Form 8849 Schedule 6 Rev January , Fill in Version Other Claims

What is the Form 8849 Schedule 6 Rev January, Fill in Version Other Claims

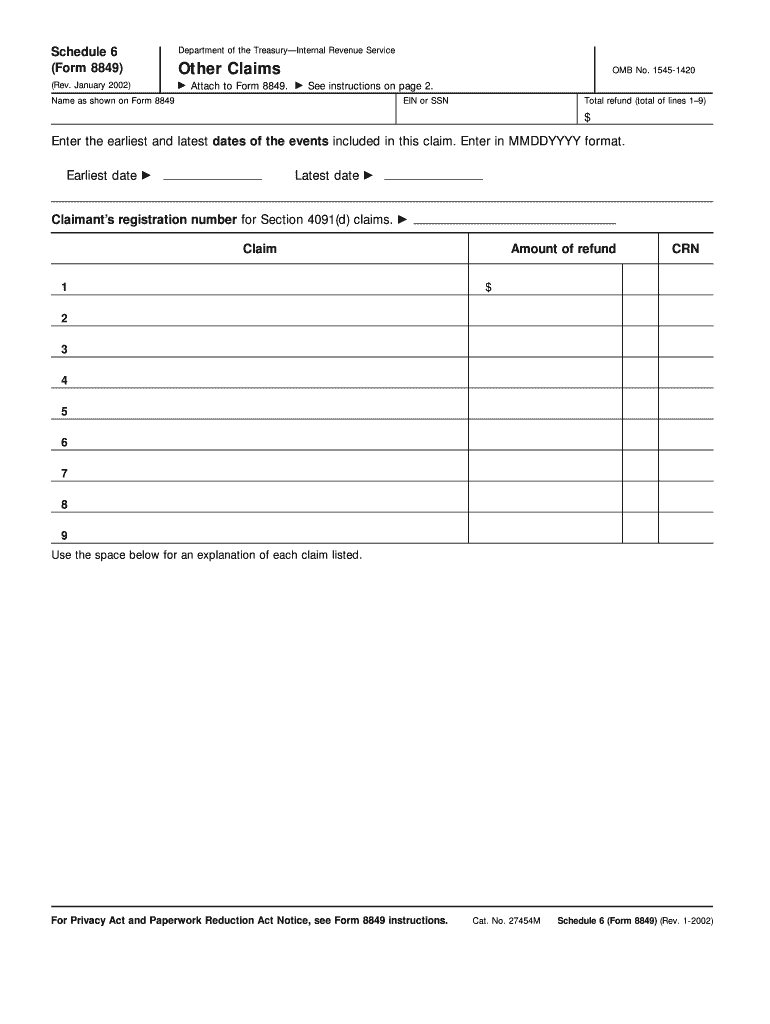

The Form 8849 Schedule 6 Rev January, Fill in Version Other Claims is a tax form used by businesses and individuals to claim refunds for certain excise taxes. This form is specifically designed for those who have incurred overpayments or have claims for refund related to specific excise taxes. It is essential for taxpayers to understand the purpose of this form to ensure they can accurately claim any refunds they are entitled to.

How to use the Form 8849 Schedule 6 Rev January, Fill in Version Other Claims

Using the Form 8849 Schedule 6 involves several steps. First, ensure you have the correct version of the form, which is the Rev January version. Next, gather all necessary documentation that supports your claim for a refund. This may include receipts, invoices, and any other relevant records. Complete the form by filling in the required fields accurately, ensuring all information aligns with your supporting documents. Finally, submit the form to the appropriate IRS address or electronically, if applicable.

Steps to complete the Form 8849 Schedule 6 Rev January, Fill in Version Other Claims

Completing the Form 8849 Schedule 6 requires careful attention to detail. Begin by entering your personal information, including your name, address, and taxpayer identification number. Next, specify the type of claim you are making by selecting the appropriate boxes on the form. Provide detailed information regarding the excise taxes you are claiming refunds for, including amounts and dates. Review the completed form for accuracy before submission to avoid delays in processing your claim.

Key elements of the Form 8849 Schedule 6 Rev January, Fill in Version Other Claims

Key elements of the Form 8849 Schedule 6 include the taxpayer's identification information, the type of claim being made, and a detailed breakdown of the excise taxes involved. Each section must be filled out completely and accurately to ensure the IRS can process the claim without issues. Additionally, it is important to include any supporting documentation that validates your claim, as this can expedite the refund process.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8849 Schedule 6 are crucial to ensure timely processing of claims. Generally, claims for refunds must be filed within three years from the date the tax was paid. It is advisable to keep track of these deadlines and submit your form as early as possible to avoid any potential issues with late submissions. Specific dates may vary based on individual circumstances, so it is important to consult the IRS guidelines for any updates.

Form Submission Methods (Online / Mail / In-Person)

The Form 8849 Schedule 6 can be submitted through various methods. Taxpayers may choose to file the form electronically if they are using compatible tax software. Alternatively, the form can be mailed to the appropriate IRS address, which is specified in the form instructions. In-person submission is typically not available for this form, making electronic and mail submissions the most common methods. Ensure that you retain a copy of the submitted form for your records.

Quick guide on how to complete form 8849 schedule 6 rev january fill in version other claims

Complete [SKS] effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any platform with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Use the tools at your disposal to fill out your form.

- Highlight signNow sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Choose how you wish to submit your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the concerns of lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Edit and electronically sign [SKS] to guarantee outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8849 Schedule 6 Rev January , Fill in Version Other Claims

Create this form in 5 minutes!

How to create an eSignature for the form 8849 schedule 6 rev january fill in version other claims

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 8849 Schedule 6 Rev January, Fill in Version Other Claims?

The Form 8849 Schedule 6 Rev January, Fill in Version Other Claims is a critical document for businesses looking to claim refunds on certain excise taxes. It provides a structured way to submit requests for refunds or credits, ensuring compliance with IRS regulations. Utilizing airSlate SignNow to complete and eSign this form simplifies the process signNowly.

-

How does airSlate SignNow simplify filling out the Form 8849 Schedule 6 Rev January, Fill in Version Other Claims?

airSlate SignNow offers an intuitive interface that allows users to fill out the Form 8849 Schedule 6 Rev January, Fill in Version Other Claims easily. With features like pre-filled templates and drag-and-drop functionality, users can efficiently input their information. This reduces the time spent on paperwork and enhances accuracy.

-

Is there a cost associated with using airSlate SignNow for the Form 8849 Schedule 6 Rev January, Fill in Version Other Claims?

Yes, there is a subscription fee for using airSlate SignNow, but it is competitively priced to provide great value. Users gain access to powerful features such as document templates, eSigning capabilities, and secure storage. This cost-effective solution is ideal for businesses processing the Form 8849 Schedule 6 Rev January, Fill in Version Other Claims.

-

Can I eSign the Form 8849 Schedule 6 Rev January, Fill in Version Other Claims online?

Absolutely! airSlate SignNow allows users to eSign the Form 8849 Schedule 6 Rev January, Fill in Version Other Claims online in a secure environment. This functionality eliminates the need for physical paperwork and enhances the speed of document processing.

-

What are the benefits of using airSlate SignNow for tax-related forms like the Form 8849 Schedule 6 Rev January, Fill in Version Other Claims?

Using airSlate SignNow for tax forms like the Form 8849 Schedule 6 Rev January, Fill in Version Other Claims streamlines the submission process and reduces the risk of errors. Businesses can easily track document status and receive timely notifications. Moreover, its compliance with legal regulations offers peace of mind during tax season.

-

Does airSlate SignNow integrate with other software for financial management?

Yes, airSlate SignNow offers seamless integrations with various financial management software, enhancing its functionality for users. This means you can easily send and manage the Form 8849 Schedule 6 Rev January, Fill in Version Other Claims directly from your preferred tools. Integration capabilities help streamline workflows and improve efficiency.

-

Is customer support available for users navigating the Form 8849 Schedule 6 Rev January, Fill in Version Other Claims?

Yes, airSlate SignNow provides comprehensive customer support to assist users with the Form 8849 Schedule 6 Rev January, Fill in Version Other Claims. Whether you have questions about eSigning or need help with the form’s features, support is readily available through various channels. This ensures users can maximize their experience with the platform.

Get more for Form 8849 Schedule 6 Rev January , Fill in Version Other Claims

Find out other Form 8849 Schedule 6 Rev January , Fill in Version Other Claims

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer