Form 8834, Fill in Version Qualified Electric Vehicle Credit

What is the Form 8834?

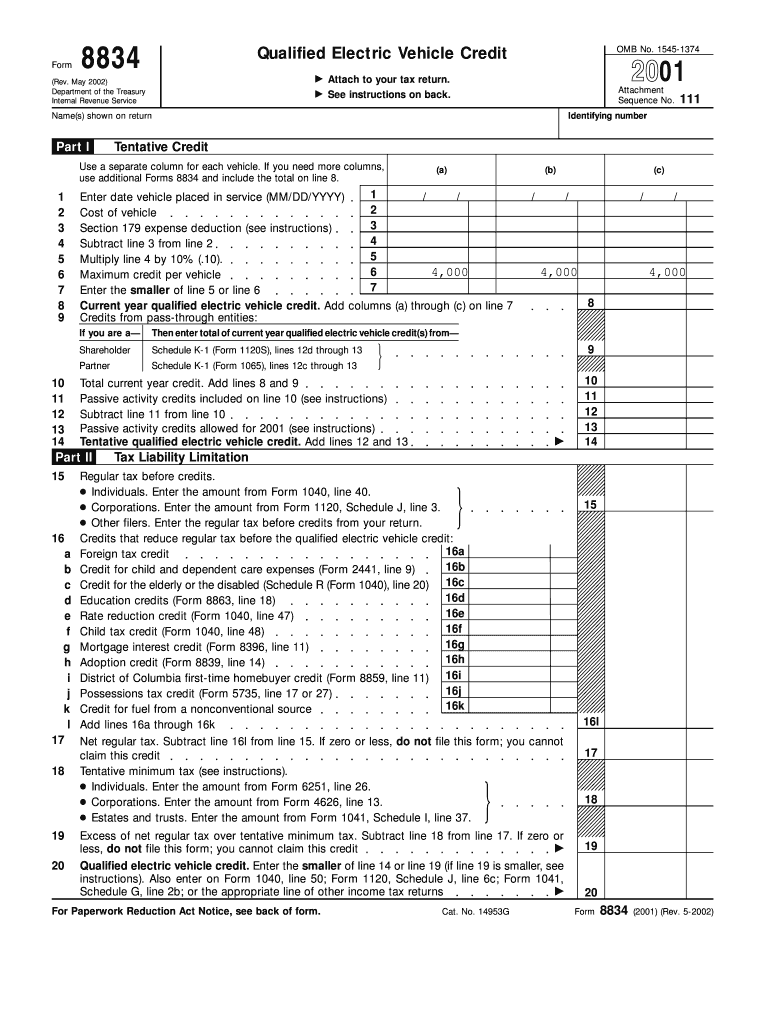

The Form 8834, also known as the Qualified Electric Vehicle Credit, is a tax form used by individuals and businesses in the United States to claim a tax credit for the purchase of qualified electric vehicles. This form helps taxpayers reduce their overall tax liability by providing a credit based on the type of electric vehicle purchased and its battery capacity. Understanding this form is essential for those looking to take advantage of available tax incentives aimed at promoting the use of electric vehicles.

Eligibility Criteria for Form 8834

To qualify for the credit claimed on Form 8834, taxpayers must meet specific eligibility criteria. The vehicle must be a qualified electric vehicle, which generally includes vehicles that are powered primarily by an electric motor and meet certain battery capacity requirements. Additionally, the vehicle must be purchased for use and not for resale. Taxpayers should also ensure that the vehicle is used predominantly in the United States to meet the criteria for the credit.

Steps to Complete the Form 8834

Completing Form 8834 involves several steps. First, gather all necessary information about the vehicle, including its make, model, and battery capacity. Next, fill out the form by providing your personal information, vehicle details, and the amount of the credit you are claiming. It is important to carefully follow the instructions provided with the form to ensure accuracy. After completing the form, review it for any errors before submitting it with your tax return.

Required Documents for Form 8834

When filing Form 8834, certain documents may be required to support your claim. These documents can include the vehicle purchase agreement, proof of payment, and any other documentation that verifies the vehicle's eligibility for the credit. Keeping thorough records is essential, as the IRS may request these documents for verification purposes. Having the necessary documentation ready can help streamline the filing process.

Filing Deadlines for Form 8834

Filing deadlines for Form 8834 align with the general tax return deadlines in the United States. Typically, individual taxpayers must file their returns by April fifteenth of each year. However, if you need additional time, you can file for an extension, which generally allows for an extension of six months. It is crucial to file Form 8834 by the deadline to ensure you receive the tax credit for the current tax year.

How to Obtain Form 8834

Form 8834 can be obtained through several methods. It is available on the official IRS website, where taxpayers can download and print the form. Additionally, many tax preparation software programs include Form 8834 as part of their offerings, making it easier for users to complete their tax returns electronically. Taxpayers can also request a physical copy of the form by contacting the IRS directly.

Quick guide on how to complete form 8834

Complete form 8834 effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, alter, and electronically sign your documents swiftly without delays. Manage form 8834 on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign form 8834 without hassle

- Locate form 8834 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign form 8834 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to form 8834

Create this form in 5 minutes!

How to create an eSignature for the form 8834

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask form 8834

-

What is Form 8834 and how do I use it with airSlate SignNow?

Form 8834 is used to claim a credit for the purchase of certain electric vehicles. With airSlate SignNow, you can easily fill out, sign, and send Form 8834 electronically. This ensures a smooth process for claiming your credits without unnecessary paperwork.

-

Can I eSign Form 8834 using airSlate SignNow?

Yes, you can eSign Form 8834 with airSlate SignNow. Our platform allows you to electronically sign and securely share your completed form. This saves time and enhances the efficiency of managing your documents.

-

What features does airSlate SignNow offer for completing Form 8834?

airSlate SignNow provides various features for Form 8834, including customizable templates, auto-fill capabilities, and secure cloud storage. These features help streamline the completion process, ensuring that all necessary information is captured accurately.

-

Is there a cost to use airSlate SignNow for Form 8834?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective. You can choose from different pricing plans based on your needs, which allows you to manage Form 8834 without breaking the bank.

-

How does airSlate SignNow integrate with other applications to process Form 8834?

airSlate SignNow seamlessly integrates with various applications such as Google Drive, Dropbox, and more. This allows you to import necessary data directly into Form 8834, making the process even more efficient and user-friendly.

-

Can I share Form 8834 with others using airSlate SignNow?

Absolutely! airSlate SignNow allows you to share Form 8834 with colleagues or clients easily. You can collaborate on the document, making it easier to collect all required signatures and information.

-

What are the benefits of using airSlate SignNow for Form 8834?

Using airSlate SignNow for Form 8834 offers several benefits, including enhanced efficiency, improved document security, and convenient access from any device. It simplifies the process of filling out and submitting your tax documents.

Get more for form 8834

Find out other form 8834

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast