Form 2106 EZ Internal Revenue Service

What is the Form 2106 EZ Internal Revenue Service

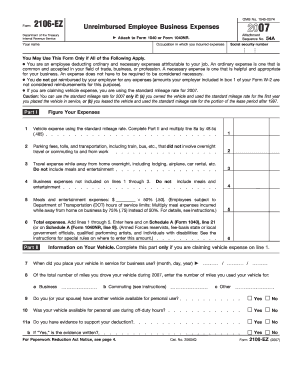

The Form 2106 EZ is a simplified version of the Form 2106, used by employees to report their unreimbursed business expenses to the Internal Revenue Service (IRS). This form is specifically designed for employees who do not receive reimbursement for their business-related expenses. It allows taxpayers to deduct certain costs incurred while performing their job duties, such as travel, meals, and other necessary expenses. The streamlined format of Form 2106 EZ makes it easier for eligible taxpayers to claim these deductions without the complexity of the full form.

How to use the Form 2106 EZ Internal Revenue Service

Using the Form 2106 EZ involves a straightforward process. First, gather all necessary documentation related to your business expenses. This may include receipts, invoices, and any other relevant financial records. Next, fill out the form by providing your personal information, including your name, address, and Social Security number. You will also need to detail the specific expenses you are claiming, ensuring they meet IRS guidelines for deductibility. Once completed, the form should be submitted along with your tax return, either electronically or via mail, depending on your filing method.

Steps to complete the Form 2106 EZ Internal Revenue Service

Completing the Form 2106 EZ involves several key steps:

- Collect all necessary documentation for unreimbursed business expenses.

- Enter your personal information accurately at the top of the form.

- List your business expenses in the designated sections, ensuring each expense is clearly described.

- Calculate the total of your expenses and enter that amount on the form.

- Review the completed form for accuracy before submission.

Key elements of the Form 2106 EZ Internal Revenue Service

The Form 2106 EZ includes several key elements that are essential for proper completion:

- Personal Information: Your name, address, and Social Security number.

- Expense Categories: Sections for different types of expenses, such as travel, meals, and entertainment.

- Total Expenses: A field to calculate and report the total amount of unreimbursed expenses.

- Signature: A space for your signature to verify the accuracy of the information provided.

IRS Guidelines

The IRS provides specific guidelines for using the Form 2106 EZ. Taxpayers must ensure that their claimed expenses are ordinary and necessary for their job. Additionally, the IRS requires that all expenses be documented with receipts or other proof of payment. It is important to adhere to the rules regarding what qualifies as a deductible expense, as improper claims can lead to audits or penalties. Familiarizing yourself with these guidelines can help ensure compliance and maximize your deductions.

Eligibility Criteria

To use the Form 2106 EZ, taxpayers must meet certain eligibility criteria. This form is intended for employees who do not receive reimbursement for their business expenses. Additionally, the expenses claimed must be directly related to the taxpayer's job and not reimbursed by an employer. It is also important to note that only employees, not self-employed individuals, can use this simplified form. Understanding these criteria can help individuals determine if they qualify to use Form 2106 EZ for their tax filings.

Quick guide on how to complete form 2106 ez internal revenue service

Easily Prepare [SKS] on Any Device

Managing documents online has gained popularity with both businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to quickly create, modify, and electronically sign your documents without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and Electronically Sign [SKS] Effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive details using the tools that airSlate SignNow has specifically designed for this purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, exhausting form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 2106 EZ Internal Revenue Service

Create this form in 5 minutes!

How to create an eSignature for the form 2106 ez internal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 2106 EZ Internal Revenue Service, and who should use it?

Form 2106 EZ Internal Revenue Service is a simplified version of the standard Form 2106 designed for employees to deduct their business expenses. It is ideal for employees who have unreimbursed expenses related to their job. This form is particularly useful for individuals such as teachers, salespeople, and other workers who incur necessary expenses as part of their employment.

-

How can airSlate SignNow assist with filing Form 2106 EZ Internal Revenue Service?

airSlate SignNow offers a streamlined eSigning solution that simplifies the process of preparing and submitting your Form 2106 EZ Internal Revenue Service. With our platform, you can easily fill out, sign, and send your tax documents electronically. This saves time and ensures that your forms are processed quickly and efficiently.

-

What features does airSlate SignNow provide for managing Form 2106 EZ Internal Revenue Service?

airSlate SignNow provides a range of features to help manage Form 2106 EZ Internal Revenue Service, including customizable templates, secure eSignatures, and audit trails. Our platform allows you to collaborate with colleagues and tax professionals, ensuring all necessary signatures are collected efficiently. Additionally, you can store and retrieve your forms securely in the cloud.

-

Is there a cost associated with using airSlate SignNow for Form 2106 EZ Internal Revenue Service?

Yes, airSlate SignNow offers various pricing plans to cater to different needs, which include features necessary for managing documents like Form 2106 EZ Internal Revenue Service. Our plans range from affordable monthly subscriptions to flexible options for larger businesses. We also offer a free trial, allowing you to explore our services before committing.

-

Can I integrate airSlate SignNow with other software for handling Form 2106 EZ Internal Revenue Service?

Absolutely! airSlate SignNow seamlessly integrates with various applications such as accounting software and CRM systems to enhance your workflow for managing Form 2106 EZ Internal Revenue Service. This integration streamlines document management and ensures all relevant data is synchronized across platforms, making your filing process more efficient.

-

What are the benefits of using airSlate SignNow for electronic signatures on Form 2106 EZ Internal Revenue Service?

Using airSlate SignNow for electronic signatures on Form 2106 EZ Internal Revenue Service offers numerous benefits, including improved turnaround time, enhanced security, and greater convenience. Electronic signatures facilitate faster processing of your documents while ensuring compliance with legal standards. Additionally, our platform provides a user-friendly interface that simplifies the signing process.

-

How can I ensure my Form 2106 EZ Internal Revenue Service is securely stored using airSlate SignNow?

airSlate SignNow prioritizes the security of your documents, including Form 2106 EZ Internal Revenue Service, with robust encryption and secure cloud storage. We follow industry-standard security protocols to protect your sensitive data, ensuring that your forms are only accessible to authorized users. Regular backups also guarantee that your documents are safe and retrievable.

Get more for Form 2106 EZ Internal Revenue Service

- Bampo annual tax report city of lacey form

- Parent consent letter for baptism 243543400 form

- Yard sale permit application city of north miami northmiamifl form

- Mcgill friendship questionnaire pdf form

- Tc 301 form

- Maude schutze scholarship application form

- Gradeup science pdf form

- Azgovapppharmacy form

Find out other Form 2106 EZ Internal Revenue Service

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer