Transfer Authorization for Registered Investments HSBC Canada 2022-2026

Understanding the Transfer Authorization for Registered Investments at HSBC Canada

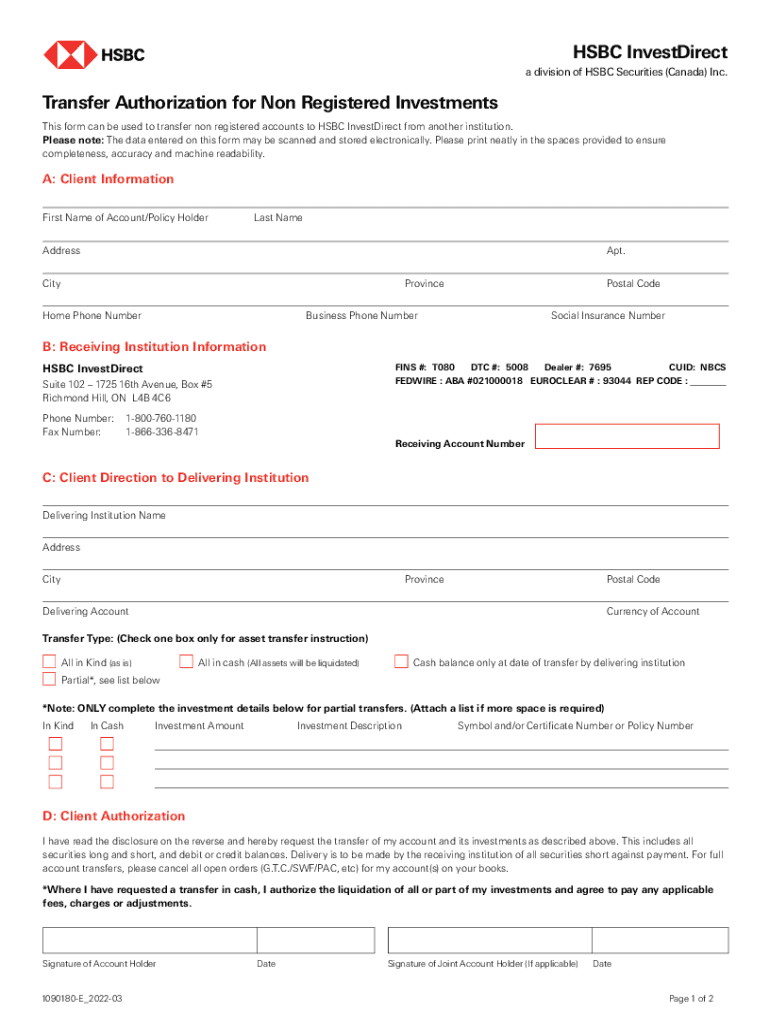

The Transfer Authorization for Registered Investments at HSBC Canada is a crucial document for clients looking to move their registered investment accounts. This form facilitates the transfer of assets from one financial institution to another, ensuring compliance with regulatory requirements. It is essential for clients who hold registered accounts, such as RRSPs or TFSAs, and wish to consolidate their investments or switch providers.

Steps to Complete the Transfer Authorization for Registered Investments

Completing the Transfer Authorization involves several key steps:

- Gather necessary information about your current investment accounts, including account numbers and details of the assets being transferred.

- Fill out the Transfer Authorization form accurately, ensuring all required fields are completed to avoid delays.

- Sign the form to authorize the transfer, confirming that you understand the implications of moving your investments.

- Submit the form to HSBC, either online or via mail, following the submission guidelines provided.

Legal Considerations for the Transfer Authorization

Using the Transfer Authorization for Registered Investments must comply with various legal requirements. Clients should be aware of the implications of transferring investments, including potential tax consequences and the impact on investment performance. It is advisable to consult a financial advisor or legal professional to understand how these transfers may affect your financial situation.

Required Documents for the Transfer Authorization

When submitting the Transfer Authorization form, clients must provide specific documents to ensure the process goes smoothly. Required documents typically include:

- A copy of government-issued identification, such as a driver's license or passport.

- Statements from the current financial institution detailing the accounts being transferred.

- Any additional forms required by HSBC to process the transfer.

Eligibility Criteria for Using the Transfer Authorization

To utilize the Transfer Authorization for Registered Investments, clients must meet certain eligibility criteria. These criteria generally include:

- Having a registered investment account with HSBC or another financial institution.

- Being the account holder or having the authority to act on behalf of the account holder.

- Meeting any specific conditions set by HSBC regarding the types of accounts eligible for transfer.

Examples of Using the Transfer Authorization for Registered Investments

Clients may find various scenarios where the Transfer Authorization is beneficial. Common examples include:

- Transferring an RRSP from a previous employer's plan to a personal account at HSBC.

- Moving a TFSA to consolidate investments for better management and performance tracking.

- Switching investment providers to take advantage of better fees or services offered by HSBC.

Quick guide on how to complete transfer authorization for registered investments hsbc canada

Effortlessly create Transfer Authorization For Registered Investments HSBC Canada on any device

Digital document management has gained immense popularity among businesses and individuals. It offers a wonderful eco-friendly substitute to conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and electronically sign your documents swiftly and without hassle. Manage Transfer Authorization For Registered Investments HSBC Canada across any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Transfer Authorization For Registered Investments HSBC Canada with ease

- Locate Transfer Authorization For Registered Investments HSBC Canada and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Transfer Authorization For Registered Investments HSBC Canada and ensure smooth communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct transfer authorization for registered investments hsbc canada

Create this form in 5 minutes!

How to create an eSignature for the transfer authorization for registered investments hsbc canada

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is HSBC server to server transfer?

HSBC server to server transfer is a secure method that allows businesses to electronically send and receive sensitive information directly between their servers. This process ensures that data is transmitted safely and efficiently, minimizing the risk of unauthorized access.

-

How does airSlate SignNow support HSBC server to server transfer?

airSlate SignNow integrates seamlessly with HSBC server to server transfer to streamline document handling within your organization. By utilizing our eSigning tools, you can automate the transmission of signed documents directly to your HSBC account, making processes faster and more efficient.

-

What features are included with airSlate SignNow's HSBC server to server transfer?

Our platform offers features such as real-time tracking of documents, cloud storage, and advanced security options, all tailored to enhance your HSBC server to server transfer experience. These tools are designed to improve workflow efficiency and ensure that your documents are always secure and accessible.

-

Is there a cost associated with implementing HSBC server to server transfer using airSlate SignNow?

Yes, there is a pricing structure associated with the use of airSlate SignNow that encompasses various features, including HSBC server to server transfer. We offer flexible plans based on your business needs, which makes it easy to find an option that fits your budget while maximizing value.

-

What are the benefits of using airSlate SignNow for HSBC server to server transfer?

Using airSlate SignNow for HSBC server to server transfer provides numerous benefits, including enhanced security, reduced processing times, and improved document management. Companies can save time and resources by automating document workflows and ensuring compliance with industry regulations.

-

Can airSlate SignNow integrate with other tools for HSBC server to server transfer?

Absolutely! airSlate SignNow supports integrations with various third-party applications to enhance your HSBC server to server transfer process. This ensures that you can connect with existing software solutions, improving collaboration and data synchronization across your business.

-

How secure is the HSBC server to server transfer with airSlate SignNow?

Security is a top priority for airSlate SignNow, especially when it comes to HSBC server to server transfer. All data transmitted through our platform is encrypted and complies with industry standards to protect your sensitive information from unauthorized access.

Get more for Transfer Authorization For Registered Investments HSBC Canada

Find out other Transfer Authorization For Registered Investments HSBC Canada

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe

- Sign South Carolina Vacation Rental Short Term Lease Agreement Now

- How Do I Sign Georgia Escrow Agreement

- Can I Sign Georgia Assignment of Mortgage

- Sign Kentucky Escrow Agreement Simple

- How To Sign New Jersey Non-Disturbance Agreement

- How To Sign Illinois Sales Invoice Template

- How Do I Sign Indiana Sales Invoice Template