4119, Statement of Michigan Income Tax Withheld for Nonresidents Form

What is the 4119, Statement Of Michigan Income Tax Withheld For Nonresidents

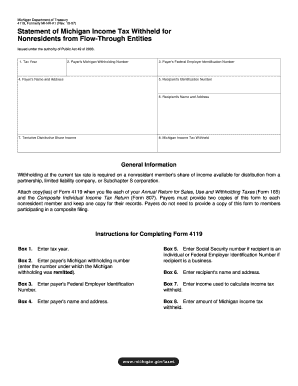

The 4119, Statement Of Michigan Income Tax Withheld For Nonresidents, is a tax form specifically designed for individuals who earn income in Michigan but are not residents of the state. This form is essential for reporting the amount of income tax that has been withheld from nonresidents' earnings. It serves as a record for both the taxpayer and the Michigan Department of Treasury, ensuring that the correct amount of tax is reported and can be reconciled during the tax filing process.

How to use the 4119, Statement Of Michigan Income Tax Withheld For Nonresidents

To effectively use the 4119 form, nonresidents must first ensure that they have received this document from their employer or the entity that withheld the tax. The form provides a summary of the income earned in Michigan and the corresponding tax withheld. Nonresidents should include this information when filing their state tax returns, as it helps to determine if they owe additional taxes or are entitled to a refund. Proper completion and submission of this form are crucial for accurate tax reporting and compliance.

Steps to complete the 4119, Statement Of Michigan Income Tax Withheld For Nonresidents

Completing the 4119 form involves several key steps:

- Gather necessary personal information, including your name, address, and Social Security number.

- Obtain the details of your income earned in Michigan and the total amount of tax withheld.

- Fill out the form accurately, ensuring that all information matches the records provided by your employer.

- Review the completed form for any errors or omissions before submission.

Once completed, the form should be submitted alongside your state tax return to ensure proper processing.

Key elements of the 4119, Statement Of Michigan Income Tax Withheld For Nonresidents

The key elements of the 4119 form include the taxpayer's identification details, the total amount of Michigan income earned, and the total income tax withheld. Additionally, the form may require information regarding the employer or entity that withheld the tax. Each section must be filled out accurately to reflect the taxpayer's financial situation and ensure compliance with state tax regulations.

Filing Deadlines / Important Dates

It is important for nonresidents to be aware of filing deadlines associated with the 4119 form. Generally, the form must be submitted by the same deadline as the Michigan state income tax return, which is typically April fifteenth for most taxpayers. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. Keeping track of these dates is essential to avoid penalties and ensure timely processing of tax returns.

Who Issues the Form

The 4119 form is issued by the Michigan Department of Treasury. Employers who withhold state income tax from nonresidents are responsible for providing this form to their employees. It is crucial for nonresidents to ensure they receive this document from their employer, as it serves as an official record of tax withholding for their income earned in Michigan.

Quick guide on how to complete 4119 statement of michigan income tax withheld for nonresidents

Accomplish [SKS] effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the suitable form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents promptly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The simplest way to modify and eSign [SKS] with ease

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information thoroughly and then click on the Done button to save your modifications.

- Choose your delivery method for your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing additional document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your chosen device. Modify and eSign [SKS] to ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 4119, Statement Of Michigan Income Tax Withheld For Nonresidents

Create this form in 5 minutes!

How to create an eSignature for the 4119 statement of michigan income tax withheld for nonresidents

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 4119, Statement Of Michigan Income Tax Withheld For Nonresidents?

The 4119, Statement Of Michigan Income Tax Withheld For Nonresidents is a tax form used by nonresidents to report income tax withheld in Michigan. This form is crucial for filing your state tax return accurately and ensures compliance with Michigan tax laws. Utilizing airSlate SignNow can streamline the process of filling out and eSigning this important document.

-

How does airSlate SignNow help with the 4119, Statement Of Michigan Income Tax Withheld For Nonresidents?

airSlate SignNow provides an easy-to-use platform to fill out and eSign the 4119, Statement Of Michigan Income Tax Withheld For Nonresidents. With its user-friendly interface, you can efficiently manage your documents without hassle. This not only saves you time but also assures you that your forms are completed correctly.

-

What are the pricing options for using airSlate SignNow for the 4119 form?

airSlate SignNow offers various pricing plans to meet different business needs, and the pricing is competitive for features provided. Each plan includes the capability to handle forms like the 4119, Statement Of Michigan Income Tax Withheld For Nonresidents efficiently. You can choose a plan based on your volume of documents and required features.

-

Are there any features specifically designed for tax documents like the 4119 form?

Yes, airSlate SignNow includes specific features for handling tax documents such as the 4119, Statement Of Michigan Income Tax Withheld For Nonresidents. These features encompass templates, secure eSignature, and document tracking to ensure that all necessary data is collected and managed efficiently. This streamlines tax compliance for businesses and individuals alike.

-

Can I integrate airSlate SignNow with other software for managing the 4119 form?

Absolutely! airSlate SignNow supports integrations with various software solutions allowing seamless management of the 4119, Statement Of Michigan Income Tax Withheld For Nonresidents. This means you can connect your existing systems for easier access and reporting, enhancing your workflow and document management efficiency.

-

What benefits does airSlate SignNow offer for managing the 4119 tax form?

Using airSlate SignNow for the 4119, Statement Of Michigan Income Tax Withheld For Nonresidents provides several benefits, such as increasing efficiency, reducing errors, and ensuring compliance. The platform's automation capabilities enable quick document handling, allowing you to focus more on your core business activities. Additionally, the security features ensure your data is protected throughout the process.

-

How secure is airSlate SignNow when handling sensitive forms like the 4119?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive documents such as the 4119, Statement Of Michigan Income Tax Withheld For Nonresidents. The platform is designed to safeguard your information, ensuring that only authorized individuals can access your documents. This peace of mind is crucial when dealing with tax-related information.

Get more for 4119, Statement Of Michigan Income Tax Withheld For Nonresidents

Find out other 4119, Statement Of Michigan Income Tax Withheld For Nonresidents

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer