CHOIX FAIT PAR UNE SOCI T DE D DUIRE DES FRAIS RELATIFS DES RESSOURCES LORSQU 'ELLE ACQUIERT UN AVOIR MINIER Form

Understanding the CHOIX FAIT PAR UNE SOCIÉTÉ DE DÉDUIRE DES FRAIS RELATIFS DES RESSOURCES LORSQU'ELLE ACQUIERT UN AVOIR MINIER

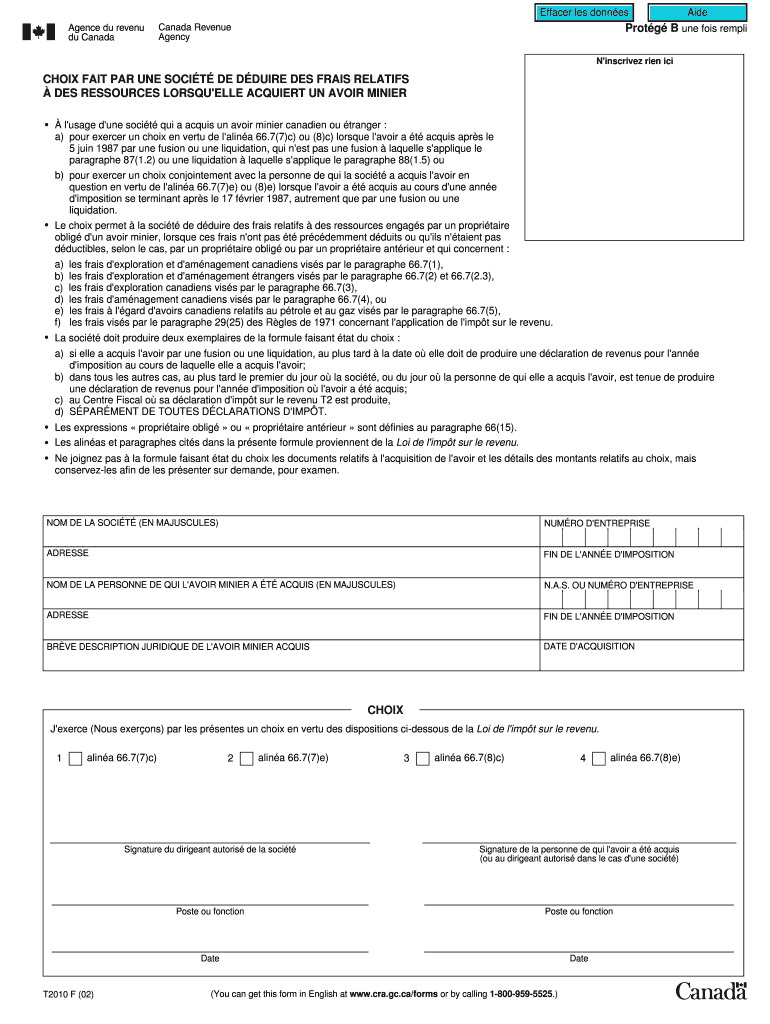

The CHOIX FAIT PAR UNE SOCIÉTÉ DE DÉDUIRE DES FRAIS RELATIFS DES RESSOURCES LORSQU'ELLE ACQUIERT UN AVOIR MINIER is a crucial document for companies involved in mining operations. This choice allows a company to deduct certain expenses related to resources when acquiring a mining asset. It is essential for companies to understand the implications of this choice, as it can significantly affect their financial statements and tax obligations.

In the context of U.S. regulations, this document serves to clarify which expenses can be deducted and under what circumstances. Companies must ensure compliance with both federal and state tax laws when making this choice.

Steps to Complete the CHOIX FAIT PAR UNE SOCIÉTÉ DE DÉDUIRE DES FRAIS RELATIFS DES RESSOURCES LORSQU'ELLE ACQUIERT UN AVOIR MINIER

Completing the CHOIX FAIT PAR UNE SOCIÉTÉ DE DÉDUIRE DES FRAIS RELATIFS DES RESSOURCES LORSQU'ELLE ACQUIERT UN AVOIR MINIER involves several key steps:

- Gather all relevant financial documents related to the mining asset acquisition.

- Identify the specific expenses that are eligible for deduction.

- Complete the form accurately, ensuring all required information is included.

- Review the completed form for accuracy and compliance with tax regulations.

- Submit the form according to the guidelines provided by the IRS or relevant state authority.

Legal Use of the CHOIX FAIT PAR UNE SOCIÉTÉ DE DÉDUIRE DES FRAIS RELATIFS DES RESSOURCES LORSQU'ELLE ACQUIERT UN AVOIR MINIER

The legal use of the CHOIX FAIT PAR UNE SOCIÉTÉ DE DÉDUIRE DES FRAIS RELATIFS DES RESSOURCES LORSQU'ELLE ACQUIERT UN AVOIR MINIER is governed by U.S. tax laws. Companies must adhere to specific regulations that dictate how and when they can claim deductions for mining-related expenses. This form is particularly relevant for businesses in the mining sector, as it provides a legal framework for expense deductions.

Failure to comply with the legal requirements can result in penalties, including fines or disallowance of deductions. It is advisable for companies to consult with tax professionals to ensure that they are using this form correctly and in accordance with the law.

Key Elements of the CHOIX FAIT PAR UNE SOCIÉTÉ DE DÉDUIRE DES FRAIS RELATIFS DES RESSOURCES LORSQU'ELLE ACQUIERT UN AVOIR MINIER

Key elements of the CHOIX FAIT PAR UNE SOCIÉTÉ DE DÉDUIRE DES FRAIS RELATIFS DES RESSOURCES LORSQU'ELLE ACQUIERT UN AVOIR MINIER include:

- The identification of eligible expenses, such as costs related to exploration, development, and extraction.

- The requirement to maintain detailed records of all expenses claimed for deduction.

- Compliance with IRS guidelines regarding the timing and method of deduction.

- Understanding the impact of these deductions on overall tax liability and financial reporting.

Examples of Using the CHOIX FAIT PAR UNE SOCIÉTÉ DE DÉDUIRE DES FRAIS RELATIFS DES RESSOURCES LORSQU'ELLE ACQUIERT UN AVOIR MINIER

Examples of using the CHOIX FAIT PAR UNE SOCIÉTÉ DE DÉDUIRE DES FRAIS RELATIFS DES RESSOURCES LORSQU'ELLE ACQUIERT UN AVOIR MINIER can illustrate its practical application:

- A mining company incurs costs for drilling and surveying a new site. By filing this choice, the company can deduct these expenses from its taxable income.

- If a company invests in equipment specifically for extracting minerals, these costs may also qualify for deduction under this choice.

- Companies that engage in environmental assessments and remediation efforts related to mining operations can potentially deduct these expenses as well.

Quick guide on how to complete choix fait par une soci t de d duire des frais relatifs des ressources lorsqu elle acquiert un avoir minier

Complete [SKS] effortlessly on any gadget

Online document management has gained immense traction among enterprises and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and electronically sign your documents quickly and without issues. Handle [SKS] on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to modify and electronically sign [SKS] effortlessly

- Find [SKS] and then click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact confidential information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and has the same legal standing as a conventional wet ink signature.

- Review all the details and then click on the Done button to preserve your changes.

- Choose how you want to send your form, by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to CHOIX FAIT PAR UNE SOCI T DE D DUIRE DES FRAIS RELATIFS DES RESSOURCES LORSQU 'ELLE ACQUIERT UN AVOIR MINIER

Create this form in 5 minutes!

How to create an eSignature for the choix fait par une soci t de d duire des frais relatifs des ressources lorsqu elle acquiert un avoir minier

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to CHOIX FAIT PAR UNE SOCI T DE D DUIRE DES FRAIS RELATIFS DES RESSOURCES LORSQU 'ELLE ACQUIERT UN AVOIR MINIER?

airSlate SignNow is a digital document management solution that enables businesses to send and electronically sign documents efficiently. It supports the process of CHOIX FAIT PAR UNE SOCI T DE D DUIRE DES FRAIS RELATIFS DES RESSOURCES LORSQU 'ELLE ACQUIERT UN AVOIR MINIER, ensuring compliance and facilitating financial decisions related to resource acquisition.

-

How can airSlate SignNow help with document workflow management in mining acquisitions?

With airSlate SignNow, businesses can streamline their document workflow management, especially during CHOIX FAIT PAR UNE SOCI T DE D DUIRE DES FRAIS RELATIFS DES RESSOURCES LORSQU 'ELLE ACQUIERT UN AVOIR MINIER. The platform allows users to create, send, and manage contracts efficiently, reducing overhead and ensuring that all documentation is compliant with industry standards.

-

What features should I look for to support CHOIX FAIT PAR UNE SOCI T DE D DUIRE DES FRAIS RELATIFS DES RESSOURCES LORSQU 'ELLE ACQUIERT UN AVOIR MINIER?

Key features to seek include document templates, customizable workflows, and audit trails. These functionalities allow organizations to make informed decisions during the CHOIX FAIT PAR UNE SOCI T DE D DUIRE DES FRAIS RELATIFS DES RESSOURCES LORSQU 'ELLE ACQUIERT UN AVOIR MINIER process while maintaining a clear record of all transactions.

-

What are the pricing options for airSlate SignNow for companies dealing with resource acquisitions?

airSlate SignNow offers a range of pricing plans tailored to fit different business needs. Each plan is designed to support the requirements of organizations participating in CHOIX FAIT PAR UNE SOCI T DE D DUIRE DES FRAIS RELATIFS DES RESSOURCES LORSQU 'ELLE ACQUIERT UN AVOIR MINIER, making it cost-effective for varying scales of operation.

-

Can airSlate SignNow integrate with other software platforms for better resource management?

Yes, airSlate SignNow can seamlessly integrate with various software applications, enhancing overall resource management. This feature is beneficial for companies involved in CHOIX FAIT PAR UNE SOCI T DE D DUIRE DES FRAIS RELATIFS DES RESSOURCES LORSQU 'ELLE ACQUIERT UN AVOIR MINIER, as it helps consolidate workflows and maintain data integrity.

-

How secure is airSlate SignNow for handling sensitive documents related to mining acquisitions?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect sensitive documents. This security is crucial for businesses making CHOIX FAIT PAR UNE SOCI T DE D DUIRE DES FRAIS RELATIFS DES RESSOURCES LORSQU 'ELLE ACQUIERT UN AVOIR MINIER, ensuring that all data remains confidential and safe.

-

What benefits can companies expect when they adopt airSlate SignNow?

Companies that adopt airSlate SignNow can expect to streamline their document processes, reduce turnaround times, and improve compliance. Particularly for organizations engaged in CHOIX FAIT PAR UNE SOCI T DE D DUIRE DES FRAIS RELATIFS DES RESSOURCES LORSQU 'ELLE ACQUIERT UN AVOIR MINIER, these benefits lead to more efficient operations and better decision-making.

Get more for CHOIX FAIT PAR UNE SOCI T DE D DUIRE DES FRAIS RELATIFS DES RESSOURCES LORSQU 'ELLE ACQUIERT UN AVOIR MINIER

- Kplc co ke form

- Study abroad incoming application form vesalius college

- Das kenntnis buch pdf form

- Decodable reader 16 kindergarten decodable reader 16 in the kit form

- Eagle scout candidate brag sheet form

- Cvs caremark prior authorization form

- Pre exercise screening form template

- Recibo de pago hacienda pr form

Find out other CHOIX FAIT PAR UNE SOCI T DE D DUIRE DES FRAIS RELATIFS DES RESSOURCES LORSQU 'ELLE ACQUIERT UN AVOIR MINIER

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple