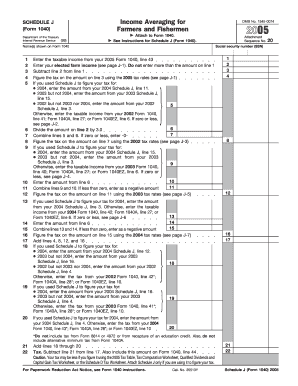

Form 1040 Schedule J Income Averaging for Farmers and Fishermen

What is the Form 1040 Schedule J Income Averaging For Farmers And Fishermen

The Form 1040 Schedule J is a tax form specifically designed for farmers and fishermen in the United States. This form allows eligible taxpayers to average their income over a period of three years, which can help mitigate the impact of fluctuating income levels due to the seasonal nature of agricultural and fishing activities. By spreading income across multiple years, individuals may reduce their overall tax liability, making it easier to manage financial responsibilities during leaner years.

How to use the Form 1040 Schedule J Income Averaging For Farmers And Fishermen

To use the Form 1040 Schedule J, taxpayers must first determine their eligibility by meeting specific criteria related to their farming or fishing income. Once eligibility is confirmed, individuals can begin filling out the form by reporting their income for the current year and the previous two years. The form will guide users through the process of calculating the average income and the resulting tax implications. It is essential to maintain accurate records of income and expenses to support the figures reported on the form.

Steps to complete the Form 1040 Schedule J Income Averaging For Farmers And Fishermen

Completing the Form 1040 Schedule J involves several key steps:

- Gather documentation of income from farming or fishing activities for the current year and the previous two years.

- Fill out the income sections of the form, ensuring that all figures are accurate and reflect the correct amounts.

- Calculate the average income by summing the income from the three years and dividing by three.

- Complete any additional calculations required for tax liability based on the averaged income.

- Review the form for accuracy and completeness before submission.

Eligibility Criteria

To qualify for using the Form 1040 Schedule J, taxpayers must meet specific eligibility requirements. Primarily, they must derive a significant portion of their income from farming or fishing activities. The IRS defines this as earning at least two-thirds of total income from these sources. Additionally, the income must be subject to fluctuations, which is common in agricultural and fishing sectors due to seasonal variations. Taxpayers should also ensure they are filing their taxes on time to avoid penalties.

IRS Guidelines

The IRS provides comprehensive guidelines for completing the Form 1040 Schedule J. These guidelines outline the eligibility requirements, instructions for filling out the form, and details on how to calculate average income. It is crucial for taxpayers to refer to the most recent IRS publications and instructions to ensure compliance with current tax laws. Following these guidelines can help prevent errors that may lead to audits or penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040 Schedule J align with the standard tax filing deadlines for individual tax returns. Typically, taxpayers must submit their forms by April 15 of the following tax year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable for farmers and fishermen to keep track of any changes in deadlines and to file early to avoid last-minute complications.

Quick guide on how to complete form 1040 schedule j income averaging for farmers and fishermen

Complete [SKS] effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers a superb eco-friendly option to conventional printed and signed papers, as you can easily find the necessary format and securely save it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents promptly without delays. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign [SKS] without stress

- Find [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign [SKS] and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1040 schedule j income averaging for farmers and fishermen

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1040 Schedule J Income Averaging For Farmers And Fishermen?

Form 1040 Schedule J is a tax form that allows eligible farmers and fishermen to average their income over the past three years to lower their taxable income. This can lead to signNow tax savings during years of high profitability. Understanding this form is crucial for effective tax planning.

-

How can airSlate SignNow help with Form 1040 Schedule J Income Averaging For Farmers And Fishermen?

With airSlate SignNow, you can easily create, send, and eSign documents related to your Form 1040 Schedule J Income Averaging For Farmers And Fishermen. Our platform streamlines the process of document handling, ensuring that tax forms are filled out accurately and submitted on time.

-

What features does airSlate SignNow offer for managing tax-related documents?

airSlate SignNow provides features such as document templates, eSignature capabilities, and real-time tracking of document status. These tools simplify the management of tax forms, including the Form 1040 Schedule J Income Averaging For Farmers And Fishermen, providing a seamless experience.

-

Are there any pricing plans for using airSlate SignNow for tax documents?

Yes, airSlate SignNow offers flexible pricing plans that cater to both individual users and businesses. Each plan is designed to provide value for managing documents, including those related to Form 1040 Schedule J Income Averaging For Farmers And Fishermen, ensuring that you find an option that fits your needs.

-

Can I integrate airSlate SignNow with my accounting software?

Absolutely! airSlate SignNow allows for integrations with various accounting software to streamline your tax document management. This means you can efficiently handle Form 1040 Schedule J Income Averaging For Farmers And Fishermen, ensuring accuracy and saving time during tax season.

-

What are the benefits of using airSlate SignNow for farmers and fishermen?

By using airSlate SignNow, farmers and fishermen can simplify their workflow by managing tax documents electronically. This not only ensures compliance with the tax regulations related to Form 1040 Schedule J Income Averaging For Farmers And Fishermen, but also provides peace of mind through secure document handling.

-

Is airSlate SignNow suitable for small businesses in the agricultural sector?

Yes, airSlate SignNow is an excellent choice for small businesses in the agricultural sector, including farmers and fishermen. Our platform is cost-effective and user-friendly, making it easy to manage and eSign essential documents, such as Form 1040 Schedule J Income Averaging For Farmers And Fishermen.

Get more for Form 1040 Schedule J Income Averaging For Farmers And Fishermen

- Tractor quotation format

- Fact sheet for hud assisted residents form

- The ersatz elevator pdf form

- Return and exchange form underworks

- Bodyguard application form 327269245

- Iec centrifuge manual form

- Esic form 7b sample

- Divorce without minor children superior court maricopa county superiorcourt maricopa form

Find out other Form 1040 Schedule J Income Averaging For Farmers And Fishermen

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement