Surplus Lines Disclosure and Acknowledgement at My Form

Understanding the Surplus Lines Disclosure and Acknowledgement

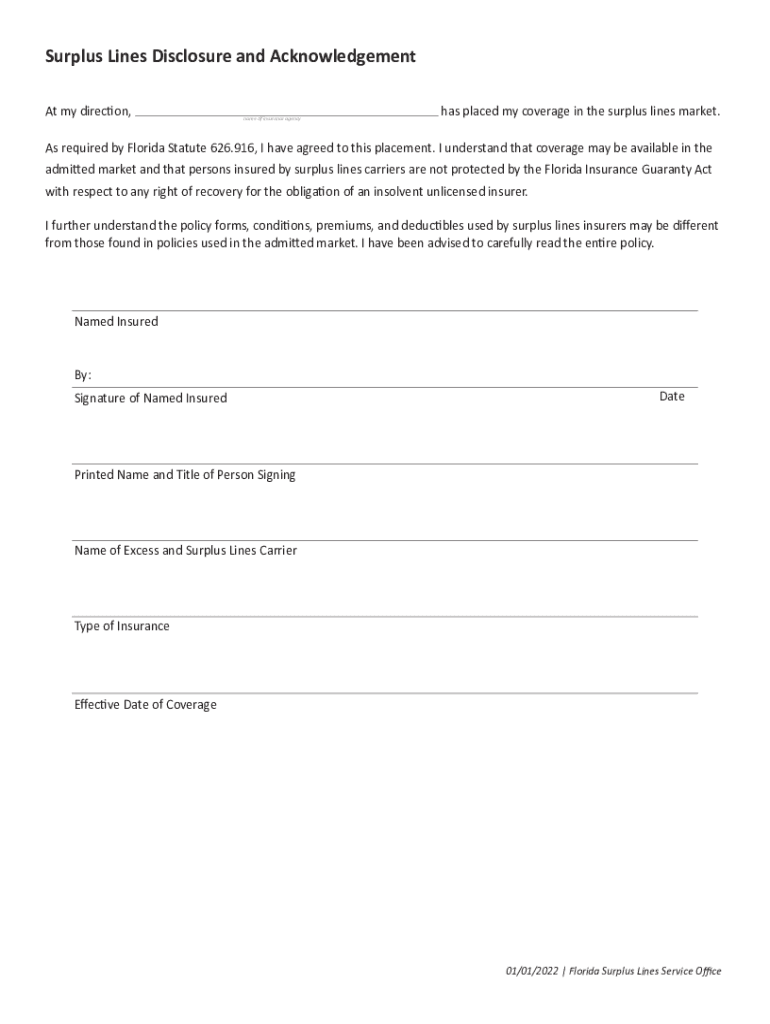

The surplus lines disclosure and acknowledgement is a crucial document in the insurance industry, particularly for policies that cover risks not available in the standard market. This form serves to inform policyholders about the nature of their coverage and the implications of obtaining surplus lines insurance. It is essential for ensuring that consumers are aware of their rights and responsibilities when engaging with surplus lines insurers.

This document typically outlines the specific risks associated with the policy, the financial stability of the insurer, and any limitations on coverage. By signing this disclosure, the policyholder acknowledges their understanding of these factors, which can help mitigate misunderstandings in the future.

Steps to Complete the Surplus Lines Disclosure and Acknowledgement

Completing the surplus lines disclosure and acknowledgement form involves several important steps. First, gather all necessary information regarding the insurance policy, including the type of coverage, the insurer's details, and any relevant risk factors. Next, carefully read through the entire document to ensure you understand each section.

Once you have reviewed the information, fill out the required fields accurately. This may include personal details, policy specifics, and any additional disclosures mandated by state regulations. After completing the form, sign and date it to confirm your acknowledgment of the terms outlined. It is advisable to keep a copy for your records.

Legal Use of the Surplus Lines Disclosure and Acknowledgement

The surplus lines disclosure and acknowledgement is not just a formality; it has legal significance. This document is designed to protect both the insurer and the insured by ensuring that all parties are aware of the unique aspects of surplus lines insurance. It helps to clarify that surplus lines coverage may not be subject to the same regulations as standard insurance policies.

In the event of a dispute, the signed disclosure can serve as evidence that the policyholder was informed about the nature of their coverage. Therefore, it is vital to complete this form accurately and retain it as part of your insurance documentation.

State-Specific Rules for the Surplus Lines Disclosure and Acknowledgement

Each state in the U.S. has its own regulations regarding surplus lines insurance, which can affect the disclosure and acknowledgement process. For instance, some states may require additional disclosures or specific language to be included in the form. It is important to be aware of these state-specific rules to ensure compliance and avoid potential penalties.

Consulting with a licensed insurance professional or legal advisor familiar with your state's regulations can provide clarity on the requirements that apply to your surplus lines disclosure. This knowledge can help ensure that your documentation meets all legal standards.

Examples of Using the Surplus Lines Disclosure and Acknowledgement

Practical examples of the surplus lines disclosure and acknowledgement can enhance understanding of its application. For instance, if a business seeks coverage for a unique risk, such as a specialized manufacturing process, they may need to obtain surplus lines insurance. In this case, the disclosure form would outline the specific risks associated with that coverage.

Another example might involve a homeowner seeking coverage for a property in a high-risk area where standard insurers are unwilling to provide policies. The surplus lines disclosure would inform the homeowner of the implications of choosing this type of coverage, including potential gaps in protection and the financial stability of the insurer.

Disclosure Requirements for Surplus Lines Insurance

Disclosure requirements for surplus lines insurance are designed to ensure transparency between the insurer and the insured. These requirements typically include informing the policyholder about the nature of the coverage, the risks involved, and the financial status of the surplus lines insurer. Additionally, the policyholder must be made aware that surplus lines insurance may not be protected by state guarantee funds.

It is essential for insurers to provide clear and comprehensive information to policyholders, as this can help prevent misunderstandings and disputes. The disclosure should be presented in a straightforward manner, allowing the insured to make informed decisions about their coverage options.

Quick guide on how to complete surplus lines disclosure and acknowledgement at my

Effortlessly prepare Surplus Lines Disclosure And Acknowledgement At My on any device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, as you can easily locate the necessary form and securely save it online. airSlate SignNow equips you with all the functionalities needed to create, modify, and electronically sign your documents swiftly without any hold-ups. Handle Surplus Lines Disclosure And Acknowledgement At My on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to modify and electronically sign Surplus Lines Disclosure And Acknowledgement At My with ease

- Obtain Surplus Lines Disclosure And Acknowledgement At My and click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and hit the Done button to save your changes.

- Select how you wish to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced papers, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Surplus Lines Disclosure And Acknowledgement At My to ensure clear communication at every stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the surplus lines disclosure and acknowledgement at my

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a surplus lines disclosure?

A surplus lines disclosure is a legal document that provides information about insurance coverage that is not available through standard markets. It is essential for ensuring compliance with state regulations. Understanding and properly managing surplus lines disclosures is crucial for insurance agents and policyholders alike.

-

How can airSlate SignNow help with surplus lines disclosures?

airSlate SignNow streamlines the process of creating and managing surplus lines disclosures by offering easy-to-use electronic signature features. This enhances efficiency and ensures that your documents are signed and returned promptly. With our platform, you can focus on compliance and customer service instead of paperwork.

-

What features does airSlate SignNow offer for managing surplus lines disclosures?

airSlate SignNow provides a range of features such as customizable templates, secure cloud storage, and advanced tracking for surplus lines disclosures. These tools simplify the document management process, helping you maintain organization and compliance. Additionally, you can easily collaborate with colleagues and clients throughout the signing process.

-

Is airSlate SignNow cost-effective for managing surplus lines disclosures?

Yes, airSlate SignNow offers a cost-effective solution for handling surplus lines disclosures, with competitive pricing plans tailored to fit businesses of all sizes. By reducing the time spent on paperwork, you can save not only money but also improve overall productivity. Consider our subscription plans to find the best fit for your needs.

-

Can I integrate airSlate SignNow with my existing systems for surplus lines disclosures?

Absolutely! airSlate SignNow offers a variety of integrations with popular CRM and document management systems, making it easy to incorporate surplus lines disclosures into your existing workflows. This seamless integration allows you to enhance productivity while ensuring compliance with regulatory requirements.

-

What are the benefits of using airSlate SignNow for surplus lines disclosures?

Using airSlate SignNow for surplus lines disclosures provides multiple benefits, including enhanced efficiency, improved accuracy, and streamlined compliance. By digitizing your document workflows, you minimize the risk of errors and save valuable time. Plus, our platform ensures that all documents are stored securely and accessible whenever needed.

-

How does airSlate SignNow ensure compliance with surplus lines disclosure regulations?

airSlate SignNow is designed to help businesses maintain compliance with surplus lines disclosure regulations through features like audit trails and secure storage. Each document is tracked and timestamped for your records, ensuring you have the necessary documentation during audits. This way, you can confidently manage your compliance obligations.

Get more for Surplus Lines Disclosure And Acknowledgement At My

- Notice tenant form

- Day notice eviction form

- Stallion breeding contract form

- Credit card application for unsecured open end credit form

- Credit application with form

- Notice of changes to credit card agreement 497331610 form

- Agreement one year form

- Helmet waiver in favor of a business offering pony rides form

Find out other Surplus Lines Disclosure And Acknowledgement At My

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP