55 Names Shown on Your Income Tax Return Identifying Number Note Figure the Amount of Your Contribution Deduction Before Complet Form

Understanding the 55 Names Shown On Your Income Tax Return Identifying Number Note Figure The Amount Of Your Contribution Deduction Before Completing This Form

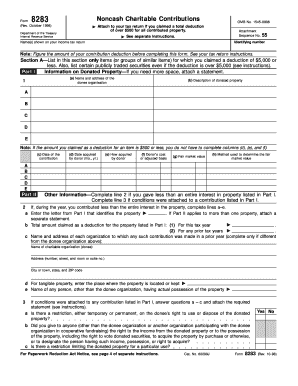

The 55 Names Shown On Your Income Tax Return Identifying Number Note Figure The Amount Of Your Contribution Deduction Before Completing This Form is a crucial document for taxpayers who wish to claim deductions for contributions made throughout the tax year. This form helps identify the specific contributions that can be deducted from your taxable income, thereby potentially lowering your overall tax liability. It is essential to accurately fill out this form to ensure compliance with IRS regulations and to maximize your deductions.

Steps to Complete the 55 Names Shown On Your Income Tax Return Identifying Number Note Figure The Amount Of Your Contribution Deduction Before Completing This Form

Completing the 55 Names Shown On Your Income Tax Return Identifying Number Note Figure The Amount Of Your Contribution Deduction Before Completing This Form involves several key steps:

- Gather all relevant documentation regarding your contributions, including receipts and bank statements.

- Review the instructions provided with the form to understand the specific requirements for each section.

- Fill in your identifying information accurately, ensuring that your name and Social Security number are correct.

- List each contribution made during the tax year, including the date, amount, and purpose of the contribution.

- Double-check your entries for accuracy before submitting the form.

Key Elements of the 55 Names Shown On Your Income Tax Return Identifying Number Note Figure The Amount Of Your Contribution Deduction Before Completing This Form

Several key elements are integral to the 55 Names Shown On Your Income Tax Return Identifying Number Note Figure The Amount Of Your Contribution Deduction Before Completing This Form:

- Identifying Information: Your name, address, and Social Security number must be clearly stated.

- Contribution Details: Each contribution must be documented with the date, amount, and recipient organization.

- Deduction Amount: Clearly indicate the total amount you wish to deduct from your taxable income.

- Signature: Ensure that you sign and date the form to validate your submission.

Legal Use of the 55 Names Shown On Your Income Tax Return Identifying Number Note Figure The Amount Of Your Contribution Deduction Before Completing This Form

The legal use of the 55 Names Shown On Your Income Tax Return Identifying Number Note Figure The Amount Of Your Contribution Deduction Before Completing This Form is essential for ensuring that your tax filings comply with IRS regulations. This form serves as a formal declaration of the contributions you have made, which may qualify for tax deductions. Accurate completion of this form protects you from potential audits and ensures that you are not claiming deductions for ineligible contributions.

IRS Guidelines for the 55 Names Shown On Your Income Tax Return Identifying Number Note Figure The Amount Of Your Contribution Deduction Before Completing This Form

The IRS provides specific guidelines for completing the 55 Names Shown On Your Income Tax Return Identifying Number Note Figure The Amount Of Your Contribution Deduction Before Completing This Form. Taxpayers should refer to the IRS website or the form’s instructions for detailed information on:

- Eligibility criteria for claiming contributions.

- Documentation required to substantiate your claims.

- Deadlines for submission to avoid penalties.

Examples of Using the 55 Names Shown On Your Income Tax Return Identifying Number Note Figure The Amount Of Your Contribution Deduction Before Completing This Form

Examples of how to use the 55 Names Shown On Your Income Tax Return Identifying Number Note Figure The Amount Of Your Contribution Deduction Before Completing This Form can provide clarity on its practical application. For instance:

- A taxpayer who donates to a qualified charity can list the donation amount and date on the form.

- Individuals contributing to retirement accounts may also use this form to document their contributions for tax deduction purposes.

Quick guide on how to complete 55 names shown on your income tax return identifying number note figure the amount of your contribution deduction before

Complete [SKS] effortlessly on any gadget

Digital document management has become favored among enterprises and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can access the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and eSign your documents swiftly without delays. Manage [SKS] on any gadget using airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The easiest way to modify and eSign [SKS] with ease

- Find [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that function.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal value as a conventional wet ink signature.

- Review all the details and then hit the Done button to store your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management in just a few clicks from the device of your preference. Modify and eSign [SKS] and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 55 Names Shown On Your Income Tax Return Identifying Number Note Figure The Amount Of Your Contribution Deduction Before Complet

Create this form in 5 minutes!

How to create an eSignature for the 55 names shown on your income tax return identifying number note figure the amount of your contribution deduction before

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the 55 Names Shown On Your Income Tax Return Identifying Number Note Figure?

The 55 Names Shown On Your Income Tax Return Identifying Number Note Figure is crucial for accurately determining your contribution deductions. Before completing this form, ensure that you identify these figures correctly to maximize your potential tax benefits. Understanding this helps businesses effectively manage their documents and tax implications.

-

How does airSlate SignNow facilitate managing contribution deductions?

airSlate SignNow provides an easy-to-use platform that helps you organize and manage documents related to the 55 Names Shown On Your Income Tax Return Identifying Number Note Figure. By streamlining the electronic signing process, you can quickly obtain necessary approvals on documents that pertain to your contributions before finalizing your tax forms. This ensures accuracy and efficiency in your tax documentation.

-

What features does airSlate SignNow offer for tax document management?

With airSlate SignNow, you'll benefit from features like customizable templates, automated reminders, and secure storage, especially regarding the 55 Names Shown On Your Income Tax Return Identifying Number Note Figure. These features simplify the preparation of your tax documents, ensuring that all information is correctly filled out before submission. This ultimately saves you time and reduces errors.

-

Is there a mobile app for airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows users to manage documents on the go. This is particularly useful for accessing the 55 Names Shown On Your Income Tax Return Identifying Number Note Figure anywhere, anytime. You'll be able to send and eSign documents related to your tax contributions using your mobile device, enhancing overall convenience.

-

Can airSlate SignNow integrate with other financial software?

Absolutely! airSlate SignNow seamlessly integrates with various financial software that can help with tax preparation and accounting. This integration is beneficial for effectively managing the 55 Names Shown On Your Income Tax Return Identifying Number Note Figure, as it allows for direct access and importation of required data into your tax forms. This smooth workflow helps you keep everything organized.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans designed to meet the needs of businesses of all sizes. Whether you need basic features or advanced capabilities, there is a plan that can accommodate your requirements when it comes to managing the 55 Names Shown On Your Income Tax Return Identifying Number Note Figure. Each plan offers value with signNow cost savings for electronic signatures and document management.

-

How does using airSlate SignNow enhance document security?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive information like the 55 Names Shown On Your Income Tax Return Identifying Number Note Figure. The platform employs industry-standard encryption and secure access controls to safeguard your documents. This ensures that your tax-related documents remain confidential and are protected against unauthorized access.

Get more for 55 Names Shown On Your Income Tax Return Identifying Number Note Figure The Amount Of Your Contribution Deduction Before Complet

- Michigan buyers notice of intent to vacate and surrender property to seller under contract for deed form

- Senator tammy duckworth 416335356 form

- Limited power of attorney 22995120 form

- Mra edf form download

- Timelister pdf form

- Tuscaloosa city sign permit form

- Exam form 56385350

- Application for sanitary permit form

Find out other 55 Names Shown On Your Income Tax Return Identifying Number Note Figure The Amount Of Your Contribution Deduction Before Complet

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself