Form 6069 Rev October , Fill in Version Return of Excise Tax on Excess Contributions to Black Lung Benefit Trust under Section 4

What is the Form 6069 Rev October

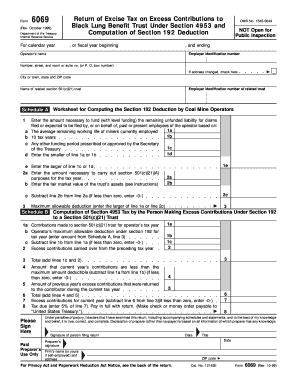

The Form 6069 Rev October is a tax form utilized in the United States for reporting excise tax on excess contributions made to the Black Lung Benefit Trust. This form is specifically designed under Section 4953 of the Internal Revenue Code. It serves as a means for organizations to calculate and report any excess contributions that exceed the allowable limits set forth by federal regulations. Understanding this form is crucial for compliance with tax obligations related to the Black Lung Benefit Trust.

How to use the Form 6069 Rev October

Using the Form 6069 Rev October involves several key steps. First, gather all necessary financial information regarding contributions made to the Black Lung Benefit Trust. Next, accurately fill in the required sections of the form, ensuring that all figures reflect the correct amounts. After completing the form, review it for accuracy to prevent any errors that could lead to penalties. Finally, submit the form according to the guidelines provided by the IRS, either electronically or by mail, depending on your preference.

Steps to complete the Form 6069 Rev October

Completing the Form 6069 Rev October requires careful attention to detail. Begin by entering your organization's name and identification number at the top of the form. Next, provide details about the contributions made to the Black Lung Benefit Trust. Calculate any excess contributions by comparing your total contributions against the allowable limits. Fill in the computation section to determine the excise tax owed. Finally, sign and date the form before submission to ensure it is officially recognized by the IRS.

Key elements of the Form 6069 Rev October

The Form 6069 Rev October includes several key elements that are essential for accurate reporting. These elements consist of the organization's identification information, a detailed breakdown of contributions, the computation of excess contributions, and the calculation of the excise tax owed. Each section must be filled out with precise figures to ensure compliance and avoid any potential penalties. Understanding these elements is vital for anyone responsible for filing this form.

Filing Deadlines / Important Dates

Timely filing of the Form 6069 Rev October is important to avoid penalties. The IRS typically sets specific deadlines for tax forms, and it is essential to adhere to these dates. Generally, the form must be filed by the fifteenth day of the fifth month following the end of the tax year. For organizations operating on a calendar year, this usually means a due date of May fifteenth. It is advisable to check the IRS website for any updates or changes to deadlines.

Penalties for Non-Compliance

Failing to file the Form 6069 Rev October or submitting inaccurate information can result in significant penalties. The IRS may impose fines based on the amount of excise tax owed, and additional penalties may apply for late submissions. In some cases, failure to comply with reporting requirements could lead to further legal consequences. Organizations should prioritize accurate and timely filing to mitigate these risks and maintain compliance with federal tax laws.

Quick guide on how to complete form 6069 rev october fill in version return of excise tax on excess contributions to black lung benefit trust under section

Complete [SKS] seamlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely preserve it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your files quickly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS apps and enhance any document-driven process today.

The easiest way to edit and eSign [SKS] effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Highlight pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to submit your form, by email, SMS, or invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 6069 rev october fill in version return of excise tax on excess contributions to black lung benefit trust under section

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 6069 Rev October, Fill in Version Return Of Excise Tax On Excess Contributions To Black Lung Benefit Trust Under Section 4953 And Computation Of Section?

The Form 6069 Rev October is a tax form used to report excess contributions to the Black Lung Benefit Trust. It allows businesses and organizations to compute their excise tax obligations under Section 4953. By filling out this form correctly, you can ensure compliance with federal tax regulations.

-

How can airSlate SignNow assist with completing the Form 6069 Rev October?

airSlate SignNow provides a user-friendly platform to help users fill out the Form 6069 Rev October electronically. Our solution simplifies the process by offering templates and guidance on how to accurately complete the form. This reduces the time and effort required to prepare your excise tax returns.

-

What pricing options are available for using airSlate SignNow to fill out the Form 6069 Rev October?

airSlate SignNow offers various pricing plans to fit the needs of different users, whether you’re an individual or a business. We provide a free trial, followed by affordable subscription packages that enable full access to our features, including filling out forms like the Form 6069 Rev October.

-

What are the benefits of using airSlate SignNow for Form 6069 Rev October?

Using airSlate SignNow for the Form 6069 Rev October streamlines the e-signature process and keeps your documents secure and organized. Our platform allows for easy collaboration between team members while ensuring that all submissions comply with legal standards. This results in faster processing times and reduced administrative costs.

-

Is it easy to integrate airSlate SignNow with other software for managing the Form 6069 Rev October?

Yes, airSlate SignNow easily integrates with various software applications, making it simple to manage the Form 6069 Rev October within your existing workflows. Whether you use accounting software or cloud storage solutions, our platform is designed to enhance productivity and align with your business tools seamlessly.

-

Can I access airSlate SignNow on mobile devices for filling out the Form 6069 Rev October?

Absolutely! airSlate SignNow is mobile-friendly and allows users to fill out the Form 6069 Rev October on various devices. This flexibility lets you complete and sign documents from anywhere, ensuring that you can manage your excise tax submissions conveniently, even on the go.

-

What security measures does airSlate SignNow implement for the Form 6069 Rev October?

airSlate SignNow prioritizes the security of your data, including when filling out the Form 6069 Rev October. We employ advanced encryption protocols and secure storage solutions to protect your sensitive information. Our commitment to security ensures compliance with industry standards and peace of mind for our users.

Get more for Form 6069 Rev October , Fill in Version Return Of Excise Tax On Excess Contributions To Black Lung Benefit Trust Under Section 4

Find out other Form 6069 Rev October , Fill in Version Return Of Excise Tax On Excess Contributions To Black Lung Benefit Trust Under Section 4

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement