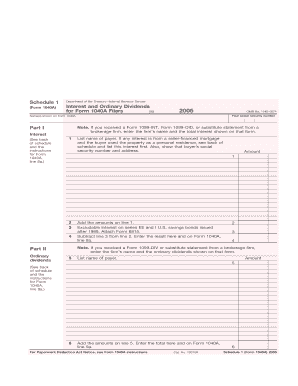

Form 1040A Schedule 1

What is the Form 1040A Schedule 1

The Form 1040A Schedule 1 is a supplementary document used by taxpayers in the United States to report additional income and adjustments to income that are not included directly on the main Form 1040A. This form is essential for individuals who have specific types of income, such as unemployment compensation, rental income, or certain adjustments like educator expenses and student loan interest deductions. Understanding the purpose of Schedule 1 is crucial for accurate tax reporting and compliance with IRS regulations.

How to use the Form 1040A Schedule 1

Using the Form 1040A Schedule 1 involves filling out the relevant sections that pertain to your financial situation. Taxpayers should first determine if they need to report additional income or claim adjustments. Once identified, the corresponding lines on Schedule 1 should be completed with accurate figures. After filling out Schedule 1, it must be attached to the main Form 1040A when submitting your tax return. This ensures that the IRS has a complete view of your financial circumstances for the tax year.

Steps to complete the Form 1040A Schedule 1

Completing the Form 1040A Schedule 1 involves several steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any receipts for adjustments.

- Identify the specific types of income or adjustments that apply to your situation.

- Fill out the appropriate sections of Schedule 1, ensuring that all figures are accurate and correspond to your financial documents.

- Review the completed Schedule 1 for any errors or omissions.

- Attach Schedule 1 to your Form 1040A before submission.

Key elements of the Form 1040A Schedule 1

The Form 1040A Schedule 1 includes several key elements that taxpayers must be aware of:

- Additional Income: This section covers various types of income that must be reported, such as unemployment benefits, alimony received, and business income.

- Adjustments to Income: Taxpayers can claim specific adjustments, including contributions to retirement accounts and student loan interest.

- Instructions: Detailed instructions are provided to help taxpayers accurately complete the form.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040A Schedule 1 align with the general tax return deadlines. Typically, individual tax returns are due by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should be mindful of these dates to avoid penalties and ensure timely submission of their tax returns.

IRS Guidelines

The IRS provides comprehensive guidelines for completing and submitting the Form 1040A Schedule 1. These guidelines include instructions on what types of income need to be reported, how to calculate adjustments, and specific requirements for documentation. Familiarizing yourself with these guidelines can help ensure compliance and reduce the risk of errors that could lead to audits or penalties.

Quick guide on how to complete form 1040a schedule 1

Prepare [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed papers, allowing you to obtain the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly without hold-ups. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign [SKS] without hassle

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to record your changes.

- Choose how you prefer to submit your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign [SKS] and ensure outstanding communication at every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1040A Schedule 1

Create this form in 5 minutes!

How to create an eSignature for the form 1040a schedule 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1040A Schedule 1 and why is it important?

Form 1040A Schedule 1 is a supplement to the standard Form 1040A used to report additional income and adjustments to income. This form is important because it helps taxpayers accurately calculate their taxable income, ensuring compliance with IRS regulations. By using airSlate SignNow, filling out and eSigning your Form 1040A Schedule 1 becomes a seamless process.

-

How does airSlate SignNow help with completing Form 1040A Schedule 1?

airSlate SignNow simplifies the process of completing Form 1040A Schedule 1 by providing an intuitive platform for document creation and eSignature. Users can easily upload their forms, edit fields, and add electronic signatures without any hassle. This leads to a quicker submission of your tax documents and fewer chances of errors.

-

What pricing options does airSlate SignNow offer for Form 1040A Schedule 1 processing?

airSlate SignNow offers flexible pricing plans, tailored to accommodate individuals and businesses alike for Form 1040A Schedule 1 processing. Users can choose from various subscription models to find one that best fits their needs, along with affordable pay-as-you-go options for occasional use. This ensures you only pay for what you need.

-

Can I integrate airSlate SignNow with other software for managing Form 1040A Schedule 1?

Yes, airSlate SignNow integrates seamlessly with various accounting and document management software, enabling users to streamline the process of managing Form 1040A Schedule 1. Popular integrations include platforms like QuickBooks, Salesforce, and Google Drive, enhancing productivity and ensuring all your documents are connected in one place.

-

What are the benefits of using airSlate SignNow for my Form 1040A Schedule 1?

Using airSlate SignNow for your Form 1040A Schedule 1 offers numerous benefits, including enhanced security, legal compliance, and time savings. The platform ensures your documents are safely stored and encrypted, reducing the risk of unauthorized access. Additionally, the streamlined workflow saves you time and minimizes errors in your tax submissions.

-

Is airSlate SignNow easy to use for individuals unfamiliar with Form 1040A Schedule 1?

Absolutely! airSlate SignNow is designed to be user-friendly and accessible for everyone, even those unfamiliar with Form 1040A Schedule 1. The platform provides helpful templates and guided prompts to assist users in filling out their forms with ease, making the eSigning process straightforward and efficient.

-

How can I ensure accurate completion of my Form 1040A Schedule 1 using airSlate SignNow?

To ensure accurate completion of your Form 1040A Schedule 1 with airSlate SignNow, utilize our built-in validation features and template suggestions. The platform allows you to double-check entries and makes it easy to correct any mistakes before finalizing your eSignature. This attention to detail helps you avoid potential issues with the IRS.

Get more for Form 1040A Schedule 1

Find out other Form 1040A Schedule 1

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF