Form 8281 Rev August , Fill in Version Information Return for Publicly Offered Original Issue Discount Instruments

Understanding Form 8281 Rev August

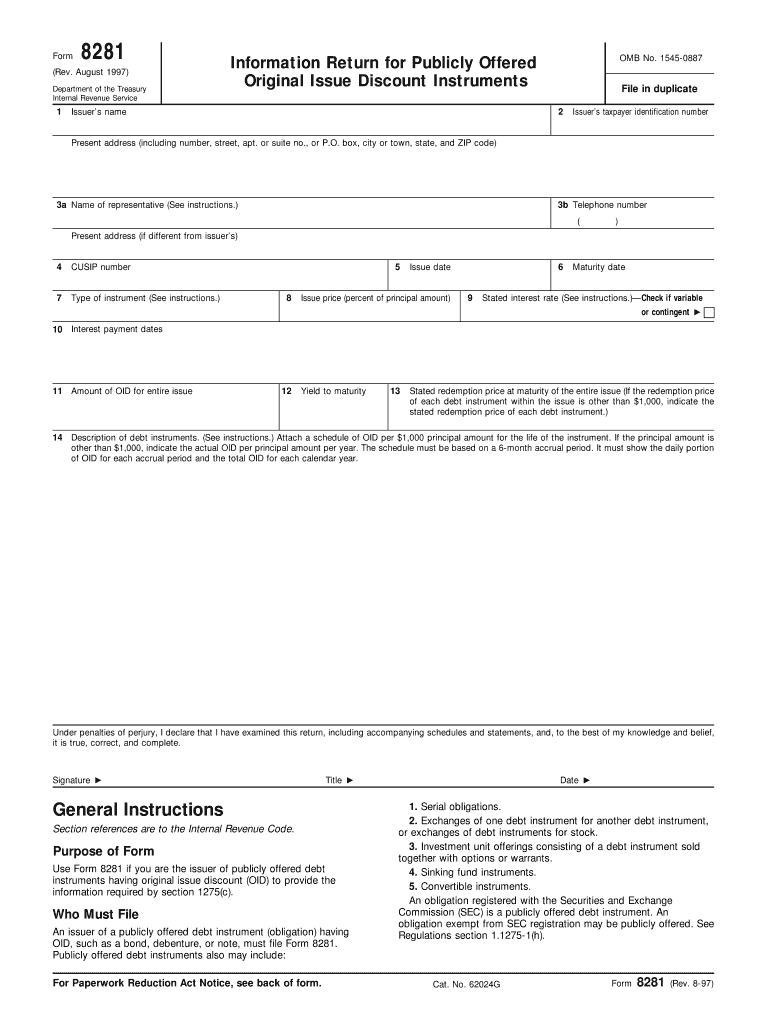

The Form 8281 Rev August is a crucial document used for reporting information regarding publicly offered original issue discount instruments. This form is essential for issuers who need to disclose specific details about the instruments they offer to the public. It ensures compliance with IRS regulations and provides necessary information for tax purposes. The form captures key data points such as the type of instrument, issue date, and the amount of original issue discount, which is vital for both the issuer and the investors involved.

How to Complete Form 8281 Rev August

Completing Form 8281 Rev August involves several steps to ensure accuracy and compliance with IRS requirements. First, gather all relevant information about the original issue discount instruments being reported. This includes the issuer's name, the type of instrument, and the total amount of discount. Next, carefully fill out each section of the form, ensuring that all figures are correct and correspond to the relevant documentation. It is important to review the completed form for any errors before submission to avoid potential penalties.

Obtaining Form 8281 Rev August

Form 8281 Rev August can be obtained directly from the IRS website or through authorized tax professionals. It is available in a fillable PDF format, making it easy for users to complete the form digitally. Additionally, businesses may also contact the IRS directly for assistance in obtaining the form or for any questions regarding its completion.

Key Elements of Form 8281 Rev August

Several key elements must be included when filling out Form 8281 Rev August. These include:

- Issuer Information: Name and address of the issuer.

- Instrument Details: Type and description of the original issue discount instruments.

- Issue Date: The date when the instrument was issued.

- Original Issue Discount Amount: The total amount of discount associated with the instrument.

- Reporting Period: The specific tax year for which the information is being reported.

Filing Deadlines for Form 8281 Rev August

Filing deadlines for Form 8281 Rev August are critical to ensure compliance with IRS regulations. Typically, the form must be filed by the issuer on or before the due date of the tax return for the year in which the instruments were issued. It is essential to stay informed about any changes to these deadlines, as they may vary from year to year. Late submissions can result in penalties, making timely filing a priority for issuers.

Legal Use of Form 8281 Rev August

Form 8281 Rev August serves a legal purpose in the reporting of original issue discount instruments. It is required by the IRS to ensure that all relevant information is disclosed for tax compliance. Issuers must understand the legal implications of failing to file this form accurately and on time, as it can lead to audits or penalties. Proper use of this form protects both the issuer and the investors by maintaining transparency in financial reporting.

Quick guide on how to complete form 8281 rev august fill in version information return for publicly offered original issue discount instruments

Effortlessly Prepare [SKS] on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can access the correct form and store it securely online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly and without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Update and eSign [SKS] with Ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or mask sensitive details with tools that airSlate SignNow includes specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8281 Rev August , Fill in Version Information Return For Publicly Offered Original Issue Discount Instruments

Create this form in 5 minutes!

How to create an eSignature for the form 8281 rev august fill in version information return for publicly offered original issue discount instruments

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of Form 8281 Rev August , Fill in Version Information Return For Publicly Offered Original Issue Discount Instruments?

The Form 8281 Rev August is used to provide essential details about publicly offered original issue discount instruments. This enables the IRS to track the issuance of these instruments and ensure accurate tax reporting for investors. It includes crucial information to help streamline compliance processes for organizations.

-

How can airSlate SignNow help me with Form 8281 Rev August?

airSlate SignNow simplifies the process of completing and submitting Form 8281 Rev August by allowing you to fill in the necessary information electronically. With our user-friendly interface, you can easily input, save, and track your submissions. Our solution ensures that your documents are organized and compliant with IRS requirements.

-

What features does airSlate SignNow offer for handling Form 8281 Rev August?

Our platform includes features like electronic signatures, template creation, and document tracking specifically tailored for Form 8281 Rev August. Additionally, it offers collaboration tools that allow multiple users to review and complete the form simultaneously. This maximizes efficiency and accuracy in your filing process.

-

Is there a cost associated with using airSlate SignNow for Form 8281 Rev August?

airSlate SignNow provides cost-effective pricing plans suitable for various business sizes when managing Form 8281 Rev August. You can choose from a range of options tailored to your needs, ensuring you only pay for what you require. We also offer a free trial, allowing you to explore our features before committing.

-

Are there any integrations available with airSlate SignNow for submitting Form 8281 Rev August?

Yes, airSlate SignNow integrates seamlessly with a variety of software solutions, enhancing your ability to manage Form 8281 Rev August. You can connect with CRM systems, cloud storage services, and more to streamline your workflow. This means you can access, fill out, and submit forms directly from your existing tools.

-

What are the benefits of using airSlate SignNow for Form 8281 Rev August?

Using airSlate SignNow for Form 8281 Rev August provides increased efficiency, reduced paperwork, and enhanced document security. Our platform allows for rapid completion and easy tracking of the form, ensuring you meet all relevant deadlines. Moreover, it minimizes the risk of errors typically associated with manual entries.

-

Can I collaborate with my team on Form 8281 Rev August using airSlate SignNow?

Absolutely! airSlate SignNow enables real-time collaboration on Form 8281 Rev August, allowing your team to work together seamlessly. You can share documents, receive feedback, and make edits simultaneously, ensuring everyone is on the same page and expediting the completion process.

Get more for Form 8281 Rev August , Fill in Version Information Return For Publicly Offered Original Issue Discount Instruments

Find out other Form 8281 Rev August , Fill in Version Information Return For Publicly Offered Original Issue Discount Instruments

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement