1545 0196 Split Interest Trust Information Return See Separate Instructions

What is the Split Interest Trust Information Return?

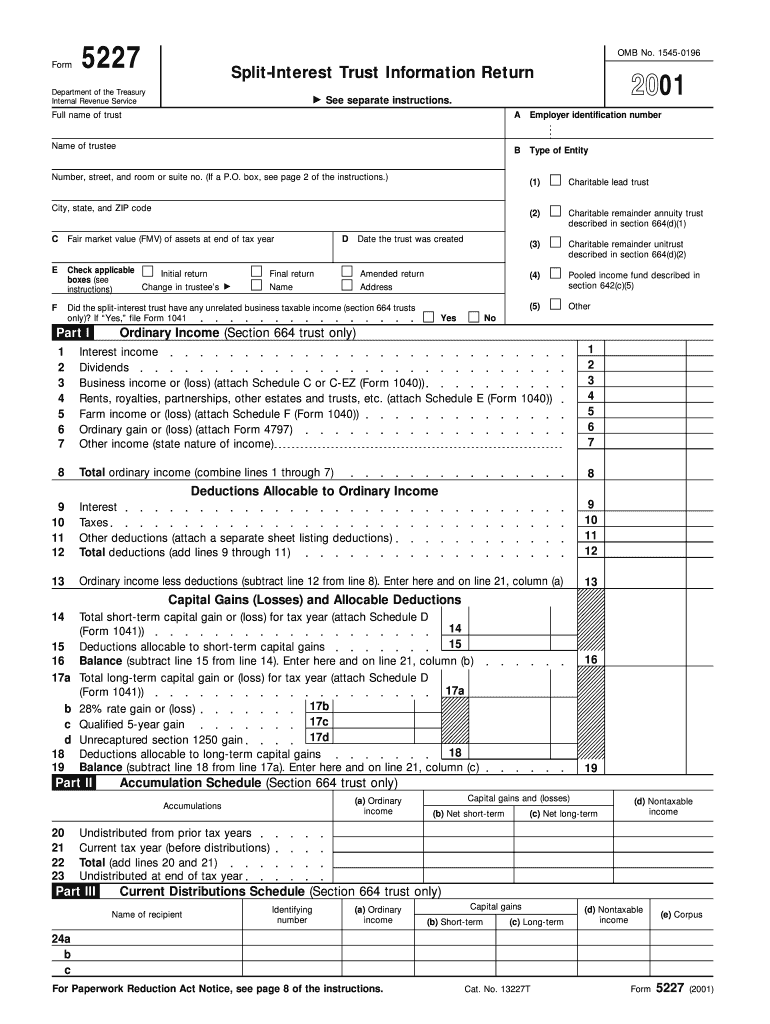

The Split Interest Trust Information Return is a tax form used to report information related to split-interest trusts. These trusts typically involve both charitable and non-charitable beneficiaries. The form is essential for ensuring compliance with IRS regulations, as it provides detailed information about the trust's income, deductions, and distributions. Understanding this form is crucial for trustees and beneficiaries to accurately report their financial activities and obligations.

Steps to Complete the Split Interest Trust Information Return

Completing the form involves several key steps:

- Gather necessary documentation, including trust agreements, financial statements, and records of income and distributions.

- Fill out the form by providing detailed information about the trust, including its name, address, and tax identification number.

- Report all income earned by the trust during the tax year, including interest, dividends, and capital gains.

- Detail any deductions the trust is eligible for, such as administrative expenses or distributions to beneficiaries.

- Ensure all information is accurate and complete before submission to avoid penalties.

Legal Use of the Split Interest Trust Information Return

The legal use of the form is primarily to comply with federal tax laws governing split-interest trusts. This form must be filed annually by the trustee of the trust. Failure to file or inaccuracies in reporting can lead to penalties and interest charges. It is important for trustees to understand their legal responsibilities and ensure that the form is submitted in accordance with IRS guidelines.

Filing Deadlines / Important Dates

The filing deadline for the Split Interest Trust Information Return typically aligns with the tax year of the trust. Generally, the form must be filed by the fifteenth day of the third month following the end of the trust's tax year. For trusts operating on a calendar year basis, this means the form is due by March 15 of the following year. It is essential to keep track of these deadlines to avoid late fees and penalties.

Required Documents

To successfully complete the form, several documents are required:

- Trust agreement detailing the terms and beneficiaries of the trust.

- Financial statements showing income, expenses, and distributions made during the tax year.

- Tax identification number for the trust.

- Records of any charitable contributions made by the trust.

Form Submission Methods

The Split Interest Trust Information Return can be submitted in various ways. Trustees may choose to file the form electronically through the IRS e-file system, which is often quicker and more efficient. Alternatively, the form can be mailed to the appropriate IRS address. It is important to ensure that the form is sent to the correct location to avoid processing delays.

Quick guide on how to complete 1545 0196 split interest trust information return see separate instructions

Complete [SKS] effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents quickly and without delays. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign [SKS] without hassle

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Modify and electronically sign [SKS] and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 1545 0196 Split Interest Trust Information Return See Separate Instructions

Create this form in 5 minutes!

How to create an eSignature for the 1545 0196 split interest trust information return see separate instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1545 0196 Split Interest Trust Information Return?

The 1545 0196 Split Interest Trust Information Return is a tax form used to report the income and deductions of a split-interest trust. Understanding how to correctly fill out this form is crucial for compliance with IRS regulations. We recommend reviewing the detailed instructions provided with the return to ensure all required information is accurately submitted.

-

How can airSlate SignNow help with the 1545 0196 Split Interest Trust Information Return?

airSlate SignNow enables users to easily send, eSign, and manage the 1545 0196 Split Interest Trust Information Return. With our user-friendly interface, you can streamline the completion and submission of this return while ensuring all signatures are obtained digitally and securely. Our solution simplifies the documentation process, allowing for efficient handling of trust information.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, ensuring you can efficiently manage documents including the 1545 0196 Split Interest Trust Information Return. Our plans range from basic options ideal for individuals to comprehensive solutions for larger organizations, allowing you to choose what fits best without overspending.

-

Are there any features specifically designed for managing trust documents?

Yes, airSlate SignNow includes features tailored for managing trust documents such as the 1545 0196 Split Interest Trust Information Return. These features include template creation, document collaboration, and secure eSignature capabilities, making it easier for users to prepare and finalize sensitive trust-related documents efficiently.

-

Can I integrate airSlate SignNow with other tools I use?

Certainly! airSlate SignNow offers numerous integrations with popular software and applications, enhancing your workflow when dealing with documents like the 1545 0196 Split Interest Trust Information Return. This allows you to seamlessly connect with tools you already use, such as CRM systems and cloud storage providers, optimizing your document management process.

-

What benefits does eSigning offer for the 1545 0196 Split Interest Trust Information Return?

eSigning offers numerous benefits for the 1545 0196 Split Interest Trust Information Return, including faster processing times and reduced paperwork. By utilizing our eSignature feature, you can ensure that all parties can sign securely and instantly, making the management of trust returns more efficient. This not only speeds up your processes but also enhances compliance and record-keeping.

-

Is airSlate SignNow secure for handling sensitive trust documents?

Absolutely! airSlate SignNow prioritizes the security of all documents, including the 1545 0196 Split Interest Trust Information Return. We implement robust encryption protocols and comply with industry standards to protect your data, ensuring that sensitive information remains confidential and secure during transmission and storage.

Get more for 1545 0196 Split Interest Trust Information Return See Separate Instructions

Find out other 1545 0196 Split Interest Trust Information Return See Separate Instructions

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself