Form 8027 Fill in Version Employer's Annual Information Return of Tip Income and Allocated Tips

What is the Form 8027 Fill in Version Employer's Annual Information Return Of Tip Income And Allocated Tips

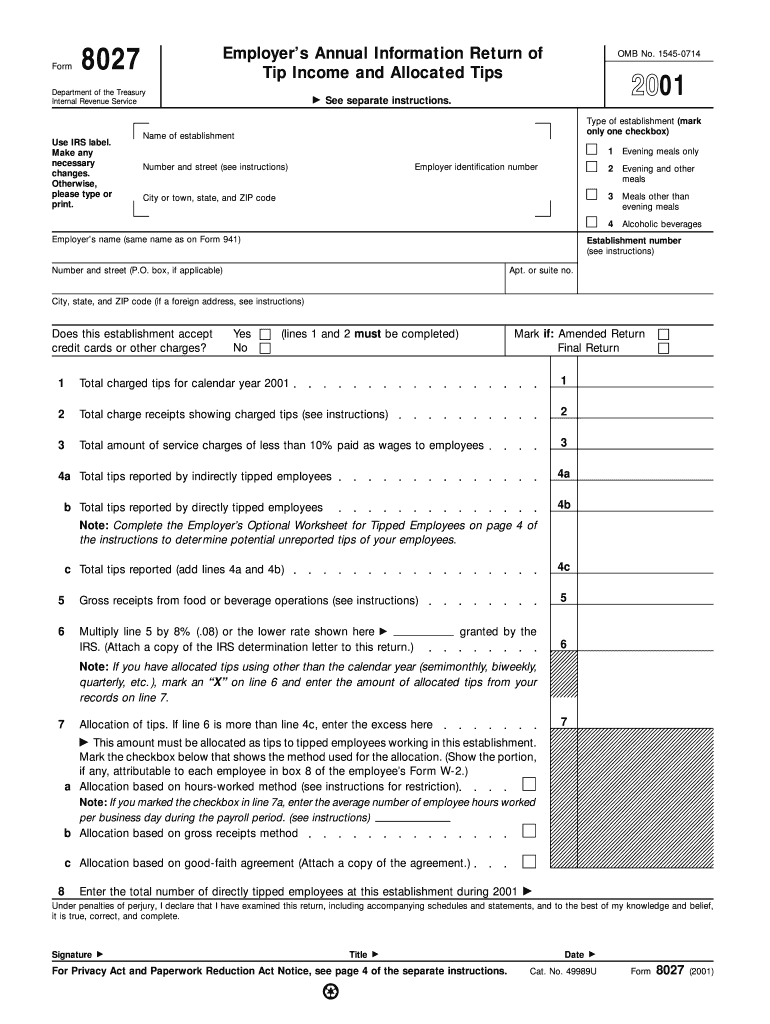

The Form 8027, officially known as the Employer's Annual Information Return of Tip Income and Allocated Tips, is a tax form used by employers in the United States to report tip income received by their employees. This form is essential for establishments where tipping is a common practice, such as restaurants and bars. Employers must accurately report the total amount of tips received and any allocated tips to ensure compliance with IRS regulations. The information collected helps the IRS monitor tip income and ensure proper tax reporting by employees.

Steps to complete the Form 8027 Fill in Version Employer's Annual Information Return Of Tip Income And Allocated Tips

Completing Form 8027 involves several key steps:

- Gather necessary information, including total sales, total tips received, and the number of employees who received tips.

- Fill out the employer's information section, including the employer's name, address, and Employer Identification Number (EIN).

- Report the total tip income received by employees and any allocated tips based on IRS guidelines.

- Ensure that all figures are accurate and reflect the correct amounts for the reporting period.

- Review the completed form for any errors before submission.

How to obtain the Form 8027 Fill in Version Employer's Annual Information Return Of Tip Income And Allocated Tips

Employers can obtain Form 8027 from the IRS website or by contacting the IRS directly. The form is available in a fillable PDF format, allowing for easy completion. Additionally, many tax preparation software programs include the form as part of their offerings, making it accessible for electronic filing. It is important to ensure that you are using the most current version of the form to comply with IRS requirements.

Legal use of the Form 8027 Fill in Version Employer's Annual Information Return Of Tip Income And Allocated Tips

Form 8027 is legally required for employers who operate establishments where tipping is customary. The IRS mandates that employers report tip income accurately to prevent tax evasion and ensure that employees pay the appropriate taxes on their earnings. Failure to file this form or inaccuracies in reporting can result in penalties and increased scrutiny from the IRS. Employers must adhere to IRS guidelines regarding the reporting of tip income to maintain compliance with federal tax laws.

Filing Deadlines / Important Dates

The filing deadline for Form 8027 is typically the last day of February following the end of the tax year. Employers must ensure that they submit the form on time to avoid penalties. If the deadline falls on a weekend or holiday, the due date may be extended to the next business day. It is crucial for employers to keep track of these dates to maintain compliance and avoid any potential issues with the IRS.

Penalties for Non-Compliance

Failure to file Form 8027 or inaccuracies in the information reported can lead to significant penalties. The IRS may impose fines for late submissions, incorrect reporting, or failure to provide required information. Employers may face a penalty of $50 for each form not filed timely, with a maximum penalty amount depending on the size of the business. It is important for employers to understand these penalties and take the necessary steps to ensure compliance with reporting requirements.

Quick guide on how to complete form 8027 fill in version employers annual information return of tip income and allocated tips

Prepare [SKS] effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the necessary form and secure it online. airSlate SignNow equips you with all the tools necessary to create, amend, and eSign your documents promptly without delays. Manage [SKS] on any gadget using airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to amend and eSign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or conceal sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the information and hit the Done button to save your modifications.

- Decide how you wish to send your form, either via email, text message (SMS), or an invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Amend and eSign [SKS] and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8027 Fill in Version Employer's Annual Information Return Of Tip Income And Allocated Tips

Create this form in 5 minutes!

How to create an eSignature for the form 8027 fill in version employers annual information return of tip income and allocated tips

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 8027 Fill in Version Employer's Annual Information Return Of Tip Income And Allocated Tips?

The Form 8027 Fill in Version Employer's Annual Information Return Of Tip Income And Allocated Tips is a document required by the IRS to report tip income and allocated tips for employers in the food and beverage industry. Completing this form accurately helps businesses comply with tax regulations and avoid penalties. Using airSlate SignNow makes it easier to fill out and submit this form electronically.

-

How can airSlate SignNow help me with the Form 8027 Fill in Version Employer's Annual Information Return Of Tip Income And Allocated Tips?

airSlate SignNow provides an intuitive platform for filling out the Form 8027 Fill in Version Employer's Annual Information Return Of Tip Income And Allocated Tips digitally. With streamlined workflows, you can easily input your data, sign the document, and send it off for processing. This saves time and reduces the risk of errors commonly associated with paper forms.

-

Is there a cost associated with using airSlate SignNow for the Form 8027 Fill in Version Employer's Annual Information Return Of Tip Income And Allocated Tips?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, ensuring that you get a cost-effective solution for completing the Form 8027 Fill in Version Employer's Annual Information Return Of Tip Income And Allocated Tips. Pricing is structured based on the number of users and features you require. Consider our plans as an investment in efficiency and compliance.

-

What features does airSlate SignNow offer for filling out forms like Form 8027?

airSlate SignNow includes features such as customizable templates, electronic signatures, and secure cloud storage, all of which facilitate the completion of the Form 8027 Fill in Version Employer's Annual Information Return Of Tip Income And Allocated Tips. These features not only enhance accessibility but also ensure that your data remains secure and compliant with regulations.

-

How secure is the information submitted through airSlate SignNow for the Form 8027?

Security is a top priority at airSlate SignNow. When submitting the Form 8027 Fill in Version Employer's Annual Information Return Of Tip Income And Allocated Tips, your data is encrypted and stored securely in compliance with industry standards. This protection ensures your sensitive financial information remains confidential.

-

Can airSlate SignNow integrate with other software I use for tax reporting?

Absolutely! airSlate SignNow supports integrations with various accounting and payroll software to help streamline your workflow, including those used for tax reporting. This makes it easier to gather and transmit the necessary data for completing the Form 8027 Fill in Version Employer's Annual Information Return Of Tip Income And Allocated Tips.

-

What are the benefits of using airSlate SignNow for my business?

Utilizing airSlate SignNow provides numerous benefits, including increased efficiency, reduced paperwork, and improved compliance when filling out forms like the Form 8027 Fill in Version Employer's Annual Information Return Of Tip Income And Allocated Tips. The user-friendly interface allows your team to focus on their core tasks rather than being bogged down by administrative work.

Get more for Form 8027 Fill in Version Employer's Annual Information Return Of Tip Income And Allocated Tips

Find out other Form 8027 Fill in Version Employer's Annual Information Return Of Tip Income And Allocated Tips

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement