City of Berea Net Profit License Fee Return Form

What is the City Of Berea Net Profit License Fee Return

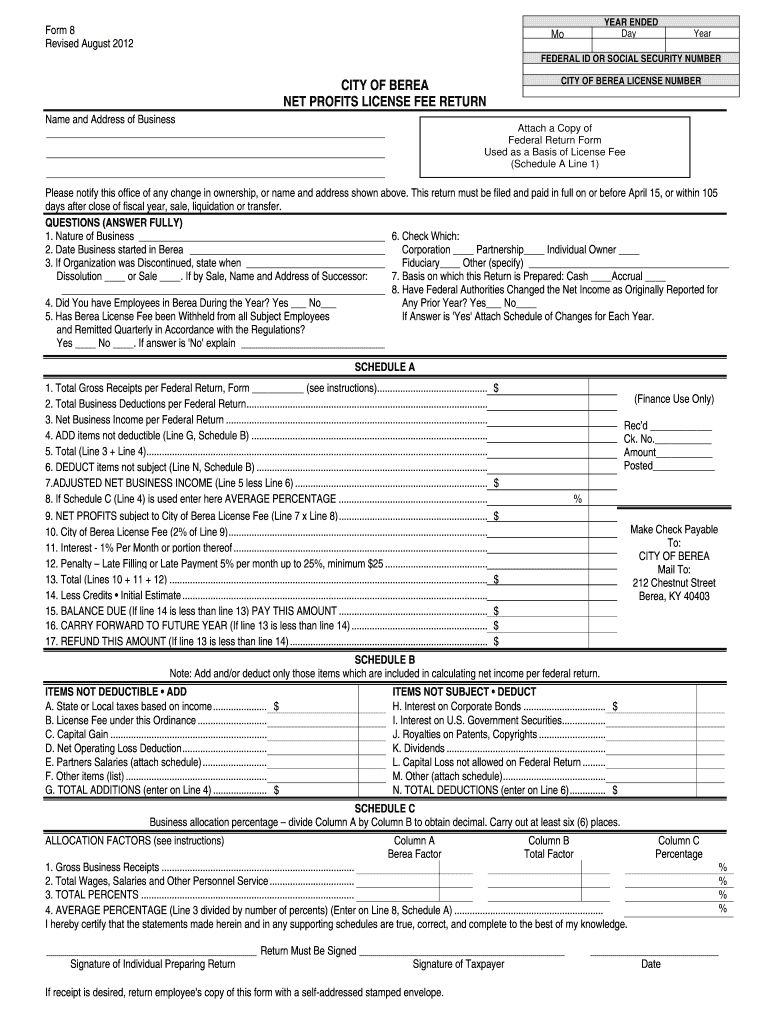

The City of Berea Net Profit License Fee Return is a form that businesses operating within Berea must file to report their net profits for the year. This return is essential for calculating the license fee owed to the city based on the business's earnings. It helps the city ensure compliance with local tax regulations and contributes to municipal funding. Understanding this form is crucial for business owners to avoid penalties and ensure accurate reporting.

Steps to complete the City Of Berea Net Profit License Fee Return

Completing the City of Berea Net Profit License Fee Return involves several key steps:

- Gather financial records, including income statements and expense reports.

- Calculate your net profit by subtracting total expenses from total revenue.

- Fill out the return form with accurate financial data, ensuring all sections are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the designated deadline to avoid late fees.

Legal use of the City Of Berea Net Profit License Fee Return

The City of Berea Net Profit License Fee Return is legally binding when completed correctly. To ensure its validity, businesses must adhere to the guidelines set forth by local regulations. This includes providing accurate financial information and submitting the form within the required timeframe. Failure to comply can result in penalties, including fines or additional fees, reinforcing the importance of understanding the legal implications of this document.

Form Submission Methods

Businesses can submit the City of Berea Net Profit License Fee Return through various methods:

- Online Submission: Many businesses prefer to file electronically for convenience and speed.

- Mail: Completed forms can be printed and sent via postal service to the appropriate city department.

- In-Person: Businesses may also choose to submit their forms directly at city offices during business hours.

Filing Deadlines / Important Dates

It is crucial for businesses to be aware of the filing deadlines for the City of Berea Net Profit License Fee Return. Typically, the return is due by a specific date each year, often aligned with the end of the fiscal year. Missing this deadline can result in penalties, so keeping track of important dates is essential for compliance.

Required Documents

To complete the City of Berea Net Profit License Fee Return, certain documents are necessary:

- Financial statements, including profit and loss statements.

- Records of all business expenses.

- Any previous tax returns that may be relevant.

- Identification information for the business entity.

Quick guide on how to complete city of berea net profit license fee return

Effortlessly prepare City Of Berea Net Profit License Fee Return on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Manage City Of Berea Net Profit License Fee Return on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to edit and electronically sign City Of Berea Net Profit License Fee Return with ease

- Locate City Of Berea Net Profit License Fee Return and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive data using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign function, which takes just seconds and carries the same legal significance as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sharing your form: via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and electronically sign City Of Berea Net Profit License Fee Return to ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of berea net profit license fee return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the city of Berea net profits license fee return?

The city of Berea net profits license fee return is a tax document required for businesses operating in Berea to report their profits and pay the appropriate license fees. By understanding this return, businesses can ensure compliance with local regulations and avoid penalties.

-

How does airSlate SignNow help with the city of Berea net profits license fee return?

airSlate SignNow streamlines the process of preparing and submitting your city of Berea net profits license fee return. Our eSignature solution allows you to sign and send your documents electronically, making submissions faster and more efficient.

-

What features does airSlate SignNow offer for managing tax documents like the city of Berea net profits license fee return?

airSlate SignNow provides features such as customizable templates, automatic reminders, and secure storage. These tools enable businesses to easily create, manage, and submit their city of Berea net profits license fee return without hassle.

-

Are there any integration options available to help with the city of Berea net profits license fee return?

Yes, airSlate SignNow integrates with various accounting and tax software, facilitating seamless management of your city of Berea net profits license fee return. These integrations help maintain accurate records and simplify the filing process.

-

What are the pricing options for airSlate SignNow related to tax document processing?

airSlate SignNow offers competitive pricing plans designed to suit the needs of different businesses. Our plans provide access to essential features for efficiently handling your city of Berea net profits license fee return and other document management tasks.

-

Can airSlate SignNow assist in tracking the status of my city of Berea net profits license fee return?

Absolutely! airSlate SignNow offers real-time tracking of your documents, including your city of Berea net profits license fee return. You'll receive notifications about the status of your submissions, ensuring you stay informed throughout the process.

-

What benefits do I gain by using airSlate SignNow for the city of Berea net profits license fee return?

Using airSlate SignNow for your city of Berea net profits license fee return simplifies the entire process, saving you time and reducing the risk of errors. Our user-friendly platform enables businesses to focus on growth while ensuring compliance with local tax requirements.

Get more for City Of Berea Net Profit License Fee Return

- Landlord tenant formsproperty rental agreementus

- Arizona contract for deed lawcontract for deed form

- Control number va 008 d form

- Oklahoma minor name change minor name change form

- Control number ms006ad form

- Construction or mechanics form

- Control number ar p001 pkg form

- Modelo de preaviso para la resolucin o finalizacin del form

Find out other City Of Berea Net Profit License Fee Return

- How Do I eSignature Arkansas Medical Records Release

- How Do I eSignature Iowa Medical Records Release

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple