Cm 2b 2018

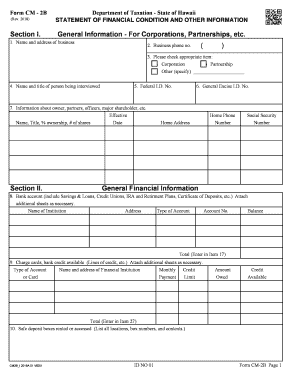

What is the CM 2B?

The CM 2B is a specific form used primarily for tax purposes within the United States. It serves as a declaration for certain tax-related information, allowing individuals and businesses to report their financial details accurately. This form is essential for ensuring compliance with federal and state tax regulations. Understanding its purpose and requirements is crucial for anyone who needs to submit it.

How to Use the CM 2B

Using the CM 2B involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant financial documents, including income statements and expense records. Next, fill out the form with precise details, ensuring that all fields are completed as required. Once filled, review the information for accuracy before submitting it to the appropriate tax authority. This careful approach helps prevent errors that could lead to penalties.

Steps to Complete the CM 2B

Completing the CM 2B involves a systematic approach:

- Collect all necessary financial documents.

- Access the CM 2B form, either online or in a printed format.

- Fill in your personal and financial information accurately.

- Double-check all entries for correctness.

- Submit the form by the designated deadline.

Legal Use of the CM 2B

The CM 2B must be used in accordance with U.S. tax laws. It is legally binding, meaning that the information provided must be truthful and accurate. Misrepresentation or failure to file this form can result in penalties, including fines or legal repercussions. It is essential to understand the legal implications of submitting this form to ensure compliance with all applicable regulations.

Filing Deadlines / Important Dates

Filing deadlines for the CM 2B can vary based on the specific tax year and the taxpayer's situation. Generally, it is advisable to submit the form by April 15 of the following year for individual taxpayers. Businesses may have different deadlines based on their fiscal year. Keeping track of these dates is crucial to avoid late fees or penalties.

Who Issues the Form

The CM 2B is typically issued by the Internal Revenue Service (IRS) or state tax authorities. These organizations provide the necessary guidelines and updates regarding the form's requirements and any changes that may occur. It is important to refer to official sources for the most current version of the form and any associated instructions.

Quick guide on how to complete employers withholding of state income tax hawaii department of

Your assistance manual on how to prepare your Cm 2b

If you’re wondering how to create and submit your Cm 2b, here are some concise instructions on how to make tax filing considerably simpler.

To begin, you just need to set up your airSlate SignNow account to revolutionize how you handle paperwork online. airSlate SignNow is an extremely user-friendly and powerful document platform that enables you to edit, create, and complete your tax documents with ease. Utilizing its editor, you can toggle between text, checkboxes, and electronic signatures and return to modify any inputs as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and simple sharing.

Follow the steps below to finalize your Cm 2b in just a few minutes:

- Create your account and begin working on PDFs within moments.

- Explore our library to find any IRS tax form; browse different versions and schedules.

- Click Get form to access your Cm 2b in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-recognized eSignature (if needed).

- Examine your document and correct any inaccuracies.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Leverage this manual to file your taxes electronically with airSlate SignNow. Keep in mind that submitting on paper can raise the likelihood of return errors and prolong refunds. Naturally, before e-filing your taxes, visit the IRS website for filing regulations specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct employers withholding of state income tax hawaii department of

FAQs

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

CA Reply to Franchise Tax Board Form re Tax Yr 2011: What income is stated in question 2 of section G? CA income only? Or out of state income?

The question asks for your gross income from all sources. If you had been a California resident in 2011, you would have filled out Schedule CA, and the amount that appears on line 22 in Column C is the amount that California considers to be your gross income, your total Federal income adjusted for differences between California law and Federal law. That number - the one you compute by filling out Part I of Schedule CA as though you had been a resident of California - is what you put on the Request for Tax Return. That includes all of the income you earned outside of California as well as any that you earned inside of California. If you want to simplify the process you can just put the amount from line 22 of your 1040 on the form, reduced by any taxable state tax refund on line 10 that you received from California in 2011, any unemployment compensation on line 19, and any taxable social security benefits on line 20(b). Those are the most common adjustments to California income. If you had a small business or earned capital gains, you might have to do a little more detailed computation, and at that point you're probably best served by consulting a professional.

-

How do I fill the income tax return form of India?

you can very easily file your income tax return online, but decide which return to file generally salaried individual files ITR 1 and businessmen files ITR 4S as both are very easy to file. First Fill the Details on First Page Name, Address, mobile no, PAN Number, Date of Birth and income from salary and deduction you are claiming under 80C and other sections. Then fill the details of TDS deduction which can be check from Form 16 as well as Form 26AS availbale online. Then complete the details on 3rd page like bank account number, type of account(saving), Bank MICR code(given on cheque book), father name. Then Click and Validate button and if there is any error it will automatically show. recity those error Then click on calculate button and finally click on generate button and save .xml file which you have to upload on income tax. This website I really found very good for income tax related problem visit Income Tax Website for Efiling Taxes, ITR Forms, etc. for more information.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

Create this form in 5 minutes!

How to create an eSignature for the employers withholding of state income tax hawaii department of

How to make an electronic signature for your Employers Withholding Of State Income Tax Hawaii Department Of in the online mode

How to generate an eSignature for your Employers Withholding Of State Income Tax Hawaii Department Of in Chrome

How to create an electronic signature for putting it on the Employers Withholding Of State Income Tax Hawaii Department Of in Gmail

How to generate an eSignature for the Employers Withholding Of State Income Tax Hawaii Department Of right from your mobile device

How to create an eSignature for the Employers Withholding Of State Income Tax Hawaii Department Of on iOS

How to create an electronic signature for the Employers Withholding Of State Income Tax Hawaii Department Of on Android devices

People also ask

-

What is cm 2b in the context of airSlate SignNow?

The term 'cm 2b' refers to a specific feature in airSlate SignNow that allows users to streamline their document signing process. With cm 2b, businesses can easily manage and store signed documents within a centralized system, ensuring compliance and efficiency.

-

How can cm 2b enhance my document workflows?

Using cm 2b within airSlate SignNow can signNowly enhance your document workflows by automating the eSignature process. This saves time and reduces errors, allowing your team to focus on more important tasks while maintaining a smooth flow of documentation.

-

What are the pricing options for using cm 2b with airSlate SignNow?

airSlate SignNow offers several pricing tiers that include access to the cm 2b feature. Depending on your organization's needs, you can choose from monthly or annual plans that provide cost-effective solutions to manage your document signing requirements.

-

What integrations are compatible with cm 2b?

cm 2b integrates seamlessly with popular platforms like Salesforce, Google Drive, and Dropbox. This compatibility enhances the functionality of airSlate SignNow, allowing users to access, send, and manage documents from various sources without interrupting their workflow.

-

What are the benefits of using cm 2b for electronic signatures?

The benefits of using cm 2b for electronic signatures include increased security, faster turnaround times, and improved tracking of document status. This feature is designed to provide businesses with a reliable and efficient way to handle their eSigning needs.

-

Is cm 2b suitable for small businesses?

Yes, cm 2b is especially designed to cater to businesses of all sizes, including small businesses. Its user-friendly interface and affordable pricing make it an ideal choice for small teams looking to utilize eSignature solutions effectively.

-

Can I customize documents with cm 2b in airSlate SignNow?

Absolutely! cm 2b allows you to customize your documents, adding fields for signatures, dates, and other necessary information. This high level of customization ensures that your documents meet your specific business requirements.

Get more for Cm 2b

- Lllnjll form

- Inventory form for sale not in due course of business tabc state tx

- Formsrr 22 doc

- Mv2132 461096295 form

- Julius caesar his time has come film viewing guide answers form

- Radiologic technologist skills checklist form

- Balimed claim form department of human services humanservices gov

- Hardship questionnaire form

Find out other Cm 2b

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure