Ated Form

Understanding the Ated Form

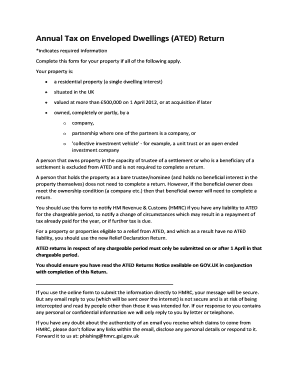

The Ated form, or Annual Tax on Enveloped Dwellings, is a tax return that applies to properties in the United Kingdom owned by companies. This tax is relevant for businesses that own residential properties valued above a certain threshold. The Ated form is essential for reporting the value of these properties and calculating the corresponding tax liability. It is crucial for businesses to understand the implications of this tax to ensure compliance and avoid penalties.

Steps to Complete the Ated Form

Completing the Ated form involves several key steps:

- Gather necessary information about the property, including its value and ownership details.

- Determine the applicable Ated charge based on the property's value as of April 1 of the relevant year.

- Fill out the Ated form accurately, ensuring all information is complete and correct.

- Submit the form by the deadline to avoid penalties.

Each step is important to ensure compliance with tax regulations and to avoid any potential issues with HMRC.

Filing Deadlines and Important Dates

Filing deadlines for the Ated form are critical for compliance. The form must be submitted by April 30 each year for the upcoming tax year. If a property is acquired after April 1, the Ated form must be submitted within 30 days of acquisition. Missing these deadlines can result in penalties, making it essential for businesses to stay informed about these dates.

Required Documents for the Ated Form

To complete the Ated form, businesses must prepare several documents:

- Proof of property ownership, such as a title deed.

- Valuation report for the property to determine its market value.

- Details of any previous Ated returns, if applicable.

Having these documents ready can streamline the process and ensure accurate reporting.

Penalties for Non-Compliance

Failure to submit the Ated form or pay the associated tax can result in significant penalties. HMRC may impose fines based on the amount of tax owed and the duration of the delay. Additionally, interest may accrue on unpaid amounts, further increasing the financial burden. Understanding these penalties emphasizes the importance of timely compliance with Ated regulations.

Who Issues the Ated Form

The Ated form is issued by HM Revenue and Customs (HMRC) in the United Kingdom. This government body is responsible for collecting taxes and ensuring compliance with tax laws. Businesses must interact with HMRC when submitting their Ated forms and managing any related inquiries or issues.

Quick guide on how to complete ated form

Complete Ated Form effortlessly on any device

Managing documents online has become increasingly prevalent among businesses and individuals. It offers a superb eco-friendly substitute for traditional printed and signed paperwork, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, edit, and electronically sign your documents swiftly without any delays. Handle Ated Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-centered task today.

How to edit and eSign Ated Form with ease

- Find Ated Form and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with features that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and carries the same legal significance as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Choose your preferred method of delivering your form—by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Ated Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ated form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'ated annual' policy at airSlate SignNow?

The 'ated annual' policy at airSlate SignNow refers to our commitment to providing transparent annual pricing models that allow businesses to budget effectively. This policy ensures that all users understand the costs associated with our eSigning and document management solutions, making it easier for them to make informed decisions.

-

How does airSlate SignNow ensure the security of my 'ated annual' documents?

At airSlate SignNow, the security of your 'ated annual' documents is our top priority. We utilize advanced encryption protocols and secure cloud infrastructures to protect all documents during transmission and storage, ensuring that your sensitive information remains confidential and accessible only to authorized users.

-

What features are included in the 'ated annual' pricing plans?

Our 'ated annual' pricing plans include a comprehensive set of features designed to streamline your document workflow. Users benefit from unlimited eSignatures, customizable templates, team collaboration tools, and integrations with other productivity apps, all aimed at improving efficiency and reducing turnaround times.

-

Can I integrate airSlate SignNow with other software under the 'ated annual' plan?

Absolutely! The 'ated annual' plan of airSlate SignNow supports a wide range of integrations with popular software applications. This allows you to streamline your workflows and enhance your document management processes seamlessly, whether you're using CRM systems, project management tools, or other productivity solutions.

-

What benefits do I gain from choosing the 'ated annual' plan?

Choosing the 'ated annual' plan at airSlate SignNow offers signNow benefits, including cost savings and predictable budgeting. Additionally, businesses gain access to premium features and priority customer support, ensuring they can efficiently handle eSigning and document workflows throughout the year.

-

Is there a trial period for the 'ated annual' plan at airSlate SignNow?

Yes, we offer a trial period for potential customers interested in our 'ated annual' plan. This allows you to explore all features and functionalities of airSlate SignNow without any financial commitment, enabling you to assess whether our solution fits your business needs before making a long-term commitment.

-

How does the 'ated annual' plan cater to businesses of different sizes?

The 'ated annual' plan is designed to cater to businesses of all sizes, from startups to large enterprises. We offer scalable solutions that can grow with your organization, ensuring that every team member has the tools they need for efficient document management and eSigning, regardless of the company size.

Get more for Ated Form

Find out other Ated Form

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure