps to Complete Form 4797

Completing Form 4797 involves several key steps:

- Gather all relevant financial records related to the property.

- Determine the type of transaction (sale, exchange, involuntary conversion).

- Fill out the form, providing details such as the description of the property, date of sale, and amounts received.

- Calculate any gain or loss from the sale, considering depreciation recapture if applicable.

- Review the completed form for accuracy before submission.

Key Elements of Form 4797

Form 4797 includes several critical elements that taxpayers must understand:

- Part I: Reports the sale of property used in a trade or business.

- Part II: Details like involuntary conversions and recapture amounts.

- Part III: Summarizes the overall gain or loss from the transactions reported.

Each part serves a specific purpose and must be completed based on the nature of the property transaction.

IRS Guidelines for Form 4797

The IRS provides specific guidelines for completing Form 4797, ensuring compliance with tax laws. Taxpayers should refer to the IRS instructions for the form, which outline eligibility criteria, reporting requirements, and common mistakes to avoid. Following these guidelines helps prevent errors that could lead to penalties or audits.

Filing Deadlines for Form 4797

Form 4797 must be filed along with your annual tax return. The deadline typically aligns with the due date for your Form 1040 or business tax return, which is usually April 15 for individual taxpayers. If you require additional time, consider filing for an extension, but ensure that any taxes owed are paid by the original deadline to avoid penalties.

Quick guide on how to complete instructions for form 4797 sales of business property also involuntary conversions and recapture amounts under sections 179 and

Complete [SKS] effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers a superb eco-friendly substitute for traditional printed and signed documents, as you can obtain the required template and securely preserve it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly and without delays. Handle [SKS] on any device with airSlate SignNow applications for Android or iOS and enhance any document-related task today.

The easiest way to edit and electronically sign [SKS] without hassle

- Obtain [SKS] and then click Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or black out sensitive details using tools that airSlate SignNow provides specifically for that reason.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method to submit your form, whether via email, SMS, an invitation link, or by downloading it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign [SKS] and guarantee excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Instructions For Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 4797 sales of business property also involuntary conversions and recapture amounts under sections 179 and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow for managing Instructions For Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280Fb2?

airSlate SignNow offers a user-friendly interface to eSign documents, making it easy to handle Instructions For Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280Fb2. Key features include document templates, real-time tracking, and secure cloud storage, ensuring that all pertinent information is readily accessible.

-

How can airSlate SignNow assist businesses with compliance regarding Instructions For Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280Fb2?

With airSlate SignNow, businesses can easily streamline the signing process for Instructions For Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280Fb2, ensuring that all documents are compliant with IRS requirements. This solution provides audit trails and timestamps, enhancing legal validity and ensuring strict adherence to compliance.

-

What pricing plans does airSlate SignNow offer for individuals needing Instructions For Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280Fb2?

airSlate SignNow provides flexible pricing plans tailored to suit individual and business needs, making it accessible for those managing Instructions For Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280Fb2. Plans include options for monthly or annual subscriptions, with discounts for longer-term commitments.

-

How does airSlate SignNow enhance the workflow for processing Instructions For Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280Fb2?

airSlate SignNow simplifies workflows by allowing users to automate reminders and notifications related to Instructions For Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280Fb2. This automation reduces the time spent on manual follow-ups and helps ensure that deadlines are met efficiently.

-

Can airSlate SignNow integrate with other platforms when handling Instructions For Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280Fb2?

Yes, airSlate SignNow offers seamless integrations with various platforms, including CRM systems and cloud storage solutions, making it easier to manage Instructions For Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280Fb2. This connectivity enables organizations to streamline their entire document management process.

-

Is there a mobile app available for handling Instructions For Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280Fb2?

airSlate SignNow provides a mobile application that allows users to access, send, and sign documents regarding Instructions For Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280Fb2 on-the-go. This flexibility ensures that users can manage their documentation anytime, anywhere.

-

What benefits does airSlate SignNow offer for small businesses dealing with Instructions For Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280Fb2?

For small businesses, airSlate SignNow offers an affordable solution to manage Instructions For Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280Fb2 efficiently. The service helps minimize processing times, reduces paper costs, and ensures secure storage of important documents.

Get more for Instructions For Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And

Find out other Instructions For Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document