Form 8821 Rev January , Fill in Version Tax Information Authorization

What is the Form 8821 Rev January, Fill in Version Tax Information Authorization

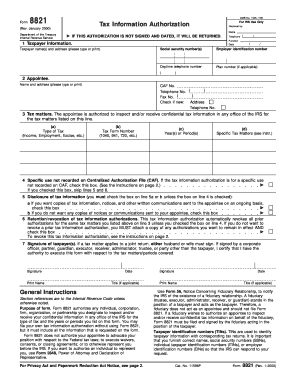

The Form 8821, officially titled Tax Information Authorization, is a document used by taxpayers in the United States to authorize specific individuals or entities to receive and inspect their tax information from the Internal Revenue Service (IRS). This form allows taxpayers to grant permission for their tax records to be accessed, which can be beneficial when seeking assistance from tax professionals or financial advisors. The Rev January version includes updates and revisions to ensure compliance with current IRS regulations.

How to use the Form 8821 Rev January, Fill in Version Tax Information Authorization

To use the Form 8821, taxpayers need to complete the form by providing their personal information, including name, address, and Social Security number. Additionally, the form requires details about the individual or organization being authorized to access the tax information. Once filled out, the form should be signed and dated by the taxpayer. It can then be submitted to the IRS to grant the designated party access to the specified tax records.

Steps to complete the Form 8821 Rev January, Fill in Version Tax Information Authorization

Completing the Form 8821 involves several straightforward steps:

- Begin by entering your name, address, and Social Security number in the designated fields.

- Provide the name and address of the person or organization you are authorizing to access your tax information.

- Specify the tax information you wish to disclose, including the type of tax and the years or periods applicable.

- Sign and date the form to validate your authorization.

- Submit the completed form to the IRS, either by mail or electronically, depending on your preference.

Legal use of the Form 8821 Rev January, Fill in Version Tax Information Authorization

The Form 8821 is legally recognized by the IRS as a valid method for taxpayers to authorize third parties to access their tax information. It is essential to understand that this form does not grant the authorized individual the ability to make tax decisions on behalf of the taxpayer. Instead, it is strictly for information access. Proper use of this form ensures compliance with privacy regulations while allowing for necessary communication between taxpayers and their representatives.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 8821. Taxpayers should ensure that all information is accurate and up to date to avoid delays in processing. The IRS recommends keeping a copy of the completed form for personal records. Additionally, the form should be submitted as soon as possible to ensure that the authorized party can access the necessary tax information when needed.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have multiple options for submitting the Form 8821. The form can be mailed directly to the IRS at the address specified in the instructions. Alternatively, taxpayers may have the option to submit the form electronically through the IRS e-file system, depending on the specific circumstances. In-person submission is generally not available for this form, as it is primarily processed through mail or electronic channels.

Quick guide on how to complete form 8821 rev january fill in version tax information authorization

Easily Prepare [SKS] on Any Device

Digital document management has gained signNow popularity among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools required to swiftly create, modify, and eSign your documents without unnecessary delays. Manage [SKS] on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

Effortlessly Modify and eSign [SKS]

- Find [SKS] and then click Get Form to begin.

- Utilize the available tools to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with the specialized tools offered by airSlate SignNow.

- Generate your eSignature using the Sign tool, which only takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method to send your form via email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or mislaid files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and eSign [SKS] to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8821 Rev January , Fill in Version Tax Information Authorization

Create this form in 5 minutes!

How to create an eSignature for the form 8821 rev january fill in version tax information authorization

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8821 Rev January, Fill in Version Tax Information Authorization?

Form 8821 Rev January, Fill in Version Tax Information Authorization is a document that allows taxpayers to authorize an individual or organization to access their tax information from the IRS. By using this form, users can ensure that their designated representatives can obtain necessary information for tax preparation and assistance.

-

How can airSlate SignNow help with Form 8821 Rev January?

airSlate SignNow simplifies the process of completing and eSigning Form 8821 Rev January, Fill in Version Tax Information Authorization. Our platform allows users to fill in the form digitally, ensuring it is accurate and compliant with IRS requirements, ultimately saving time and reducing errors.

-

What features does airSlate SignNow offer for signing forms?

airSlate SignNow offers various features for signing forms, including customizable templates, secure eSignatures, and cloud storage for documents. With these capabilities, users can efficiently manage Form 8821 Rev January, Fill in Version Tax Information Authorization and other important documents, all in one place.

-

Is airSlate SignNow affordable for small businesses?

Yes, airSlate SignNow is a cost-effective solution suitable for small businesses. Our pricing plans are designed to be flexible and economical, allowing every business to utilize services such as eSigning and document management for forms like Form 8821 Rev January, Fill in Version Tax Information Authorization without breaking the bank.

-

Can I integrate airSlate SignNow with other software for tax purposes?

Absolutely! airSlate SignNow can be easily integrated with a variety of software applications to enhance your tax processes. Whether you use accounting software or customer relationship management tools, you can streamline the handling of Form 8821 Rev January, Fill in Version Tax Information Authorization along with your other workflows.

-

How secure is the information shared on airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols to protect your sensitive data, including the information contained in Form 8821 Rev January, Fill in Version Tax Information Authorization. You can confidently send and sign documents, knowing that your information is secure.

-

Is it easy to track the status of my Form 8821 Rev January after sending it?

Yes, airSlate SignNow provides real-time tracking for all documents, including Form 8821 Rev January, Fill in Version Tax Information Authorization. You will receive notifications on the status of your document, ensuring you are aware of when it has been viewed, signed, or completed.

Get more for Form 8821 Rev January , Fill in Version Tax Information Authorization

- Modle de tdr doc form

- Elements compounds and mixtures reading form

- Hartford manufacturers errors omissions form

- Sec form 4 sec gov

- Arkansas child care facilities guaranteed loan program form

- Attestation form hppsc

- Transcript request form pottstown school district

- Generic ohs risk assessment control form swinburne edu

Find out other Form 8821 Rev January , Fill in Version Tax Information Authorization

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online