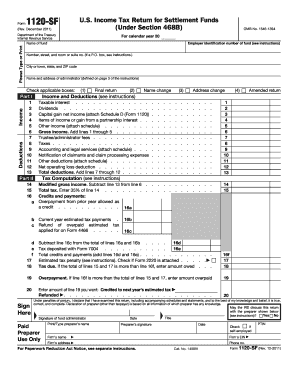

Form 1120 SF Rev December U S Income Tax Return for Settlement Funds under Section 468B

What is the Form 1120 SF Rev December U S Income Tax Return For Settlement Funds Under Section 468B

The Form 1120 SF Rev December is a specific income tax return designed for settlement funds under Section 468B of the Internal Revenue Code. This form is primarily used by certain types of trusts that receive settlement funds, allowing them to report their income and calculate their tax obligations accurately. The form is essential for ensuring compliance with federal tax regulations, particularly for entities managing funds from legal settlements.

How to use the Form 1120 SF Rev December U S Income Tax Return For Settlement Funds Under Section 468B

Using the Form 1120 SF involves several key steps. First, ensure that you have the correct version of the form, as updates may occur. Next, gather all necessary financial information related to the settlement funds, including income earned and expenses incurred. Complete each section of the form accurately, providing details about the trust and its financial activities. Finally, submit the form to the IRS by the designated deadline to avoid penalties.

Steps to complete the Form 1120 SF Rev December U S Income Tax Return For Settlement Funds Under Section 468B

Completing the Form 1120 SF requires a systematic approach:

- Obtain the latest version of the form from the IRS website or other authorized sources.

- Fill out the identification section, including the name and address of the trust.

- Report all income generated from the settlement funds, ensuring accuracy in figures.

- Detail any deductions or expenses related to the management of the funds.

- Review the completed form for any errors or omissions before submission.

Key elements of the Form 1120 SF Rev December U S Income Tax Return For Settlement Funds Under Section 468B

Several key elements are critical when completing the Form 1120 SF. These include:

- The trust's name and address, which must match IRS records.

- Income details, including interest, dividends, and any other revenue generated by the settlement funds.

- Deductions that the trust may claim, which can reduce taxable income.

- Signature of the authorized person, confirming the accuracy of the information provided.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 1120 SF. It is important to follow these guidelines closely to ensure compliance. This includes understanding the eligibility requirements for using the form, the types of income that must be reported, and the deadlines for submission. Familiarizing yourself with these guidelines can help prevent errors and potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1120 SF are crucial for compliance. Generally, the form must be filed by the fifteenth day of the third month following the end of the tax year. For example, if the tax year ends on December thirty-first, the form is due by March fifteenth of the following year. It is advisable to mark these dates on your calendar to ensure timely submission and avoid late fees.

Quick guide on how to complete form 1120 sf rev december u s income tax return for settlement funds under section 468b

Easily Set Up [SKS] on Any Device

Managing documents online has gained traction among businesses and individuals. It offers an ideal sustainable alternative to conventional printed and signed documents, as you can locate the necessary template and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-based process today.

The simplest method to alter and electronically sign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark important sections of the documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign feature, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your document, via email, SMS, or an invitation link, or download it to your computer.

Eliminate the issues of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements with just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1120 sf rev december u s income tax return for settlement funds under section 468b

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1120 SF Rev December U S Income Tax Return For Settlement Funds Under Section 468B?

Form 1120 SF Rev December U S Income Tax Return For Settlement Funds Under Section 468B is a tax form used by businesses to report the income, deductions, and liabilities related to settlement funds. This form ensures that the tax obligations for these specific funds are accurately reported to the IRS, allowing for compliance with tax regulations.

-

How can airSlate SignNow assist in filing Form 1120 SF Rev December U S Income Tax Return For Settlement Funds Under Section 468B?

airSlate SignNow simplifies the process of completing and filing the Form 1120 SF Rev December U S Income Tax Return For Settlement Funds Under Section 468B by allowing users to easily fill out and eSign the document electronically. With our user-friendly interface, you can streamline your tax filing process and minimize the complexity involved.

-

Is there a cost associated with using airSlate SignNow for Form 1120 SF Rev December U S Income Tax Return For Settlement Funds Under Section 468B?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. The cost is competitive and provides access to features that enhance your document management, making it a cost-effective solution for electronically signing and managing Form 1120 SF Rev December U S Income Tax Return For Settlement Funds Under Section 468B.

-

What features does airSlate SignNow offer for managing Form 1120 SF Rev December U S Income Tax Return For Settlement Funds Under Section 468B?

airSlate SignNow offers a variety of features that enhance the management of Form 1120 SF Rev December U S Income Tax Return For Settlement Funds Under Section 468B, including customizable templates, secure eSigning capabilities, and integration with various cloud storage services. These features help ensure the document is processed efficiently and securely.

-

Can I integrate airSlate SignNow with other applications for Form 1120 SF Rev December U S Income Tax Return For Settlement Funds Under Section 468B?

Absolutely! airSlate SignNow supports integration with numerous applications, allowing you to connect with popular tools and services to streamline your workflow. This integration helps in managing Form 1120 SF Rev December U S Income Tax Return For Settlement Funds Under Section 468B seamlessly across various platforms.

-

What are the benefits of using airSlate SignNow for Form 1120 SF Rev December U S Income Tax Return For Settlement Funds Under Section 468B?

Using airSlate SignNow for Form 1120 SF Rev December U S Income Tax Return For Settlement Funds Under Section 468B provides several benefits, including enhanced security, reduced processing time, and improved collaboration. These advantages help businesses ensure compliance while making the tax filing process smoother and more efficient.

-

How long does it take to complete Form 1120 SF Rev December U S Income Tax Return For Settlement Funds Under Section 468B using airSlate SignNow?

Completing Form 1120 SF Rev December U S Income Tax Return For Settlement Funds Under Section 468B using airSlate SignNow can be done in a matter of minutes, depending on the complexity of your tax situation. The streamlined interface and intuitive features make it easy to fill out and eSign the form quickly.

Get more for Form 1120 SF Rev December U S Income Tax Return For Settlement Funds Under Section 468B

- Proposal kegiatan event organizer outboundgatheringouting form

- 1081 form amazon

- 941a me form

- Medical services prior authorization form health choice arizona

- Freightsafe warranty claim form tnt

- Responsible driver program registration and informed consent

- Texas helmet exemption sticker form

- Medical record audit form

Find out other Form 1120 SF Rev December U S Income Tax Return For Settlement Funds Under Section 468B

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself