Form 8801 Fill in Version Credit for Prior Year Minimum Tax Individuals, Estates, and Trusts

Understanding Form 8801: Credit for Prior Year Minimum Tax

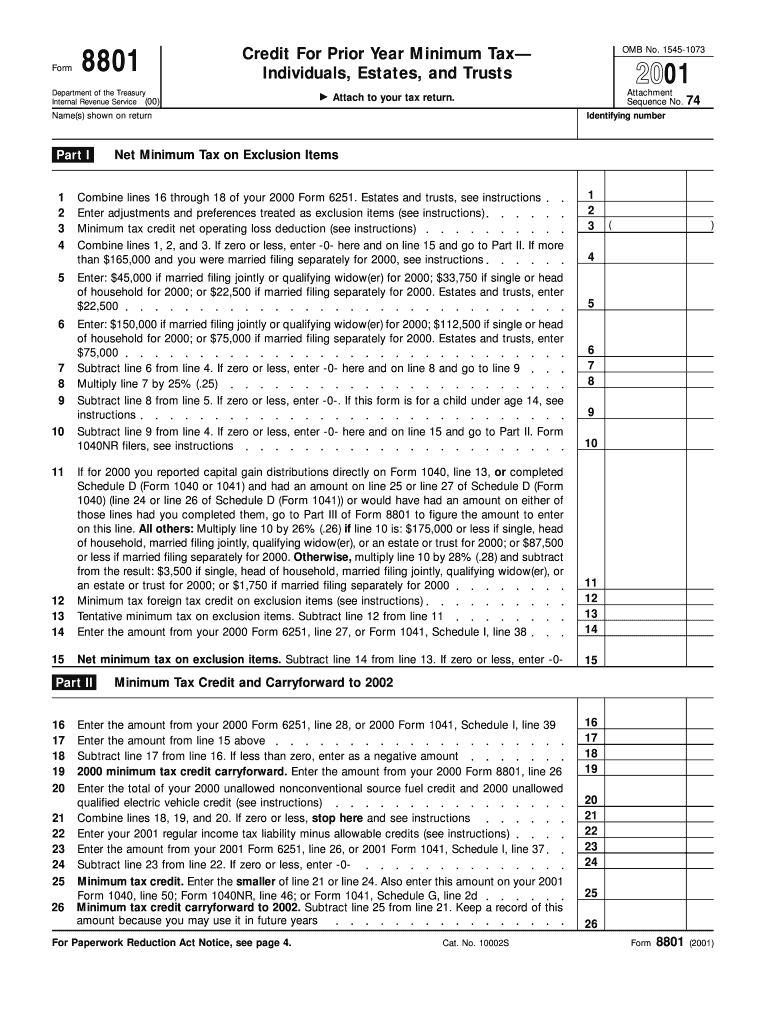

Form 8801 is a tax form used by individuals, estates, and trusts to claim a credit for prior year minimum tax. This form allows taxpayers who paid alternative minimum tax (AMT) in previous years to receive a credit against their current year tax liability. The credit is designed to alleviate the impact of AMT, ensuring that taxpayers are not overburdened by taxes in subsequent years. Understanding the nuances of Form 8801 is crucial for those eligible to claim this credit, as it can lead to significant tax savings.

Steps to Complete Form 8801

Completing Form 8801 involves several key steps to ensure accuracy and compliance with IRS guidelines. First, gather necessary financial documents, including prior year tax returns and any relevant AMT calculations. Next, fill out the form by entering your personal information, including your name, Social Security number, and filing status. Then, calculate the credit amount based on your previous year's minimum tax paid. Finally, review the completed form for errors before submitting it with your current year tax return.

Obtaining Form 8801

Form 8801 can be obtained from the IRS website or through tax preparation software. It is available as a downloadable PDF, which can be printed and filled out manually. Taxpayers may also access the form through various tax filing services that include it as part of their offerings. Ensuring you have the correct version of the form is essential for proper filing, especially if there have been updates or changes in tax law.

Key Elements of Form 8801

Form 8801 contains several important sections that taxpayers must complete. Key elements include the identification of the taxpayer, calculation of the prior year minimum tax, and the computation of the credit available for the current year. Additionally, the form requires taxpayers to provide details about any carryover credits from previous years. Each section must be filled out accurately to ensure that the credit is calculated correctly and to avoid any potential issues with the IRS.

IRS Guidelines for Form 8801

The IRS has specific guidelines regarding the use of Form 8801, including eligibility criteria and filing instructions. Taxpayers must have previously paid alternative minimum tax to qualify for the credit. The IRS also outlines the necessary documentation required to support the credit claim, such as prior year tax returns and AMT calculations. Familiarizing oneself with these guidelines is vital to successfully navigating the filing process and maximizing potential tax benefits.

Filing Deadlines for Form 8801

Form 8801 must be filed with your annual tax return, which is typically due on April fifteenth. If you are unable to file by this date, you may request an extension, but it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties. Keeping track of these deadlines is essential for ensuring compliance and taking full advantage of the credit available through Form 8801.

Quick guide on how to complete form 8801 fill in version credit for prior year minimum tax individuals estates and trusts

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly option to conventional printed and signed documents, allowing you to locate the correct template and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage [SKS] on any device with the airSlate SignNow Android or iOS applications and simplify any document operation today.

How to Modify and Electronically Sign [SKS] with Ease

- Find [SKS] and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Identify important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for these tasks.

- Create your electronic signature using the Sign tool, which takes only seconds and has the same legal significance as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to share your form via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device. Modify and electronically sign [SKS] and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8801 Fill in Version Credit For Prior Year Minimum Tax Individuals, Estates, And Trusts

Create this form in 5 minutes!

How to create an eSignature for the form 8801 fill in version credit for prior year minimum tax individuals estates and trusts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 8801 Fill in Version Credit For Prior Year Minimum Tax for Individuals, Estates, and Trusts?

The Form 8801 Fill in Version Credit For Prior Year Minimum Tax for Individuals, Estates, and Trusts allows taxpayers to claim a credit against their current year's taxes for minimum tax imposed in prior years. This form is vital for understanding your tax liability and maximizing potential credit benefits. Ensuring you fill it out correctly can lead to signNow savings.

-

How can airSlate SignNow assist me in filling out Form 8801?

airSlate SignNow provides an intuitive platform that simplifies the process of completing Form 8801 Fill in Version Credit For Prior Year Minimum Tax for Individuals, Estates, and Trusts. With features like guided workflows and e-signatures, you can efficiently manage your forms without the hassle of traditional paperwork. Plus, our platform ensures compliance with current tax regulations.

-

What are the pricing options for using airSlate SignNow for tax forms like Form 8801?

airSlate SignNow offers flexible pricing plans tailored to fit various needs, starting from a free trial to subscription-based options. Each plan is designed to provide access to features that make filling out forms like Form 8801 Fill in Version Credit For Prior Year Minimum Tax for Individuals, Estates, and Trusts easier and more efficient. You can choose a plan that best suits your budget and usage requirements.

-

Are there any key benefits of using airSlate SignNow for tax documentation?

Using airSlate SignNow for your tax documentation, including Form 8801 Fill in Version Credit For Prior Year Minimum Tax for Individuals, Estates, and Trusts, offers several benefits. These include enhanced document security, reduced turnaround time for getting signatures, and the ability to track document status in real-time. It's a cost-effective solution that empowers users to manage their tax forms seamlessly.

-

Can I integrate airSlate SignNow with other software for filling out Form 8801?

Yes, airSlate SignNow supports various integrations with popular accounting and tax software, making it easier to fill out Form 8801 Fill in Version Credit For Prior Year Minimum Tax for Individuals, Estates, and Trusts. This feature allows users to streamline their workflow by connecting tools they already use. Enjoy a cohesive experience while managing your tax documentation.

-

Is the airSlate SignNow platform user-friendly for filling out complex forms like Form 8801?

Absolutely! The airSlate SignNow platform is designed with user experience in mind, making it easy to navigate even complex forms like Form 8801 Fill in Version Credit For Prior Year Minimum Tax for Individuals, Estates, and Trusts. With clear instructions and support resources, users can confidently fill out their documents without extensive prior knowledge or training.

-

What support options does airSlate SignNow provide for users filling out Form 8801?

airSlate SignNow offers comprehensive support options for users filling out Form 8801 Fill in Version Credit For Prior Year Minimum Tax for Individuals, Estates, and Trusts. You can access resources such as FAQs, video tutorials, and live chat support to address any questions or concerns you may have. Our commitment is to ensure you have the assistance you require for a smooth document preparation experience.

Get more for Form 8801 Fill in Version Credit For Prior Year Minimum Tax Individuals, Estates, And Trusts

Find out other Form 8801 Fill in Version Credit For Prior Year Minimum Tax Individuals, Estates, And Trusts

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online