Source of Down Payment, Settlement Charges, Andor Subordinate Financing Explain Form

Understanding the Source of Down Payment, Settlement Charges, and Subordinate Financing

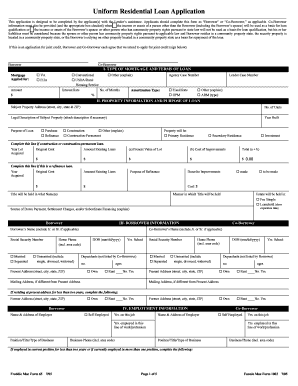

The source of down payment refers to the origin of funds used to make the initial payment on a property purchase. This can include personal savings, gifts from family, or grants from government programs. Settlement charges encompass various fees associated with the closing of a real estate transaction, such as title insurance, appraisal fees, and attorney fees. Subordinate financing involves secondary loans taken out to help cover the down payment or closing costs, often used when the primary mortgage does not cover the full amount needed. Understanding these components is essential for potential homebuyers to navigate the financial aspects of purchasing a home effectively.

How to Use the Source of Down Payment, Settlement Charges, and Subordinate Financing

Utilizing the source of down payment involves documenting where your funds are coming from, which is crucial for mortgage approval. Lenders typically require proof of these funds, such as bank statements or gift letters. When it comes to settlement charges, it is important to review the closing disclosure, which outlines all fees and charges associated with the transaction. For subordinate financing, it is necessary to understand the terms of the secondary loan, including interest rates and repayment schedules, to ensure that it aligns with your financial capabilities.

Steps to Complete the Source of Down Payment, Settlement Charges, and Subordinate Financing

Completing the source of down payment involves several steps:

- Gather documentation for your down payment source, such as bank statements or gift letters.

- Review the settlement charges listed in your closing disclosure to ensure all fees are accounted for.

- Evaluate any subordinate financing options, including terms and conditions.

- Submit the required documents to your lender for verification.

- Ensure that all financial aspects align with your budget and long-term financial goals.

Legal Use of the Source of Down Payment, Settlement Charges, and Subordinate Financing

Legally, the source of down payment must be verifiable and compliant with lender requirements. This means that any funds used must be documented and legitimate. Settlement charges are regulated to ensure transparency and fairness in real estate transactions. Subordinate financing must also adhere to legal standards, including proper disclosure of terms and conditions to all parties involved. Understanding these legalities helps protect buyers from potential disputes or financial issues down the line.

Key Elements of the Source of Down Payment, Settlement Charges, and Subordinate Financing

Key elements include:

- Source of Down Payment: Must be documented and legitimate.

- Settlement Charges: Include various fees that must be disclosed and understood.

- Subordinate Financing: Involves secondary loans that should be clearly defined in terms of repayment.

Each of these elements plays a critical role in the home buying process, impacting overall affordability and financial planning.

Quick guide on how to complete source of down payment settlement charges andor subordinate financing explain

Complete [SKS] seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly and without delays. Manage [SKS] on any device utilizing airSlate SignNow's Android or iOS applications and enhance any document-oriented task today.

How to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to finish your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Decide how you want to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and eSign [SKS] to ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Source Of Down Payment, Settlement Charges, Andor Subordinate Financing explain

Create this form in 5 minutes!

How to create an eSignature for the source of down payment settlement charges andor subordinate financing explain

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the source of down payment, settlement charges, andor subordinate financing?

The source of down payment, settlement charges, andor subordinate financing refers to the various funding options available for covering initial costs associated with real estate transactions. Understanding these sources is crucial for buyers to ensure they have the necessary financial support, as they can greatly influence the affordability and accessibility of property purchases.

-

How does airSlate SignNow help streamline the process of documenting down payment sources?

AirSlate SignNow offers a simplified eSigning solution for all your documentation needs, including those related to the source of down payment, settlement charges, andor subordinate financing. Our platform allows users to securely sign and send necessary documents with ease, facilitating quicker transactions and minimizing hassles.

-

What are the benefits of using airSlate SignNow for settling charges associated with financing?

Using airSlate SignNow for settling charges allows businesses to automate documentation workflows, ensuring that all necessary forms related to the source of down payment, settlement charges, andor subordinate financing are completed accurately and efficiently. This leads to faster processing times, reduced errors, and overall better financial management.

-

Can airSlate SignNow integrate with other financial software to manage financing documentation?

Yes, airSlate SignNow provides seamless integrations with popular financial software, enhancing your ability to manage documents related to the source of down payment, settlement charges, andor subordinate financing. This ensures that your financial workflows remain synchronized and efficient, leading to better document management and compliance.

-

What types of documents can be signed using airSlate SignNow for financing?

AirSlate SignNow allows users to sign a wide range of documents related to the source of down payment, settlement charges, andor subordinate financing. This includes loan agreements, settlement statements, and other financial contracts vital for ensuring a smooth financing process.

-

How does pricing work for airSlate SignNow services concerning financial documentation?

AirSlate SignNow offers various pricing plans that cater to businesses needing solutions for documenting the source of down payment, settlement charges, andor subordinate financing. Our competitive pricing model is designed to provide cost-effective options while ensuring you have access to robust features necessary for efficient document management.

-

Is there customer support available if I have questions about financing documentation?

Absolutely! AirSlate SignNow provides dedicated customer support to assist you with any inquiries related to the source of down payment, settlement charges, andor subordinate financing. Our team is well-trained to help troubleshoot issues and provide guidance on using our platform effectively.

Get more for Source Of Down Payment, Settlement Charges, Andor Subordinate Financing explain

- Evalueringsskema skabelon form

- Arizona warranty deed to community property with rights of survivorship form

- 1098 t gordon conwell form

- Fillable mr yuk form

- Application for corporate associate member karachi chamber of form

- Completed iqms forms

- Zebras super teacher worksheets form

- City of berea net profit license fee return form

Find out other Source Of Down Payment, Settlement Charges, Andor Subordinate Financing explain

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast