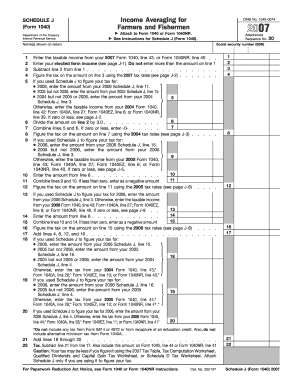

Income Averaging for Farmers and Fishermen SCHEDULE J Form 1040 Department of the Treasury Internal Revenue Service OMB No

Understanding the Income Averaging for Farmers and Fishermen SCHEDULE J Form 1040

The Income Averaging for Farmers and Fishermen SCHEDULE J Form 1040 is designed specifically for individuals in the farming and fishing industries. This form allows eligible taxpayers to average their income over a three-year period, which can help mitigate the impact of fluctuating income levels typical in these sectors. By averaging income, farmers and fishermen can potentially lower their tax liability during years of higher earnings, making their financial situation more manageable.

Steps to Complete the Income Averaging for Farmers and Fishermen SCHEDULE J Form 1040

Completing the SCHEDULE J Form 1040 involves several key steps:

- Gather your income records from the past three years, including any relevant documents such as 1099 forms or profit and loss statements.

- Calculate your total income for each of the three years you are averaging.

- Determine your average income by dividing the total income by three.

- Complete the form by entering your averaged income and any other required information, such as deductions or credits.

- Review the completed form for accuracy before submission.

Eligibility Criteria for Using the Income Averaging for Farmers and Fishermen SCHEDULE J Form 1040

To qualify for income averaging using SCHEDULE J, taxpayers must meet specific criteria:

- Taxpayers must be engaged in farming or fishing as their primary source of income.

- They should have income that varies significantly from year to year.

- Eligible taxpayers must have reported income for at least two of the three years being averaged.

Required Documents for the Income Averaging for Farmers and Fishermen SCHEDULE J Form 1040

When preparing to file the SCHEDULE J Form 1040, it is essential to have the following documents ready:

- Income statements from the past three years, such as 1099s or W-2s.

- Records of any deductions or credits that may apply.

- Previous tax returns for the years being averaged, which can provide context for income fluctuations.

Filing Deadlines for the Income Averaging for Farmers and Fishermen SCHEDULE J Form 1040

Taxpayers must adhere to specific filing deadlines for the SCHEDULE J Form 1040. Typically, the deadline aligns with the standard tax filing date, which is April 15th of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to confirm the exact dates each tax year to avoid penalties.

IRS Guidelines for the Income Averaging for Farmers and Fishermen SCHEDULE J Form 1040

The IRS provides comprehensive guidelines regarding the use of SCHEDULE J. These guidelines include instructions on how to complete the form, eligibility requirements, and how to handle income averaging. Taxpayers are encouraged to review these guidelines carefully to ensure compliance and to maximize potential tax benefits.

Quick guide on how to complete income averaging for farmers and fishermen schedule j form 1040 department of the treasury internal revenue service omb no

Prepare [SKS] with ease on any gadget

Digital document management has become widely embraced by businesses and individuals. It offers a perfect environmentally friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents promptly without delays. Manage [SKS] on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to edit and eSign [SKS] effortlessly

- Locate [SKS] and then click Get Form to proceed.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your updates.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your selected device. Edit and eSign [SKS] and ensure outstanding communication at any point of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Income Averaging For Farmers And Fishermen SCHEDULE J Form 1040 Department Of The Treasury Internal Revenue Service OMB No

Create this form in 5 minutes!

How to create an eSignature for the income averaging for farmers and fishermen schedule j form 1040 department of the treasury internal revenue service omb no

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Income Averaging For Farmers And Fishermen SCHEDULE J Form 1040?

Income Averaging For Farmers And Fishermen SCHEDULE J Form 1040 is a tax option that allows eligible farmers and fishermen to average their income over a three-year period. This can help to reduce the tax burden in years of higher income, providing financial relief. It is essential for managing taxes effectively and planning for future earnings.

-

How can airSlate SignNow assist with managing SCHEDULE J Form 1040?

airSlate SignNow streamlines the process of completing and eSigning SCHEDULE J Form 1040. With our easy-to-use platform, you can send documents securely, ensuring compliance with the Income Averaging For Farmers And Fishermen SCHEDULE J Form 1040 Department Of The Treasury Internal Revenue Service OMB No. Our solution simplifies tax filing for farmers and fishermen.

-

Is there a cost associated with using airSlate SignNow for tax documents?

Yes, airSlate SignNow offers a competitive pricing model tailored to businesses needing to manage documents like the Income Averaging For Farmers And Fishermen SCHEDULE J Form 1040. We provide various plans designed to meet different business needs, ensuring our users get a cost-effective solution for document management and eSigning.

-

What are the key features of airSlate SignNow for tax document management?

airSlate SignNow features include secure eSigning, document templates, and real-time collaboration, all crucial for handling the Income Averaging For Farmers And Fishermen SCHEDULE J Form 1040. Additionally, our platform offers audit trails and integrations, making it a robust tool for tax preparation and filing.

-

Are there integrations available with airSlate SignNow for tax-related tasks?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software and platforms that can assist in preparing the Income Averaging For Farmers And Fishermen SCHEDULE J Form 1040. These integrations simplify the workflow, allowing you to manage documents without switching between different applications.

-

What benefits does airSlate SignNow offer for farmers and fishermen?

For farmers and fishermen, airSlate SignNow offers signNow benefits, including enhanced efficiency in managing the Income Averaging For Farmers And Fishermen SCHEDULE J Form 1040. Our digital platform reduces paperwork, speeds up the signing process, and ensures that your documents are secure and compliant with IRS regulations.

-

How does airSlate SignNow ensure document security?

airSlate SignNow prioritizes document security by utilizing advanced encryption and secure storage solutions for all files, including the Income Averaging For Farmers And Fishermen SCHEDULE J Form 1040. Our platform complies with the highest security standards set by regulatory bodies, ensuring your sensitive information remains protected.

Get more for Income Averaging For Farmers And Fishermen SCHEDULE J Form 1040 Department Of The Treasury Internal Revenue Service OMB No

Find out other Income Averaging For Farmers And Fishermen SCHEDULE J Form 1040 Department Of The Treasury Internal Revenue Service OMB No

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast