IRA Distribution Form Baldwin & Clarke 2017-2026

What is the IRA Distribution Form Baldwin & Clarke

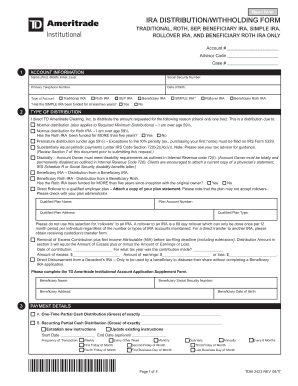

The IRA Distribution Form Baldwin & Clarke is a specific document used to request distributions from an Individual Retirement Account (IRA). This form is essential for account holders who wish to withdraw funds from their IRA, whether for retirement income, emergencies, or other financial needs. It ensures that the distribution process adheres to IRS regulations and helps prevent potential tax penalties associated with improper withdrawals.

How to use the IRA Distribution Form Baldwin & Clarke

To effectively use the IRA Distribution Form Baldwin & Clarke, individuals must first complete the form accurately. This involves providing personal information, specifying the amount to be withdrawn, and selecting the distribution method. Once completed, the form should be submitted to the financial institution managing the IRA. It is important to retain a copy for personal records and to ensure compliance with tax regulations.

Steps to complete the IRA Distribution Form Baldwin & Clarke

Completing the IRA Distribution Form Baldwin & Clarke involves several key steps:

- Gather necessary personal information, including your name, address, and Social Security number.

- Indicate the type of IRA from which you are withdrawing funds.

- Specify the amount you wish to withdraw and the reason for the distribution.

- Select your preferred method of receiving the funds, such as direct deposit or check.

- Review the form for accuracy and completeness before signing and dating it.

Key elements of the IRA Distribution Form Baldwin & Clarke

The IRA Distribution Form Baldwin & Clarke includes several key elements that must be completed for a valid distribution request. These elements typically include:

- Account holder's personal information.

- Type of IRA account (Traditional, Roth, etc.).

- Amount and reason for the distribution.

- Distribution method (direct deposit, check, etc.).

- Signature of the account holder, confirming the request.

IRS Guidelines

The IRS has established guidelines governing IRA distributions to ensure compliance with tax laws. These guidelines dictate the tax implications of withdrawals, including potential penalties for early distributions before age fifty-nine and a half. It is crucial for individuals to understand these regulations to avoid unexpected tax liabilities. Consulting with a tax professional can provide clarity on how these guidelines apply to specific situations.

Required Documents

When submitting the IRA Distribution Form Baldwin & Clarke, certain documents may be required to support the request. Commonly required documents include:

- Proof of identity, such as a driver's license or passport.

- Any additional forms required by the financial institution.

- Tax identification number or Social Security number.

Form Submission Methods

The IRA Distribution Form Baldwin & Clarke can typically be submitted through various methods, depending on the policies of the financial institution. Common submission methods include:

- Online submission through the institution's secure portal.

- Mailing the completed form to the designated address.

- In-person submission at a local branch office.

Create this form in 5 minutes or less

Find and fill out the correct ira distribution form baldwin amp clarke

Create this form in 5 minutes!

How to create an eSignature for the ira distribution form baldwin amp clarke

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRA Distribution Form Baldwin & Clarke?

The IRA Distribution Form Baldwin & Clarke is a specialized document designed to facilitate the withdrawal of funds from an Individual Retirement Account (IRA). This form ensures that all necessary information is collected and processed efficiently, making it easier for account holders to manage their retirement funds.

-

How can I access the IRA Distribution Form Baldwin & Clarke?

You can easily access the IRA Distribution Form Baldwin & Clarke through the airSlate SignNow platform. Simply log in to your account, navigate to the forms section, and search for the IRA Distribution Form Baldwin & Clarke to begin the process.

-

Is there a cost associated with using the IRA Distribution Form Baldwin & Clarke?

Using the IRA Distribution Form Baldwin & Clarke through airSlate SignNow is part of our subscription plans, which are designed to be cost-effective. We offer various pricing tiers to suit different business needs, ensuring that you can manage your IRA distributions without breaking the bank.

-

What features does the IRA Distribution Form Baldwin & Clarke offer?

The IRA Distribution Form Baldwin & Clarke includes features such as eSignature capabilities, secure document storage, and easy sharing options. These features streamline the process of completing and submitting your IRA distribution requests, making it more efficient and user-friendly.

-

How does the IRA Distribution Form Baldwin & Clarke benefit users?

The IRA Distribution Form Baldwin & Clarke benefits users by simplifying the withdrawal process from their retirement accounts. With its intuitive design and electronic signature options, users can complete their forms quickly and securely, reducing the time and hassle typically associated with IRA distributions.

-

Can I integrate the IRA Distribution Form Baldwin & Clarke with other tools?

Yes, the IRA Distribution Form Baldwin & Clarke can be integrated with various third-party applications and tools. This allows users to streamline their workflows and enhance productivity by connecting their document management processes with other essential business systems.

-

What security measures are in place for the IRA Distribution Form Baldwin & Clarke?

airSlate SignNow prioritizes security for all documents, including the IRA Distribution Form Baldwin & Clarke. We implement advanced encryption protocols and secure access controls to ensure that your sensitive information remains protected throughout the signing and submission process.

Get more for IRA Distribution Form Baldwin & Clarke

- Coal tax return form 55a100 kentucky department of revenue revenue ky

- Fcc form 497 universal service administrative company usac

- Dla form 1822 5564100

- Spartanburg housing authority application form

- Nonprofit fiscal sponsor agreement template form

- Nonprofit membership agreement template form

- Nonprofit shareholder agreement template form

- Nonprofit sponsorship agreement template form

Find out other IRA Distribution Form Baldwin & Clarke

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online